Contents: Click on Link to View

Toggle06:45 Big day in Economic Data - German CPI, US PCE - Inflation : BTC at $63K

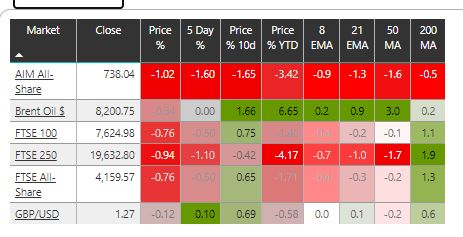

Yesterday saw heavy selling across the board in the UK indices with the small and mid caps selling the most and with selling concentrated in pharmaceuticals Household goods and home construction, precious metals, Medical equipment supplies media. Banks continued to show positive momentum as did consumer goods and electrical equipment

US closed with some selling led by techs with the Nasdaq down -0.54%

The US Dollar Index continues sideways and showed little reaction to yesterday's price PCE data - full inflation data later today at 13:30 may move the needle

Gold dipped to the 21EMA and bounced back to the $2036 level yet again staying rangebound - see Chart

Bitcoin, blasted through the $60K levels and continues the parabolic move north currently at $64,000 and looks stretched and prone to a pullback

Brent still at $82 in a range - Chart

Copper flat at the top of channel and looks set to move north pending dollar moves

Dollar decision time ? - Click to enlarge

gold top of channel tracing 50 MA - Click to enlarge

Brent on the 200 MA sideways, may sell - Click to enlarge

Bitcoins blast off in full parabolic mode - prone to pullbacks

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar

Ones to Watch - Oil Services HTG and SEPL Reporting: OCDO beats : AVCT places at 50p

Charts for both HTG and SEPL have shown some pullbacks into results which may see expectations beaten by the actual numbers: SEPL announces a special divi and looks set bounce from the 50MA : being the more bullish of the two - RNS

Financial highlights

•

Revenue $1,061.3 million up 12% from $951.8 million in 2022.

•

Average realised oil price $83.39/bbl (2022: $101.67/bbl); average realised gas price $2.90/Mscf (2022: $2.82/Mscf).

•

Unit production opex of $10.4/boe, (2022: $10.3/boe).

•

Cash generated from operations of $520 million, down 10% on 2022, funding capex of $184 million and enhanced shareholder returns.

•

Balance sheet strengthened, year-end cash at bank $450 million (2022: $404 million), excluding $128.3 million MPNU deposit.

•

Net debt at year end 2023 reduced to $306 million (YE 2022: $366 million). Net Debt to EBITDA 0.7x.

Operational highlights

•

Production averaged 47,758 boepd, up 8% from 2022 (44,104 boepd), and within original guidance.

•

Year end 2023 independently audited 2P reserves up 9% to 478 mmboe (YE 2022: 438 mmboe), 47% liquids.

•

Drilled and completed 14 wells in 2023 (of which 6 completed in 4Q 2023), in line with our revised well program.

•

ANOH gas plant achieved mechanical completion on 29th December 2023. Our government partner recently announced the tunnelling operations on the Niger river crossing portion of the OB3 pipeline have begun. Seplat's first gas guidance of 3Q 2024 is unchanged.

•

Carbon emissions intensity: 27.9 kg CO2/boe (2022: 23.9 kg CO2/boe).

•

Achieved more than 8.7 million hours without Lost Time Injury (LTI) on Seplat-operated assets in 2023.

Hunting HTG - RNS

Hunting PLC (LSE:HTG), the precision engineering group, today announces its results for the year ended 31 December 2023.

Financial Highlights

·

Order book increased by 19% to $565.2m.

·

Revenue increased by 28% to $929.1m.

·

Non-oil and gas revenue increased 59% from $47.6m to $75.9m.

·

Gross margin improved to 25% from 24%.

·

EBITDA, ahead of previous guidance provided, and increased by 98% to $103.0m.

·

EBITDA margin of 11% up from 7%.

·

$83.1m of previously unrecognised deferred tax assets recognised at year-end.

·

Total dividends declared in the year of 10.0 cents per share, up from 9.0 cents in 2022.

OCDO strong results off an almost double bottom chart could see a move north

AVCT finally announces a placing at 50p ending the speculation though at a very significant discount to the close of 76p at 50p

ARB CLOSED AT 17.3p

Argo Blockchain didn't rally as expected and continue to see heavy selling at the 20.5p level : having taken partial profits previously, I closed the remainder of the position at 17.3p as the price action doesn't look heathy despite the strength in BTC . My entry point was 17.0p posted here

Previously I wrote:

Argo Blockchain has been underwhelming in its response to the BTC with significant resistance at the 21.5-22p which has seen selling into this level : I'd expect this to clear assuming no major pullbacks in BTC which would potentially open the door to a move north of 24p based on volume profile

It hasn't cleared and instead there seems to be a breakdown in correlation which used to exist between crypto and the like of ARB and QBT : neither of which seem to be to be working : the overall sentiment in UK markets currently isn't supportive of high beta names like ARB in any case so prefer to sit this out and preserve capital. I am also guilty of being biased here as I made enormous profits from ARB having bought in the 3-10p region and then sold at various points on the ride up to 320p.

This used to be a good idea - it now no longer seems to be and that is the nature of trading sometimes - I am wrong on this occasion for this trade at this timescale despite the signals and setup. That included a vol squeeze long which had fired in the chart below and a good rising trendline