Contents: Click on Link to View

ToggleToday's trading opportunities from RNS newsflow catalysts that trigger trend changes

Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Best viewed in full screen by hitting the diagonal arrow on the bottom right of report bar

Premarket

Oil Firm ,Gold Clears 50MA, Copper Holding

Brent oil slips back below the $84 handle but stays firm while Gold finally clears the 50 MA as the dollar tracks sideways clinging to its 200MA

Copper holding gains while platinum advanced yesterday to the 50MA with urnanium holding below $100 at $99.65

<Click on charts to expand > <Click on charts to expand >

<Click on charts to expand >

Ones to Watch 07:30

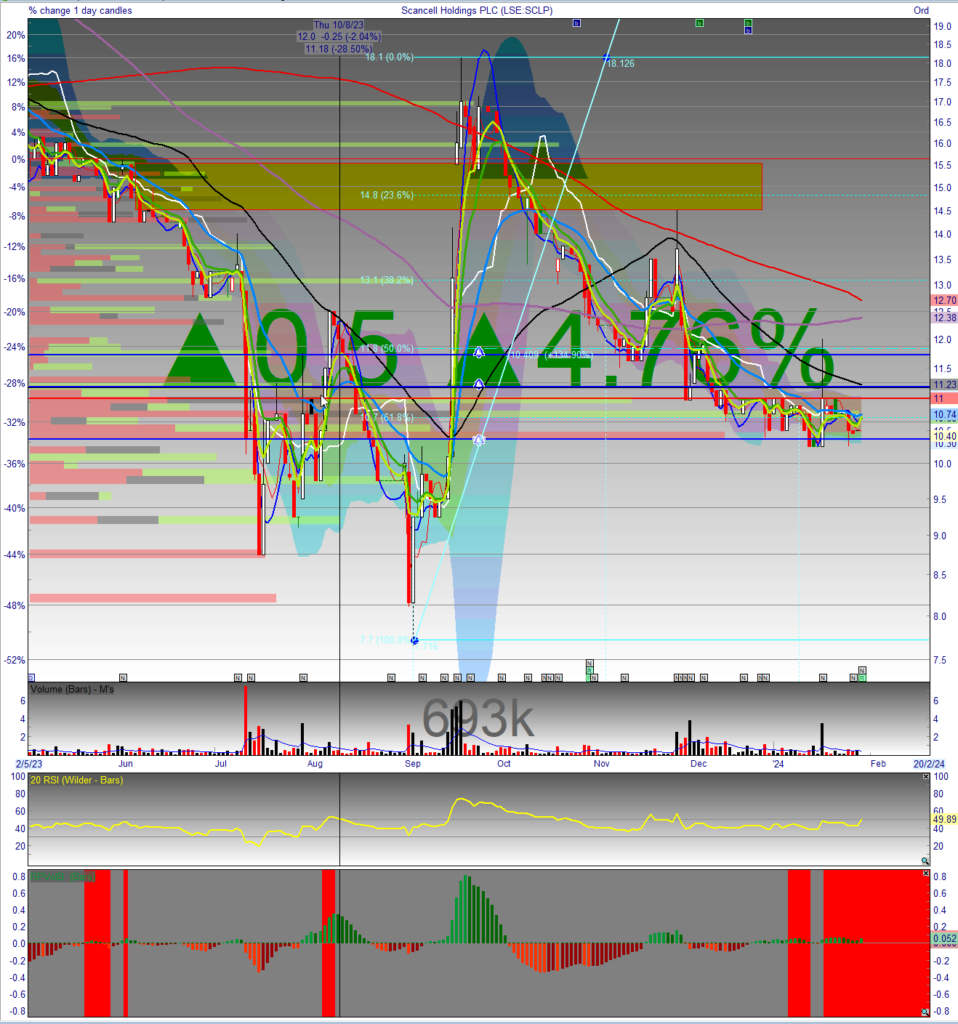

Scancell Holdings 's TU doesn't bring much new but may save as a reminder of the promise ahead - chart sits in a vol squeeze which is a 61.8% retrace of the Sep'23 pop - this may reload on the reminder

[stock_market_widget type="inline" template="generic" assets="SCLP.L" markup="{name} ({symbol}) {price} ({change_pct}){last_update}" style="font-size:x-small" api="yf"]Uranium Names on the Move GCL AURA BKY - Quarterly Reports and Spot Price Outlook Catalysts

Geiger Counter

Geiger Counter GCL ] has checked back in to the rising trendline and has bounced looking set to resume the uptrend assuming support from uranium

Geiger Counter GCL ] has checked back in to the rising trendline and has bounced looking set to resume the uptrend assuming support from uranium

open GCL Chart

I am long GCL from a 49p entry point and also long Yellow Cake from 420p/490 entries

Berkeley Energia

has updated the market this morning and is making a move off base albeit there are caveats to the challenges BKY faces owing to opposition of its rights to mine uranium in its Spanish Salamanca mine 3 hours wets of Madrid. This introduces something of a binary risk however if BKY are successful then there's significant upside to this namewhich has no debt and AUD$75m on the balance sheet : good for a trade with a stop below 14p building out a bit of volume around 15.5 p with a potential 16p entry on spread

has updated the market this morning and is making a move off base albeit there are caveats to the challenges BKY faces owing to opposition of its rights to mine uranium in its Spanish Salamanca mine 3 hours wets of Madrid. This introduces something of a binary risk however if BKY are successful then there's significant upside to this namewhich has no debt and AUD$75m on the balance sheet : good for a trade with a stop below 14p building out a bit of volume around 15.5 p with a potential 16p entry on spread

open Berkeley Energia chart BKY

Aura Energy

Aura energy has rallied 4% gapping above the 200 day moving average on an upbeat Quarterly Report this am having checked back in to a 61.8% Fibonacci retracement of the June 23 swing low to the October 23 high following an equity release on 12 Jan 24

Open AURA chart