Below are the summary pages and links to the 2023 global macro outlook reports from the world's biggest financial insitutions.

These are useful as insights on how some of the biggest money managers are postioning based on market expectations.

- Blackrock

- Barclays

- Bank of America

- Deutsche Bank

- Goldman Sachs

- HSBC

- JP Morgan

- Morgan Stanley

- Schroders

Blackrock 2023 GLOBAL INVESTMENT OUTLOOK

A new investment playbook

Barclays Q1 2023 Global Outlook: Living with shock and awe

Next year will be a long, hard slog

2023 may well be one of the slowest years for global growth in decades.

Our analysts expect the world to grow at 1.7% next year, a big slowdown from the 6%+ growth of 2021 and a significant drop from the 3.2% growth expected for 2022.

Inflation will likely fall slowly, with consumer prices worldwide rising at a 4.6% average next year.

BoA: Outlook 2023: Back to the (new) future

Could the coming year bring a return to a more

promising market environment as global

economies reset?

Topics explored include:

- New ways to think about bonds vs. equities as rates shift

- What a potential recession could mean for the markets

- Dealing with inflation, volatility and other investment risks

- Portfolio strategies and opportunities to consider now

Deutsche Outlook 2023/24: New global realities

We look at the expected recession in the winter half-year 2022/23 and the onset of recovery, how

inflation will peak,

while the labor market loses momentum

and private consumption is hit by the loss of purchasing power.

Construction and Capex spending are set to deteriorate.

Fiscal policy continues to lean against the headwinds but should normalize somewhat.

Loan growth, both with corporates and private households, may slow substantially.

In a medium-term perspective, we discuss risks for the manufacturing industry and Germany’s geopolitical and competitive position

HSBC Looking for the Silver Lining Q1 2023

The world economy continues to slow, with the Eurozone and the UK in recession,

the US being more resilient but growing well below trend,

and China showing limited potential for a quick or sustained recovery.

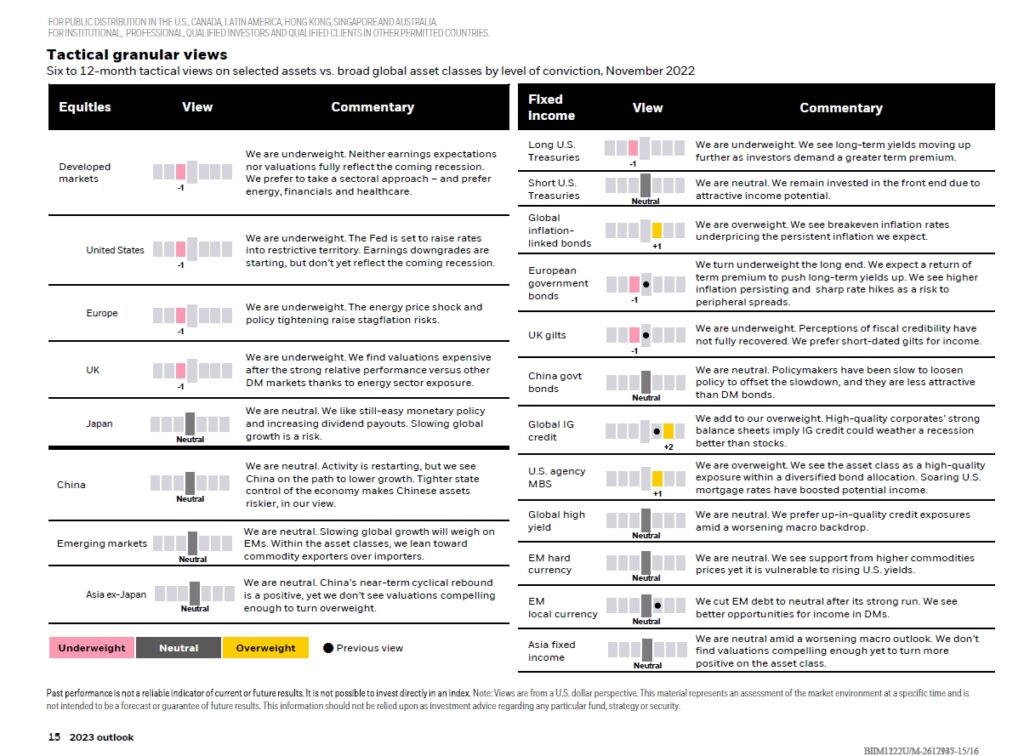

As we enter 2023, we remain cautious with an underweight in equities, balanced with overweights in bonds and hedge funds.

But we also look for the silver lining and examine what could eventually make us more constructive later in 2023.

J.P. Morgan Outlook 2023 See the potential Weaker growth, stronger markets

Most things that could have gone wrong for investors did in 2022. Markets that entered the year with extended valuations buckled under high inflation, an aggressive global rate hiking cycle, and the war in Ukraine.

Unusually, both stocks and bonds suffered big losses in 2022 — one of the worst years ever for a balanced portfolio.

But here’s the good news. Precisely because markets are so battered, lower equity valuations and higher bond yields, in our view, offer investors the most attractive entry point for a traditional portfolio in over a decade.

In this year’s outlook, we consider key economic and market forces — the consequences of monetary policy tightening, weakness across the global economy, market pricing and valuation resets — and discuss what they might mean for your portfolio.

Morgan Stanley: 2023 Global Macro Outlook

2023 is likely to see weaker growth, less inflation and the end of rate hikes, with the U.S. narrowly missing a recession, Europe contracting and Asia offering green shoots for growth.

With excessive post-COVID consumer demand, bloated retail inventories and the battle against inflation continuing to weigh on growth in 2023, Morgan Stanley believes global GDP growth will top out at just 2.2%, narrowly defying recession, but lower than the 3% growth expected for 2022.

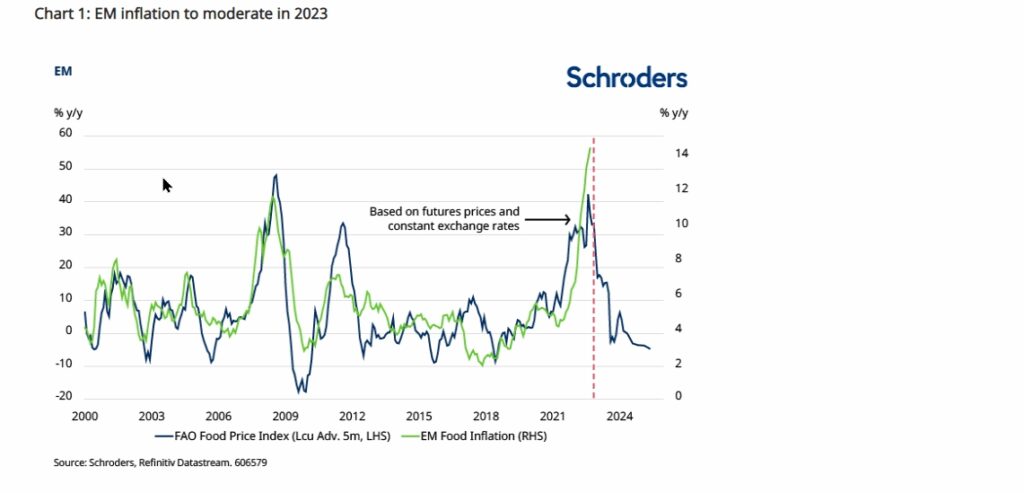

Schroders: Outlook 2023, Emerging markets: can stocks perform despite slowing growth?

- Economic growth is likely to slow in 2023 owing to slower global demand for goods, a weaker outlook for commodity prices and tighter domestic policy

- Easing inflation may set the scene for economic recovery in 2024

- A pivot from the zero-Covid policy in China, global disinflation, US dollar stabilisation or depreciation and valuations may be supportive of emerging equity markets in 2023.