Contents: Click on Link to View

ToggleToday's trading opportunities from RNS newsflow catalysts that trigger trend changes

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

ITM Pullback Add

Nice orderly pullback in ITM power providing an opportunity to get long again from a bounce off a confluence of the 38.2 fib retracement of the breakout and a 50% retracement from swing low of the 31st of January: added back at 57p

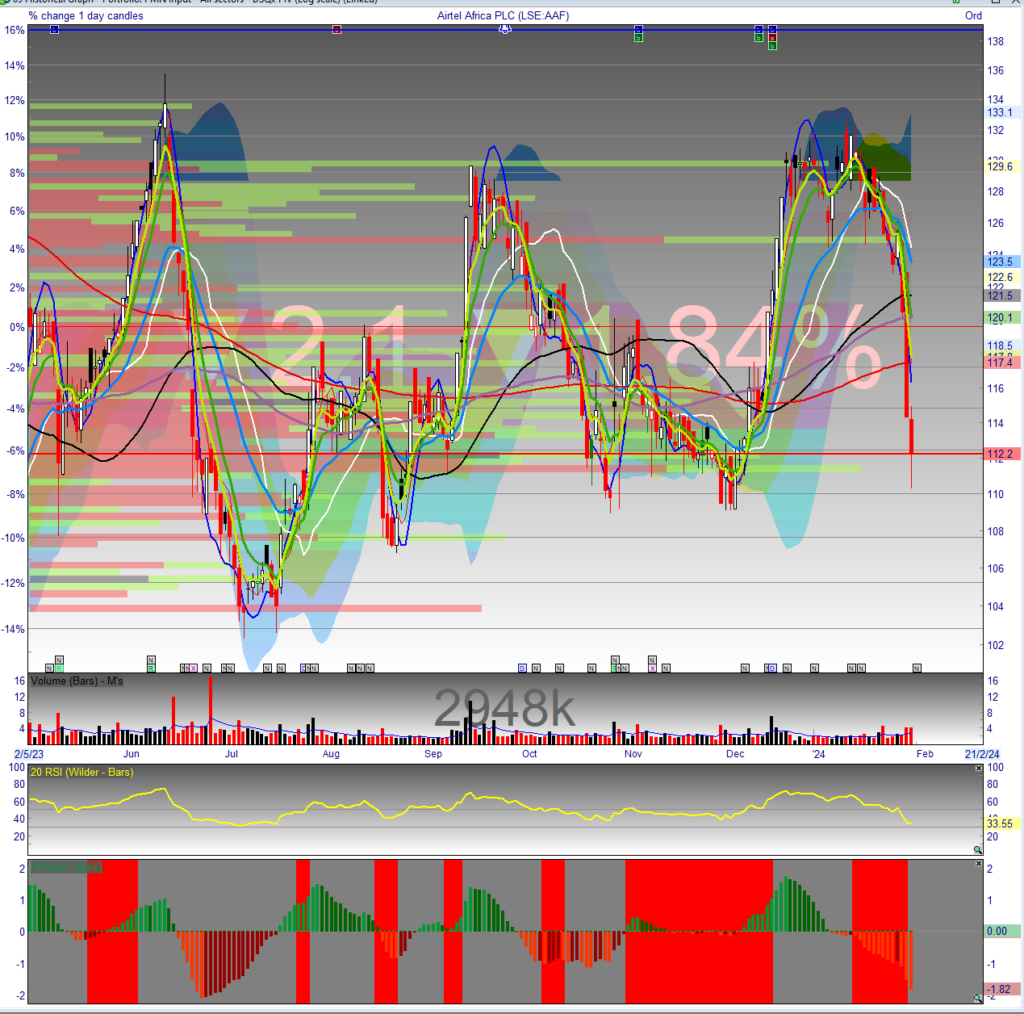

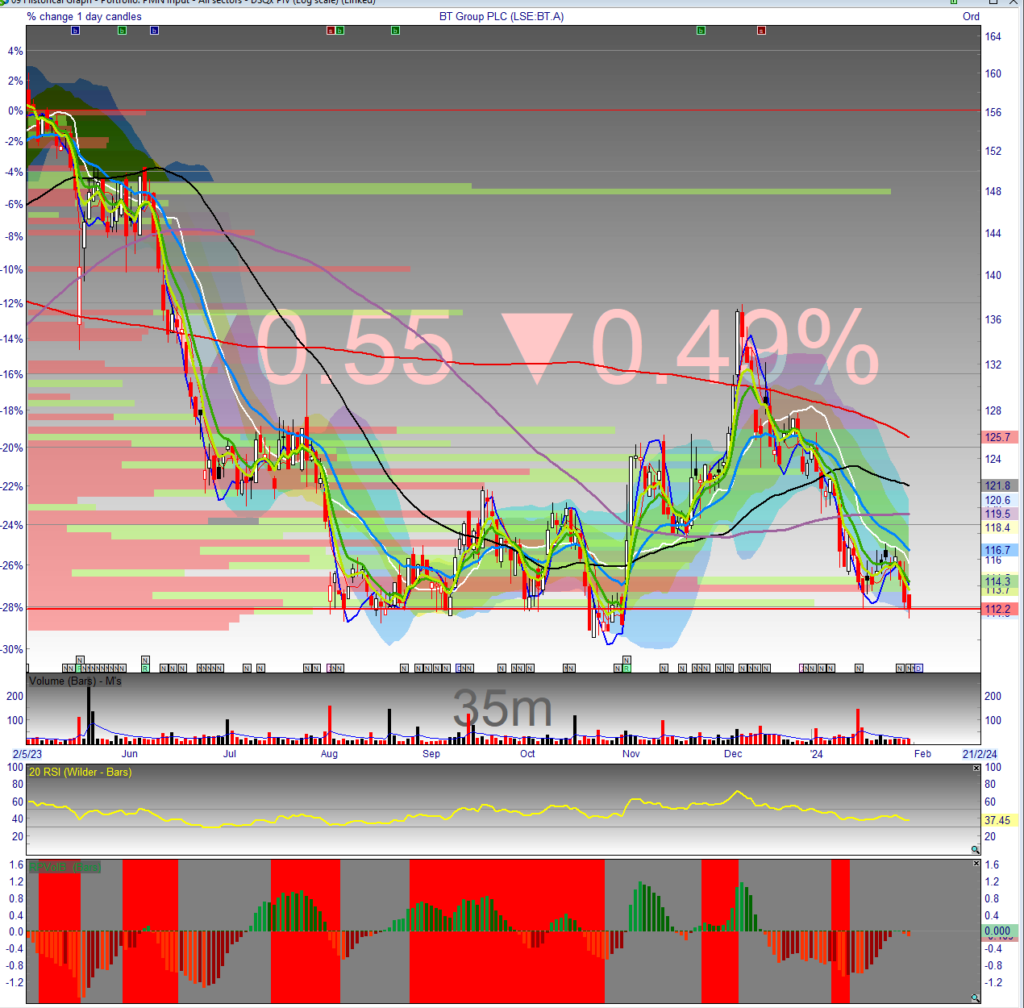

Ones to Watch 07:30 AAF BT

AAF and BT may see positive reactions to update - charts suggest opportunities to surprise to the upside and both sets of results look favourable. Wait for the market response for any potential JoB trade as not very compelling catalysts and risk-on is slightly dampened post Fed.

· Revenue in constant currency grew by 20.2%, with Q3'24 growth accelerating to 21.0%. Reported currency revenues declined by 1.4% to $3,861m. In Q3'24, reported currency revenues declined by 8.3% as currency devaluation (primarily the Nigerian naira devaluation) continued to impact reported revenue trends.

· All segments continued to deliver double-digit constant currency growth. Across the Group mobile services revenue grew by 18.6% in constant currency, driven by voice revenue growth of 11.2% and data revenue growth of 28.5%. Mobile money revenue grew by 31.8% in constant currency.

· Constant currency EBITDA increased 21.9%, with Q3'24 EBITDA growing 23.3%. The EBITDA margin of 49.4% increased 72bps over the prior period despite foreign exchange headwinds and inflationary pressure. Reported currency EBITDA declined by 0.4% to $1,908m, with Q3'24 EBITDA 8.3% lower as currency headwinds continued to impact reported trends.

· Profit after tax was $2m in the period, primarily impacted by significant foreign exchange headwinds, particularly the $330m exceptional loss after tax following the devaluation of the Nigerian naira in June 2023 and the Malawian kwacha in November 2023 after the structural changes in their respective FX markets. The Nigerian naira devalued further in Q3'24, resulting in a $140m derivative and foreign exchange losses net of tax, which is not treated as an exceptional item.

· EPS before exceptional items was 7.1 cents, a decline of 34.6%. Basic EPS at negative (1.6 cents) compares to 12.5 cents in the prior period, impacted by the significant derivative and foreign exchange losses as explained above.

and BT results BT has 1.7% short interest

Continued strong execution of our strategy

• FTTP build rate accelerated to 73k per week delivering a record of 950k premises passed in the quarter. FTTP footprint is now expanded to 13m premises with a further 6m where initial build is underway

• Strong Openreach customer demand for FTTP with net adds of 432k in Q3. Total premises connected now 4.4m with increased take-up of 34%

• Openreach broadband ARPU grew by 10% year-on-year due to price rises and increased volumes of FTTP; Openreach broadband lines losses of 369k year to date, a 2% decline in the broadband base; ongoing weak broadband market conditions mean losses will exceed 400k in FY24

• Consumer broadband ARPU increased 5% year-on-year and Consumer postpaid mobile ARPU increased 8% year-on-year; monthly churn for the quarter remained stable in a competitive market with broadband and postpaid mobile at 1.1% and 1.2% respectively

• Business financial performance continues to be impacted by higher input costs, legacy declines and prior year one-offs, partly offset by cost transformation and growth in Small & Medium Business (SMB) and Security

• Retail FTTP base grew year-on-year by 46% to 2.4m of which Consumer 2.3m and Business 0.1m; 5G base 10.3m, up 30% year-on-year. RootMetrics named EE the UK's best mobile network for the 21st time running

• BT Group NPS of 25.7, up 3.6pts year-on-year, further improving customer experience

Continued pro forma revenue and EBITDA growth year to date:

• Pro forma adjusted1 revenue £15.8bn, up 3% on Q3 FY23 due to price increases and fibre-enabled product sales in Openreach, increased service revenue1 in Consumer with 2023 annual contractual price rises being aided by higher roaming and increased FTTP connections, and SMB trading momentum and price rises in Business, offset partially by legacy product declines; reported revenue was up 1%

• Pro forma adjusted1 EBITDA £6.1bn, up 3% with revenue flow through and cost control more than offsetting cost inflation and one-off items in the prior year

• Reported profit before tax of £1,498m, up 15%

• Reconfirming all FY24 financial outlook metrics

Premarket

Dollar Firm Above 200MA after Fed Decision

Higher volatility yesterday upon a more hawkish Fed meeting lowering the probability of rate cuts, boosting the dollar, denting gold slightly and paring some enthusiasm in equities on what was the last day of the month anyway. All of the metals retreated while Brent oil dropped 2.1% to an $80 handle

European CPI and US mega tech earnings from|Apple, Amazon and Meta today will further set direction

Dollar looks set to move north above the 200MA

<Click on charts to expand >

Brent dropped 2% though the 200 MA

<Click on charts to expand >