Run Profits is now live with access to all the data reports for low cost monthly subs find out more ....

Oil testing $90, Gold Holds Firm, Metals Firm, Indices Sideways to Up; Retail Sales at 0700

FTSE 100 , futures unch as the index maintains its bullish bias dipping to the 8EMA yesterday just below the 200MA and finding demand yet again : it has spent 6 trading sessions going sideways as it digests the big October rally. Momentum is slowing but the bias remains to the upside with just 160 points to test the 7500

FTSE250 is also seeing demand around the 8EMA, yesterday was yet another test of this level which saw buying and a close up 0.1%: this despite the Autumn statement which many had expected to be bearish the mid caps

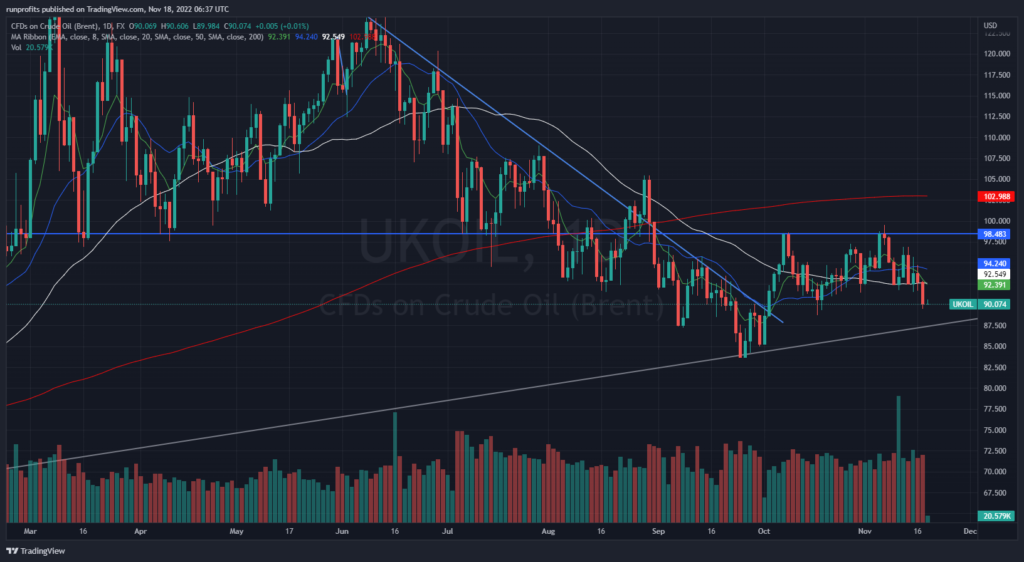

FTSE 100 and 250 names took the Autumn Budget in their stride although oil and gas names did see selling. An expected windfall tax impacted UK names like Serica and Energean. Further weakness in crude with a dip below $90 compounded this

AIM All-Share pulled back 1% to the 8 EMA which held

As highlighted Monday, oil weakness persists a volatility squeeze short has now fired across daily, weekly and monthly timescales . When all three timescales align this can signal some major moves. If the $90 slips then a test to $87 looks likely. This will support the travel sectors so airlines tend to see a pop on weaker oil.

A stronger dollar on the back of a higher European CPI sent gold lower to test the 5EMA as suggested yesterday, that the dip was this shallow is bullish and suggests we have further to run : I am long gold (from Thurs 03 Nov major reversal $1620) ) and looking for a test of the $1800 before trimming further

Copper has checked and bounced on the 8EMA as did silver while the PGMs maintain strenght off the recent reversal on weaker dollar (see table)

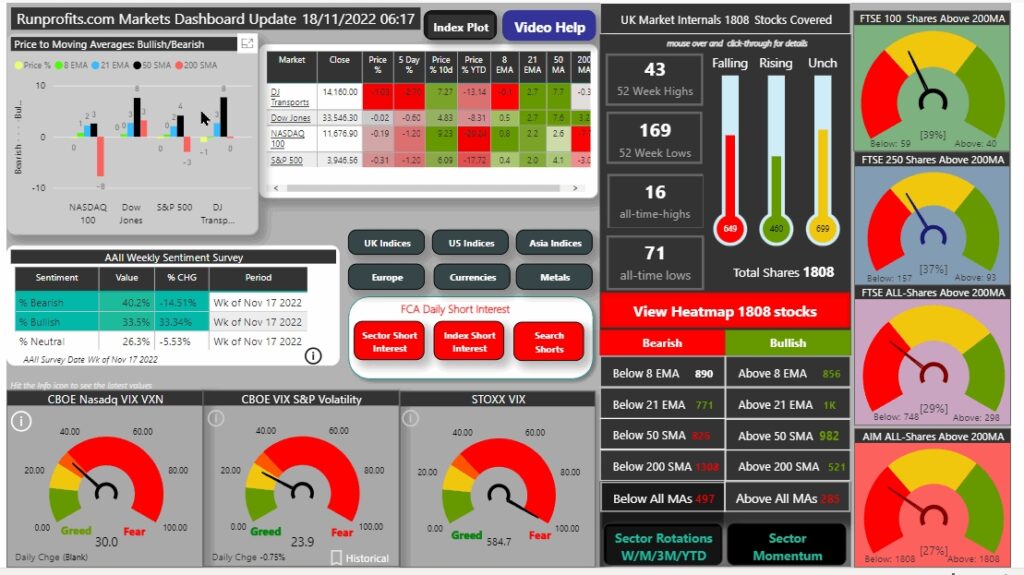

Market Dashboard and Sentiment:

VIIX below 24 so risk remains on. AAII weekly survey shows a tilt to bullish +33% change week on week though overall sentiment remains bearish (40%) to neutral (26%)

US Heatmap

US closed mildly red with the DOW continuing to outperform : both the S&P and NAZ dipped to the 8EMA and bounced which is bullish although AAPl +1.3% featured in that

Econ Calendar

Today's economic calendar Retail sales at 0700 expected -6.9% YoY or 0.6% MoM