Huge Economic Calendar Day UK CPI Data, PPI, BoE, US Retail Sales

FTSE100 futures -20 at 7348 closed -0.2% yesterday : the megacap index in a bullflag eyeing the 7500 upper trendline though RSI shows flagging momentum into resistance. Cable will likely help set direction and will mirror the CPI read and interest rate expectation.

US closed in green led by tech (ses heatmap) : NAS +1.45% clearing the 100MA for the first time since Sep 22: S&P +0.9% to resistance while DOW made a near double top to the Aug highs and a key level to watch on the end of year rally thesis.

Gold $1774 after a brief visit above $1780 as dollar appears to base around the $106 level:( its just above the 200MA at 104.9 which may see a check especially on CPI data). Gold looks overdue a pullback which would be an opportunity to add assuming dollar weakness continues

Copper pulled back after the recent stellar run but remains north of the 8EMA and eyeing the 200MA.

Brent at $93.2 is tracking its 50MA but rejecting its 21EMA: may stay in range until EIA inventoires later today

FTSE 250 Charts

Highlighted yesterday, FTSE250 make another attempt at the 20146 level and rejected yesterday with a mild pullback of 1%: after an 18% move in a month this is no big deal and is likely healthy. UK inflation will heavily affect the index so a lower CPI will boost while a higher one will impact many of its core sectors especailly Travel and Retail

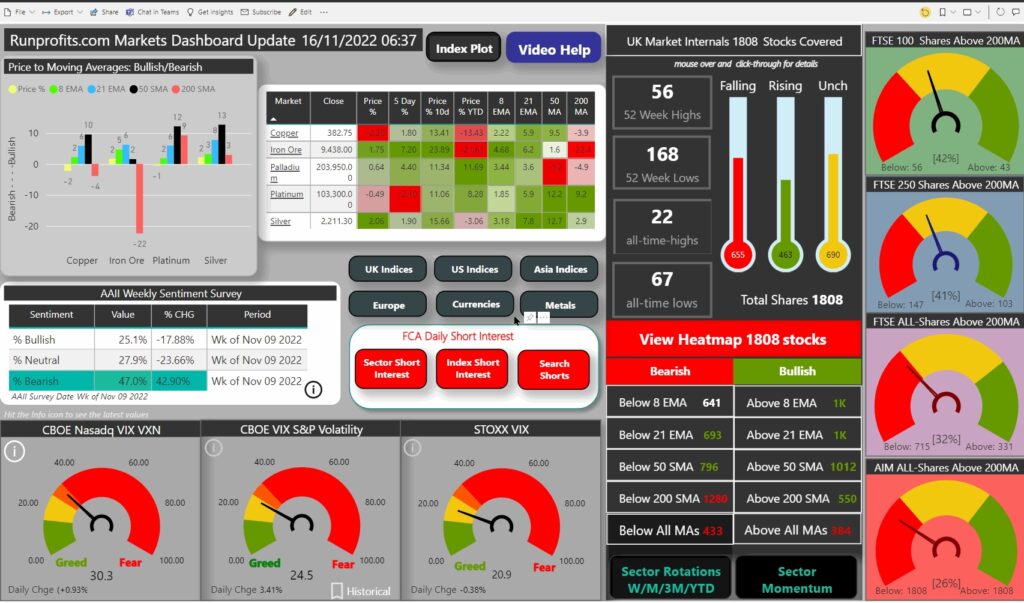

Market Dashboard and Sentiment

US Heatmap

Econ Calendar

Today's economic calendar CPI , PPI at 0700