Contents: Click on Link to View

ToggleDollar Drops 200MA, Gold on a Rip, Sentiment Improves, Copper Nods

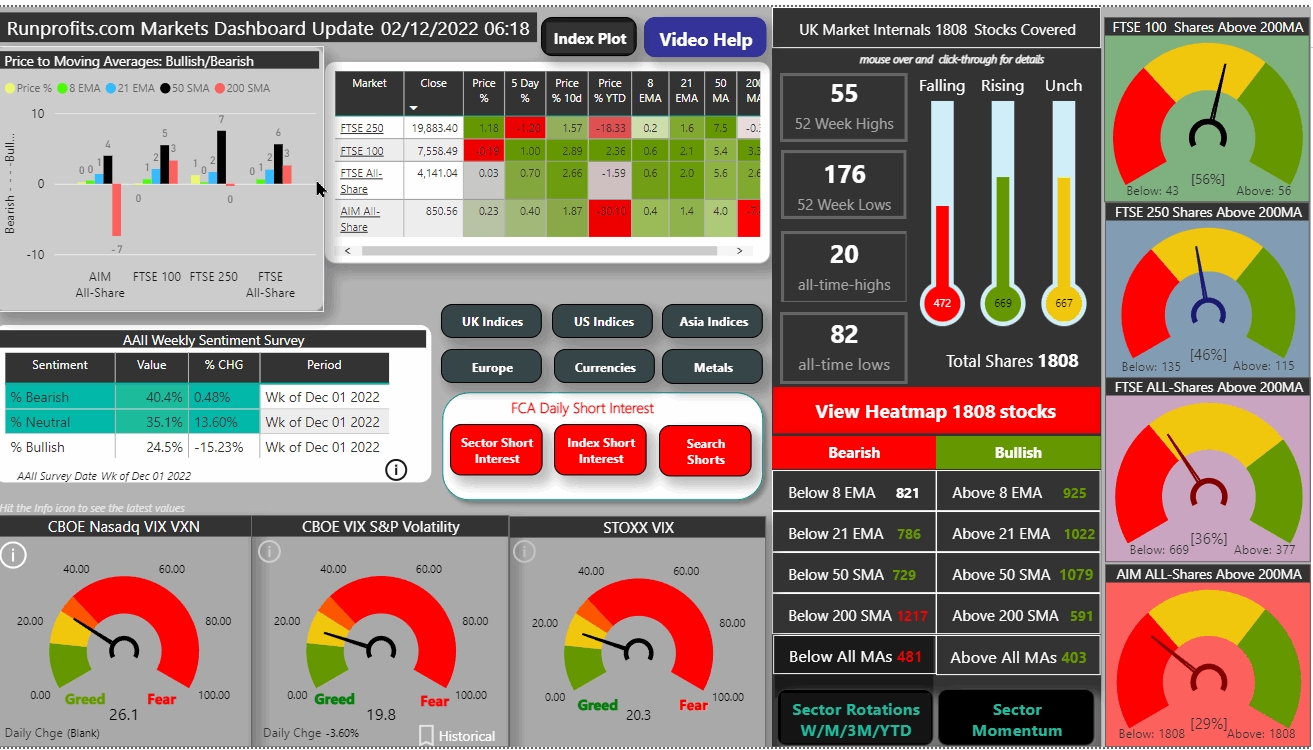

Dollar weakness continues, cable makes a big move north to close above the 200MA for the first time since Jul '22: strength dents the megacaps (USD earnings) , supports the midcaps reflected in FTSE 100 losing - 0.2% yesterday while the FTSE250 rallied 1.2% to close on the 200 MA.

Gold makes the 1800, much quicker than I expected (not a complaint): checks back to 200MA at $1796 and bounces - looks bullish

Oil did hit the 21EMA at $88.6, but didn't hold it: rangebound off the 8EMA and sideways: one to watch for a directional move

Doc Copper seems ok with these moves in a minor bullflag looking to the 200MA above for another test

US closed consolidating the big "Santa move" in the face of steepening yield curves and recessionary fears S&P unch on the day: AAII weekly sentiment survey shows improving retail sentiment after November's big move: nothing moves sentiment quite like price . Still 40% bearish.

VIX below 20 suggests risk-on for now. US NFP at 13:30 potential market mover - see economic calendar

FTSE 250 Back to Test 200MA: Bullish

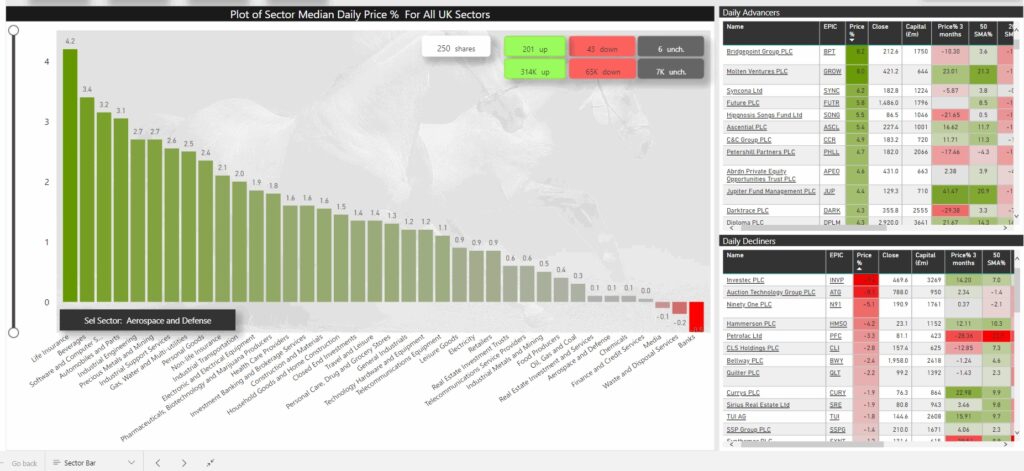

FTSE 250 rallied 1.2% to restest the 200MA yet again : appears to be forming a bullflag and looks set to break above this resistance .

Stronger pound supports more inflationary senistive key sectors in the mid caps with Travel, Retail and Construction as potential winners

Yesterday saw a broad rally with 202 names in green

AIM Meh on the day +0.2%

AIM all-share saw broader selling with 218 names in retreat and 189 up , 349 unch on the day

Renewable energy, retail and services were the outperformers . Sector plot opposite show continued outperfomance of Consumer Services, Banks, Retail, Beverages and Leisure Goods with many double digits gains over the past month .

Sector plots can be drilled through into relative strength views of each sector to spot the strongest names which can further be filtered by volume, market cap and daily values traded (£) to fine tune trading and investing opportunities.

Gold Miners on the Move: A Sector Look

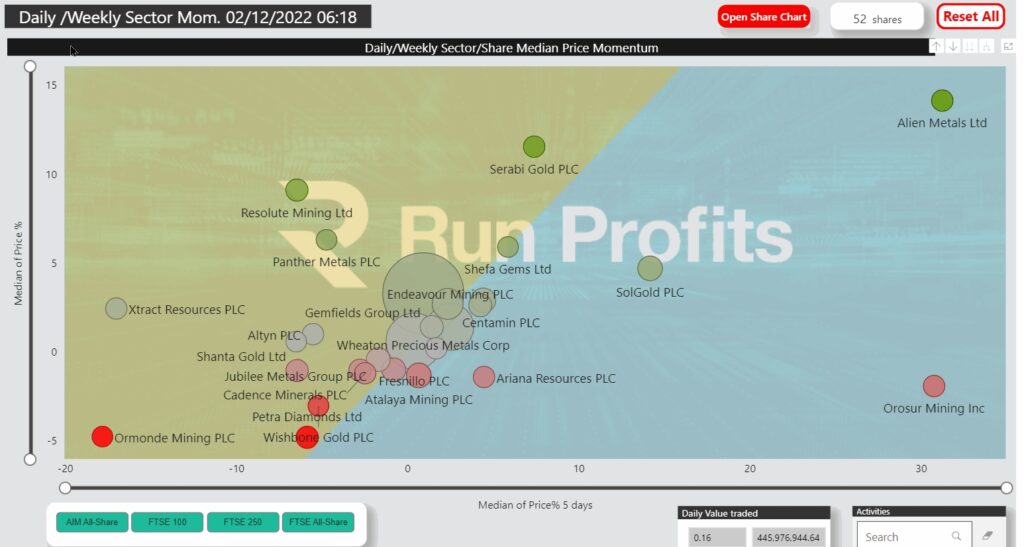

as gold continues to show strength, gold miners should follow suit.

Yesterday saw continued strength in Alien Metals and Orsur leading the 52 name strong Precious Metals sector. OMI reported drilling resutls in RNS today .

Serabi, SolGold, Shefa Gems, Endeavour and Centamin confinued to advance.

Pan African went ex div yesterday but still saw some buying.

You can do more indepth sector research as well as view the techncials in the Sectors Area of Run Profits