Contents: Click on Link to View

Toggle06:45 UK Indices Continue Catch-Up : FTSE 250 New 52 Week High, AIM Sets-Up to Break Out: 32% of FTSE100 making 52 Week Highs this Week

FTSE 250 closed in the green Wednesday continuing its mov north making another new 52 week high, AIM All share also advanced and is in a volatility squeeze set to break out. 16 of the FTSSE 100 components made 52 week highs yesterday alone, making 32 this week in total . 49 of the FTSE250 have made 52 week highs this week while AIM sees just 33 of the 645 making 52 week highs

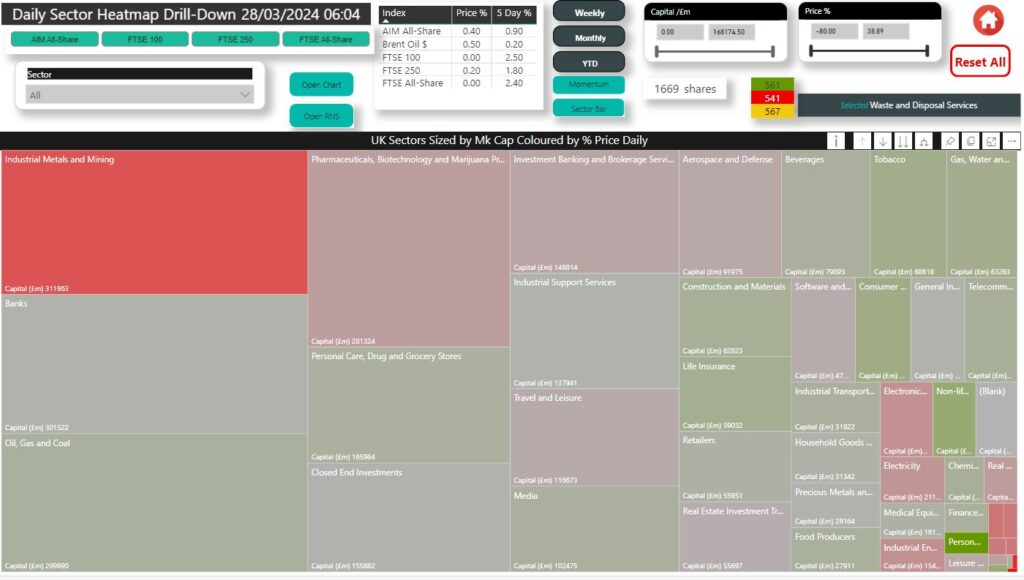

Heat map below shows the participating sectors with a fairly even split of advancers to decliners to unchanged and a fairly broad rally across the board with outperformance in a number of key inflation sensitive sectors like travel retail construction. Notable outperformance of Renewables names - these tend to behave like liquidity indicators and are increasingly turning more bullish

In commodities and currencies, dollar index continues to hold around the 104 level into the US GDP numbers later today. Gold which had been consolidating around the 8 EMA makes a move north eyeing the $2200 level and last week's all-time-highs. Today's US data may provide the catalyst to set direction more firmly - mindful of the shooting star pattern formed on the weekly last week highlighted in the weekly wrap . The price action continues to maintain a bullish bias and may just grind higher given the consensus bullishness on gold as an inflation hedge.

Brent oil dipped briefly yesterday on the EIA inventories unexpected build but held the 21 EMA but bid off this and holds north of the 8 EMA maintaining its bullish bias and supporting Oil & Gas names

Copper which had dipped again to the 21 EMA yesterday has bid off this and is holding around the$4 level

Dollar holds the $104 level into US GDP data later today

Brent consolidating around the 8 EMA having bounced off the 21EMA on EIA inventories : maintains bullish bias

Gold defying stronger dollar, traces 8EMA support - eyes $2200 level

On the calendar

- UK GDP at 0700

- US GDP at 13:30

Owing to Easter family holidays - there will be no Pre Close Update to RPG this afternoon

End of day data will be published after market close around 17:30 as normal

Happy Easter

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar