Here Comes Santa Clause? US Stocks breakout on Fed Speech: Gold eyes $1800 on Weaker DXY

FTSE 100 futures + 40 on cash close following an explosive response to the Jay Powell speech after the UK close yesterday at 18:30: NAZ +5% S&P +2.2% as the likes of AAPl gained 4.9% though almost all names close in green - see heatmap

irrespective of the predictions on bottoms and “end of the bear markets”, this confirms the FTSE100 break above key resistance higlighted yesterday and does set us up for a potential strong rally to year end. Will look for follow-through today and see how the move is consolidated as a new month starts with new capital at work.

Look to the shorts for some potential squuezes in the most shorted see most shorted

(click on any of the images to expand)

A weakened dollar provides support for commodities which should be reflected in miners and oilers today: watch the 200MA in the DXY around $105.9: if this is lost convincingly then gold may well rally agressively. Copper made a strong move off the 21EMA and looks set to test the 200MA resistance in the coming days : positive signs from a China reopen are needed to move the metal north of this

I remain long gold and added around $1754 yesterday , my interim target of $1800 may well be reached in the coming day or two though the rally off the Powell speech may be prone to some selling. the 200MA at $1796 may provide resistance - see chart.

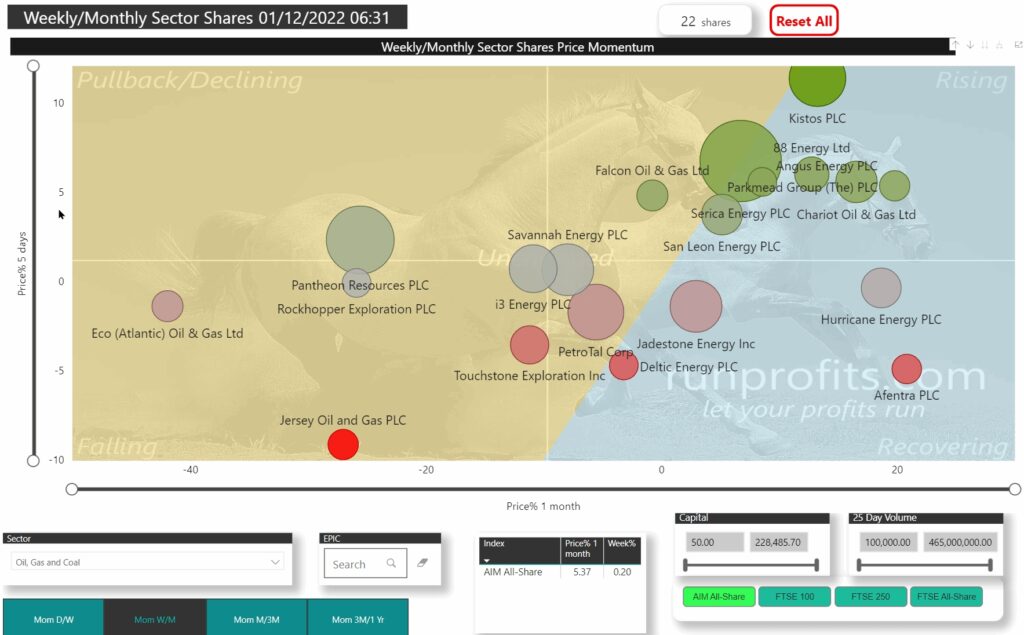

Here's view of the most bullish names in the precious metals sector over the past week/month : see sectors to DYOR over mutliple timeframes with filtering by mcap, volume and index .

Oil is holding around the $86 level following a strong up day yesterday though a clear an close on the 21EMA around $88.6 would see us back above that long term trend line and signal some more strength to come. For now, I remain cautious given the potential to slip below $80 towards a $72 support

Of the 109 oil and gas names, IOG, CASP and TLOU remain the most bullish over the past week/month. This trade is long in the tooth and very crowded so prone to sell-offs as other sectors rally and compete for capital. If oil remains weak, I'd expect underperformance in this sector as laggard names in other sectors play catch-up to year end. OPEC+ intervention and gep-political may buffet this either way

Drilling into AIM only, removing any names below £50m MCAP and <100K dialy volume with exlcusion of the most bullish outliers shows 22 names with KIST, 88E, ANG , CHAR and SQZ showing outperfromance relative to peers over the weekly/monhtly timeframes: see plot.

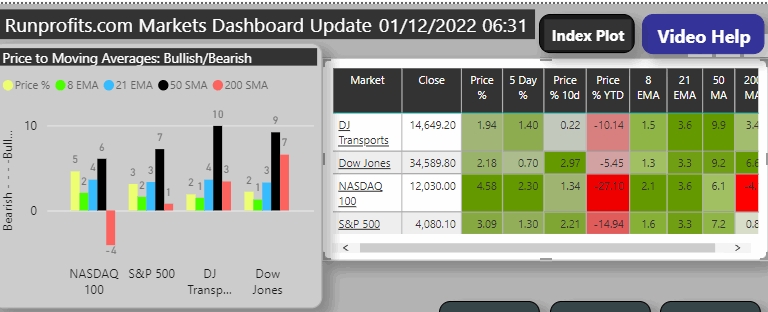

Market Dashboard and Sentiment:

VIX at 21.9 continues to suggest risk-on is supported

US Heatmap as of Close Wed 30 Nov 22

Econ Calendar

Start of month economic indicators today with Retail Sales. PCE, ISMs and an ECB speech at 16:45

Today's economic calendar