Contents: Click on Link to View

ToggleAM Price Action 09:00 : Markets in a Risk-Off “Wait and See “Mode before Tomorrow’s Macro Data

UK markets pulling back slightly in advance of tomorrow’s UK inflation data and US FOMC decision . Brent oil's continued rise now above $86 is also a spectre of prolonged inflation which fits with the “higher for longer” narrative on interest rates. Given the run- up in markets especially in the US on the expectation of multiple rate cuts in 2024, a hawkish FOMC meeting tomorrow may be met with volatility and profit taking . The DXY dollar index has rallied as highlighted premarket in anticipation

The FTSE100 and FTSE250 are in pullback mode slipping below their 8EMAs and may well check their 21EMAs: the AIM All-Share dipping below its 200MA again although momentums is improving in the small cap space

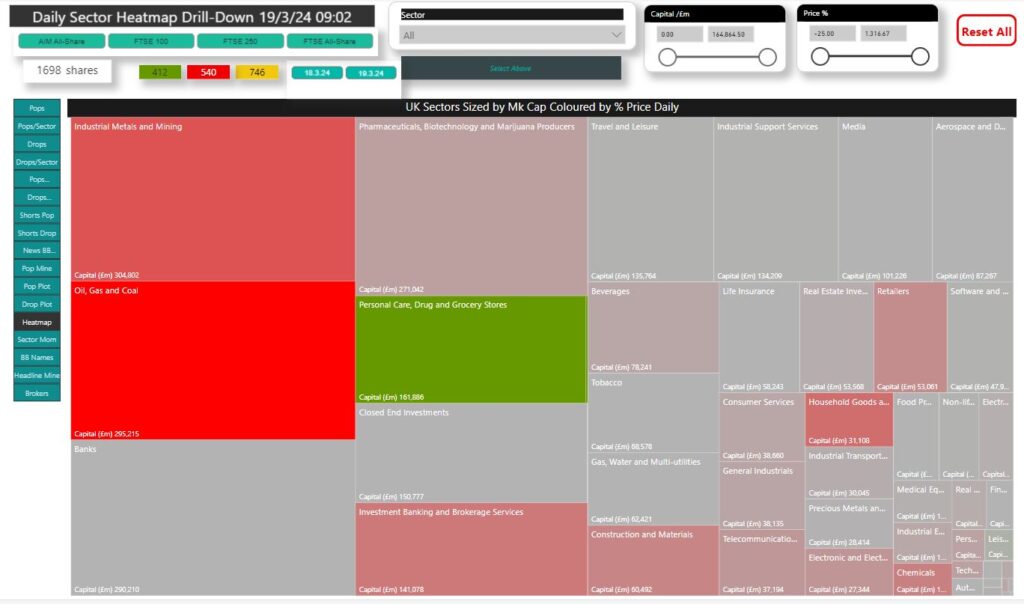

The heatmap at 0900 shows fairly broad selling with 412 advancers to 540 decliners while almost 750 are unch – hence a wait and see.

A stronger dollar has dented the miners as 43 sell to 19 risers with 59 unch while Oil & Gas names see 25 risers to 35 fallers with 42 unch despite the firmer oil prices

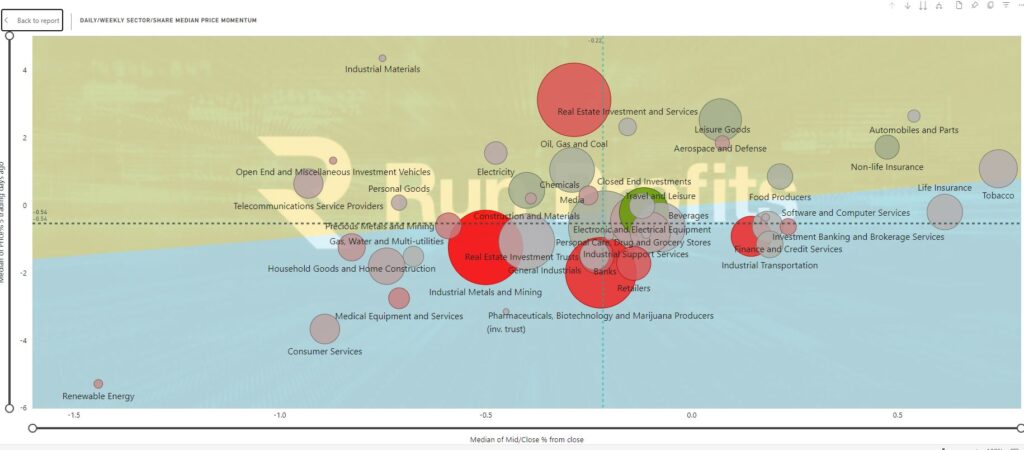

In momentum terms, the continued strength the likes of Tobacco, Insurance and Food Producers highlights the defensive mood

<Click on image to enlarge, click outside enlarged image to return>

UK heatmap intraday price changes at 0900

Daily/Weekly Sector Momentum with Tobacco, Insurance and Food Producers showing strength while Renewables, Consumer Services and Household/Home Construction show weakness

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar

Pre Market- Dollar Strengthens eyes 104: brent above $86 : BTC sells to $64K

Dollar continued to strengthen eyeing the 104 level and clearing the 50 and 200 MA though there may be some resistance around the 103.8 level - This has caused all of the metals to pull back as highlighted in the weekly wrap although gold has continued to hold around the 8 EMA level. Continued dollar strength into the FOMC meeting tomorrow will likely pressure gold with a potential pullback to the 21 EMA level around $2119

Oil has continued its breakout clearing the $86 level with a potential to break $87 and the top of the rising channel: this lifted oilers yesterday but dented travel and retail

Dollar clears 50 and 200MA

Oil above $86 towards top of rising channel

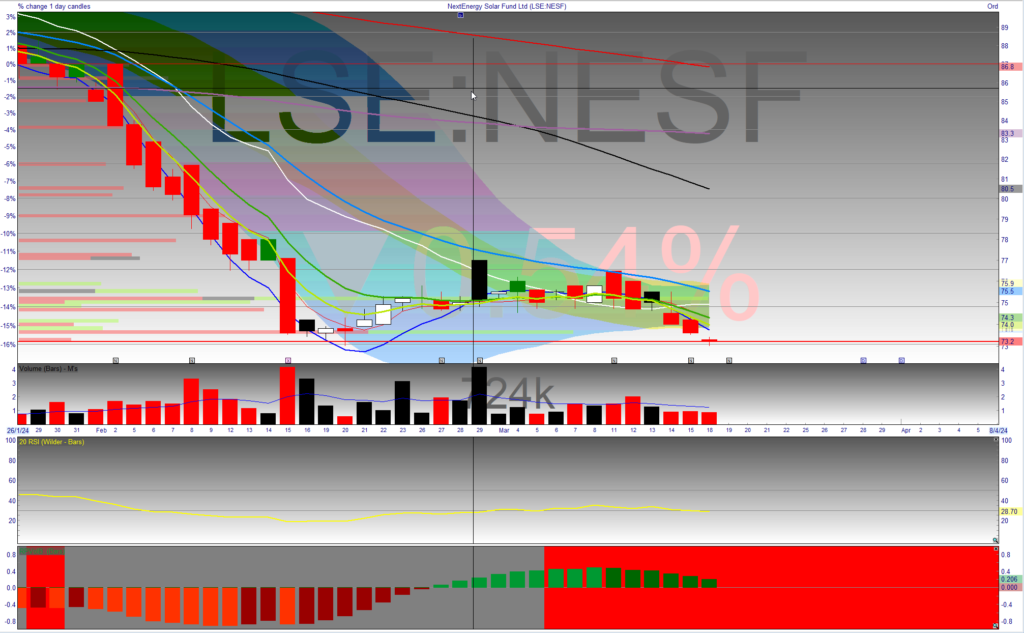

NESF One to Watch

NextEnergy Solar Fund - See RNS

significant catalysts for a double bottom reversal set-up chart

maiden standalone 50MW energy storage asset, named Camilla, has successfully begun commercial operations. This is a significant milestone for the Company as it increases NESF's total installed net capacity above 1GW to 1,014MW.