Daily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Open a chart using the opposite Search Box (add .L to the EPIC to specify UK): covers every asset class and most markets incl. US : redirect basic charting pages.

Search by Company/EPIC Below

[stock_market_widget type="search" template="redirect" color="#23282c" url="/stocks/{symbol_lc}" target="_blank" api="yf"]

Pre Market Sentiment and Charts Influencing UK Markets 06:35 (3 mins read)

FTSE futures -40 on cash close from a red US close .UK markets spent yesterday consolidating – the FTSE100 still below its 200MA following Monday’s test and rejection: it does maintain a bullish bias for now although RSI is declining

The FTSE250 checked back on the 100MA and held down 0.32%

AIM All Share dipped 0.6% to the recently crossed 50MA, the level held for now. This may be a bullish sing although it needs 3 or more closes above a major MA to signify trend may be changing

Brent crude continued to slump and has moved back to the 91 level: it is showing some signs of potentially moving south form here with a RPVOLb on the daily: I favour a check of the 50MA at $91.8 for more clarity on direction

Gold has stayed firm despite moving $100 in 4 trading days: it looks to be consolidating ready to move further north

US markets blew off some of the recent steam with a drop of 2% in the S&P, 2.4% IN the NAZ. The DOW which had just spent 2 days north of the 200MA dropped 2% losing the bid level but pausing at the 8EMA which may be telling

The failure of the crypto ETX exchange may be unsettling given potential contagion: bitcoins drop of 16% was mirrored by a similar drop in MicroStrategy which holds 130,000 BTC on its balance sheet in a much-publicised Saylor leveraged long

The big number today is US inflation at 13:30 – that’s likely to have an impact on direction. The DXY has rallied back above the '22 trendline after a brief slip below.A hot CPI will boost this north and inversely affect equities and risk. We tread nimble into binary risk events

Market Dashboard and Sentiment

VIX picked up just 2% to clear 26 and remains supportive of risk-on for now

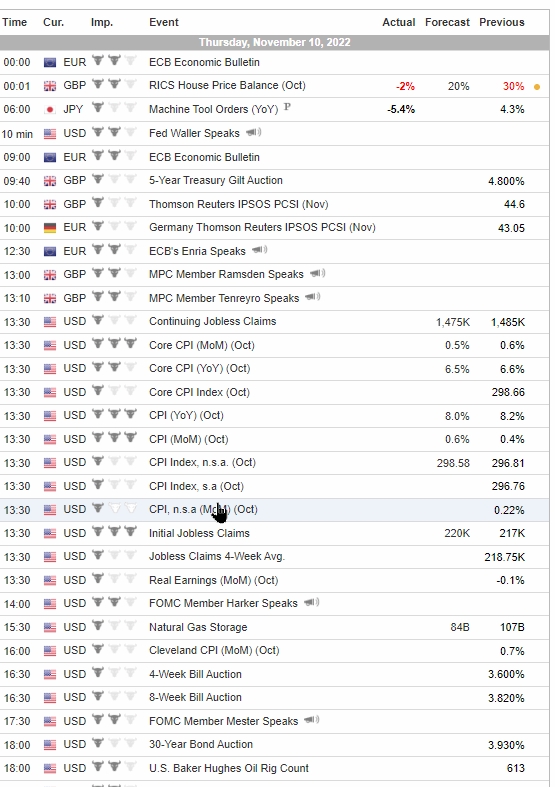

Econ Calendar

Today's economic calendar US inflation at 13:3

0