Contents: Click on Link to View

TogglePre Close ARB sells back to the 21EMA - Key Support Does it Bid as BTC Signals a Reversal Intraday: PAF Rallies on a Red Day

Into the last hour of trading as the US come back from a day off in a mood: VIX has spiked 11% to near 16 with the NASDAQ dipping below its 21EMA for just the second time in 2024 - so is it BTFD time again or will this be a real pullback?

Nvidia reports tomorrow After the market close, these are hugely anticipated results and underpin whole AI thesis that is driving many of the key tech stocks in America. Any disappointment in Nvidia earnings is likely to spill over into broader selling and is probably just a catalyst for some much needed profit taking. Should that occur it'll be interesting to see the extent of the selling and how broad that might be given the relative performance of other sectors.

In the UK, Barclays promises and financial engineering today helped spur the stock 9% higher I Making a similar move as Natwest did last Friday albeit gaping above the 200 MA which had proved resistance of late

Close Brother CBG is staging a dramtic reversal up 16% from its lows intrday while MTRO is showing sings of making a break for it as the banking sector heats up

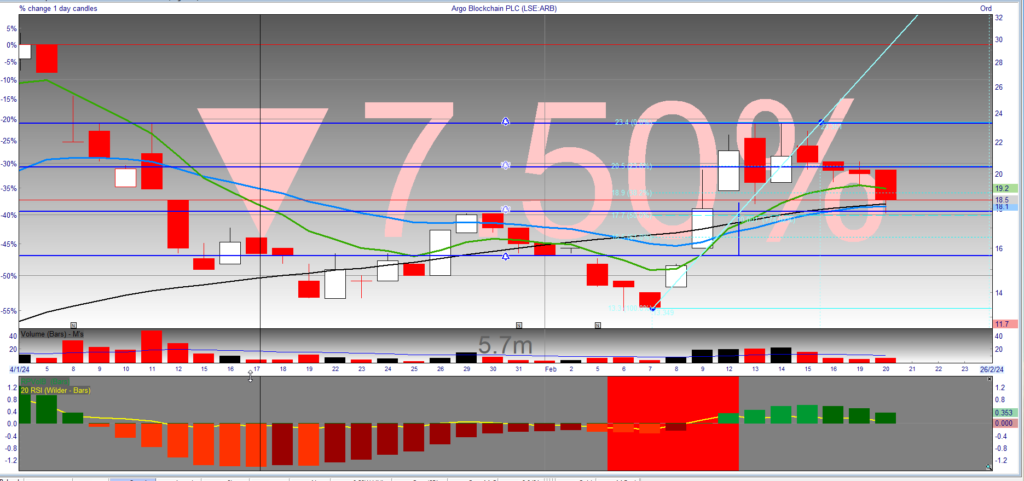

Argo Blockchain ARB - sells back 10% today - but finds support around the 21EMA which is confluent with a 50% retrace of the recent breakout - this tends to be a volatile name a bit like bitcoin so I size and manage appropriately: This may prove a good area to add though Bitcoin does remain below key resistance and can't seem to break through the $53K barrier for now: and is forming a reversal candle on the daily chart . ARB’s chart is showing increasing volume on updates and lower volume on down it days which tends to support a more accumulation type phenomenon

Pan African Resources (I am long) rallies 5.6% despite the down day - this has been respecting its 21EMA as support since it broken out above it on an operational update on 22 Jan 24

Pre Market- 0750: Dollar Firm, BTS $52K : Gold $2020

The FTSE100 made a new 2024 high intraday yesterday before slipping back slightly to close just shy of unch on the year: futures are at 7724 unch off the cash close

The dollar held firm around the 104 level hugging the 8 EMA. Brent oil pushes up into resistance around the $83 level

Copper and platinum pulled back slightly from the recent moves. Uranium is holding on to its 21 EMA around the 102 level

Bitcoin continues to encounter resistance around the $52,000 mark

Relatively quiet in the economic calendar with earnings at 7 from ANTO BARC BHP IHG BPS

Dollar holding firm around the 104 level in an uptrend

Dollar holding firm around the 104 level in an uptrend

Brent crude pushes up into resistance close to the $83 level

Copper slips back slightly from the big move on Friday consolidating around the 50 MA

Today's trading opportunities from RNS newsflow catalysts that trigger trend changes

Daily RPG Reports: 15:21 Update Published Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar

One to Watch AXL Drilling Results

Arrow Exploration looks set to continue positive momentum with additonal catalysts from drillig results - RNS

Marshall Abbott, CEO of Arrow commented:

"The thick pay zones encountered in the CN-4 and CN-5 wells underpins the step change in value that has been created. The Company expects material reserves additions and production from further development of the multi-zone potential at Carrizales Norte. The defined Ubaque reservoir has set the stage for conventional horizontal exploitation which we expect to lead to material production, cash flow and reserves growth. Additional pay zones currently behind pipe provide further opportunities for production and reserves increases in the future.

"The CN-4 and CN-5 well results have helped determine the size of the Ubaque pool at Carrizales Norte and there are strong indications that the reserves additions will transform Arrow into a much larger company. Multiple development locations are anticipated based on current results.