UK Markets Narrative Mon 29 Oct 18 EOD

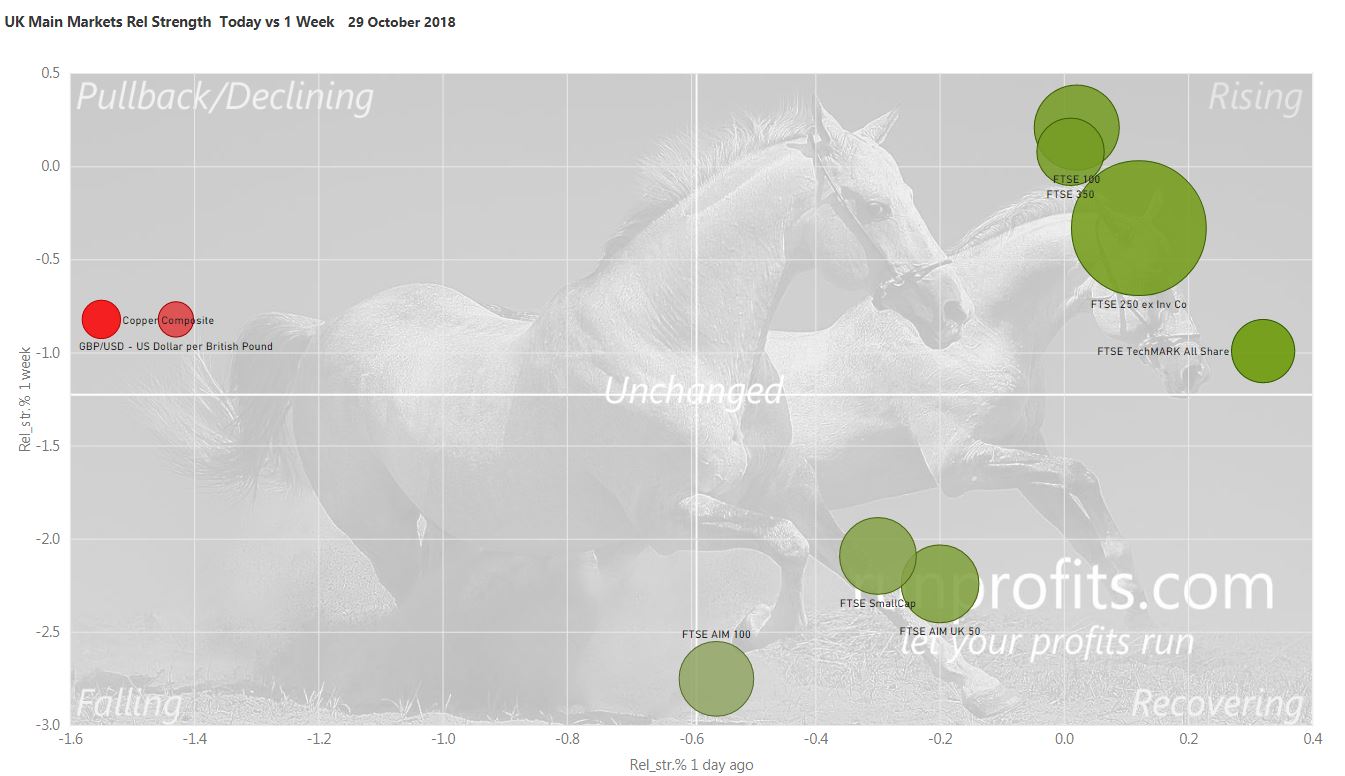

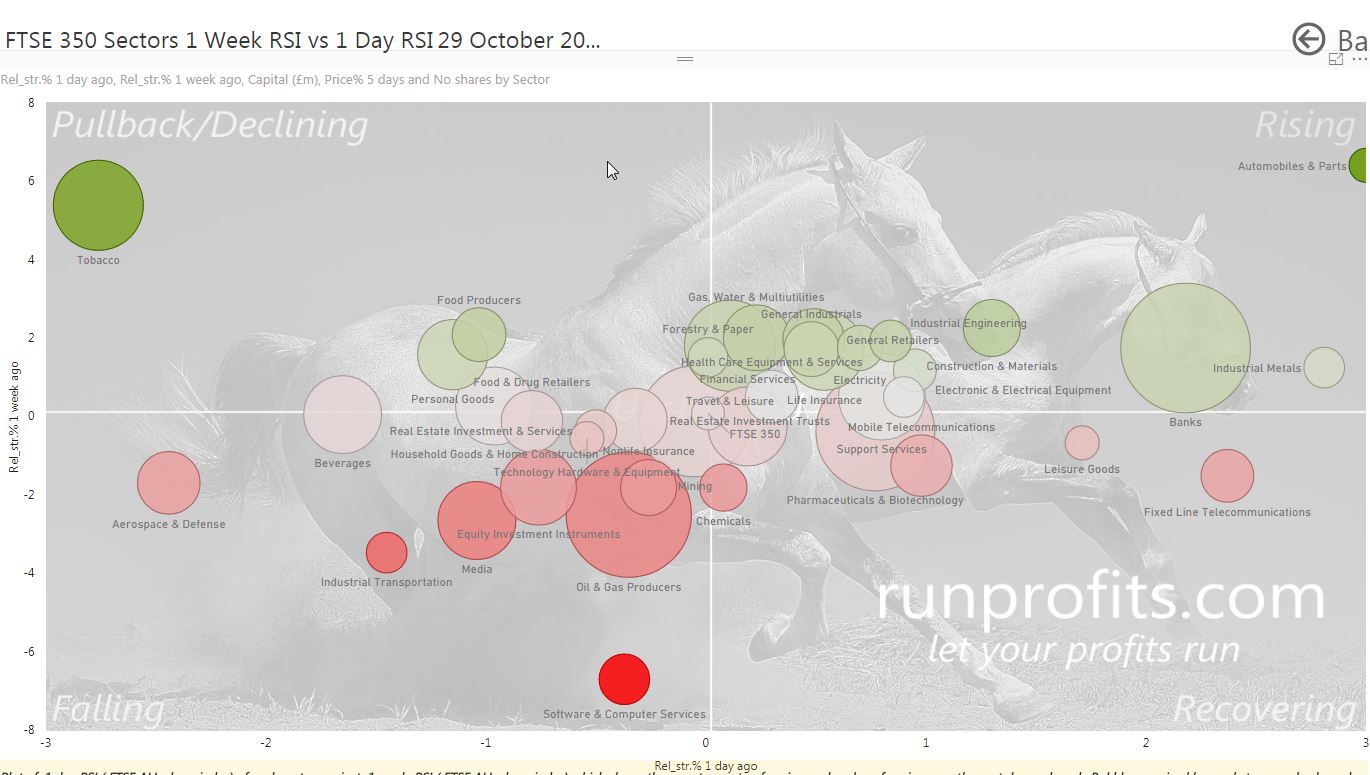

Today’s price action featured strong rallies across the board as the main UK indices recovered from oversold: HSBC earnings beat helped lift Banks which closed up 3.4% with Construction, Mobile, O&G Services, Support Services and Pharm all closing up over 2%.

All of the indices faded into the close as enthusiasm waned but early indications may suggest that the selling has at least paused for now. This week is a big earnings week in the UK and in the US so the future direction of markets will be heavily influenced by the quality of the results and the outlooks and guidance

In the NMX, the following sectors are bullish on most or all timescales: Utilities, Ind Metals, Health Care Equipment with Food Producers and Fixed Line Comms. Most of these are heavily defensive sectors and may give insights into the direction of rotation following this sell-off.

The UKX and NMX closed up over 1.2% and above their 8EMAs: this is the first time in 18 trading days and may well prove to be significant. Two consecutive closes above the 21 EMA is normally a sign that the short-term trend has changed. These are key levels to watch while taking selective longs in outperforming recovery stocks with good fundamentals AND technicals.

The MCIX closed up 1.2%, AIM100 up 0.7% with the TASX closing 1.6% to the good

Oil sold-off to close around $77, gold and silver sold-off as did all the base metals. The UK budget announcement sent the GBP lower against USD which was just below $1.27 at pixel.

Apple will announce this week which is often the bellwether for the US: assuming good results, and with month end rebalancing due, we expect a strong bounce into the end of month.

Click for UK Daily Markets Update

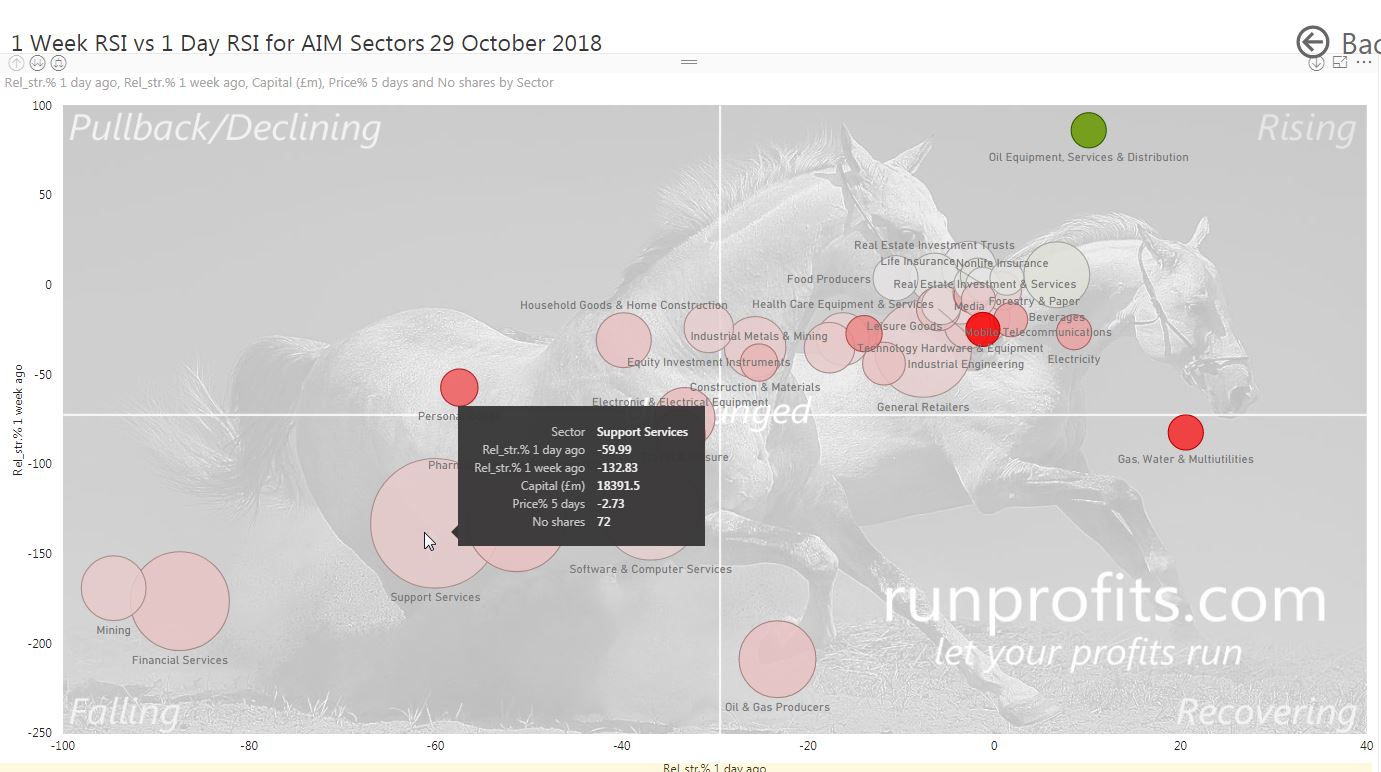

Click for AIM ALL-Share Report

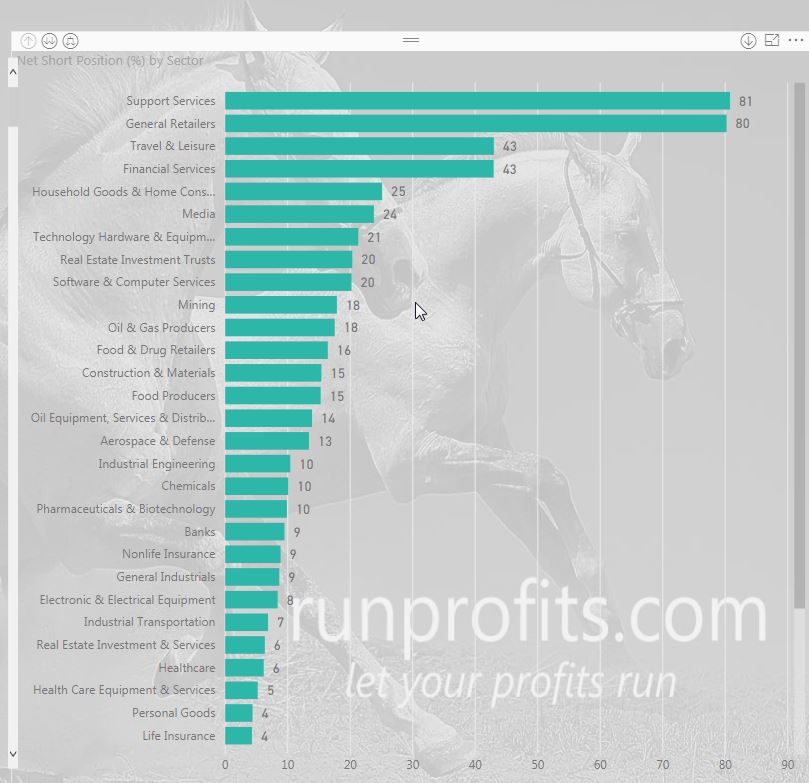

Click for Daily Short Interest Report