Dollar Bounces, Gold Pullback, EU Inflation and Autumn Statement Today

FTSE 100 futures -20 on cash following yesterday’s hotter CPI and statement from the BoE: as flagged in yesterday’s Datum, the higher CPI dented the mid caps as the FTSE250 retreated a further 2% from that key overhead resistance line and 200MA: it did check and bounce n the 8EMA which is encouraging. As anticpiated, Travel, Retail and Housing sectors sold-off most .Today's budget statement being very houshold specific will impact the mid caps so again sectors like Retail, Travel and Housing are likely to respond accordingly although windfall taxes will also affect energy and utility names

AIM All-Share pulled back 1% to the 8 EMA which held

As highlighted Monday, oil weakness persists as we enter day 3 of a volatility squeeze short to the $90 level: macro suggests this should hold although slowing economic activity is normally reflected in decreasing demand

Gold has finally taken a pause back to the $1764 5EMA level,: a check back to the $1750 8 EMA may well be on the cards while the 21EMA at $1700 is confluent with the 100MA and still a possible checkpoint without violating the change in trend (ECB CPI may provide a catalyst for a spike lower: Gold will often do this and run stops before reversing and continuing north)

Copper continues to pullback having rejected an assault on the 200MA on Monday – it slips the 8EMA

US sold off mildly with the techs giving back some gains -1.5% but checking the 5EMA and maintaining bullish bias. S&P - 0.8% while the DOW held -0.1%

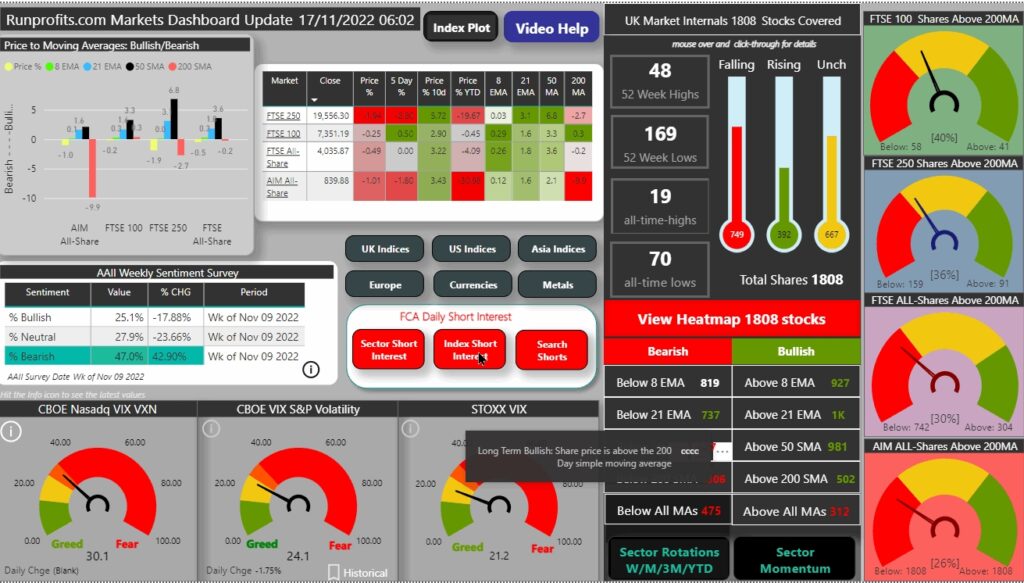

Market Dashboard and Sentiment: VIX ticks up to 24

US Heatmap

Econ Calendar

Today's economic calendar European CPI at 0700 with the UK Budget at 12:00. Two major market moving events