Contents: Click on Link to View

TogglePre Market Sentiment and Charts Influencing UK Markets 06:35(3 mins read)

US elections overnight didn't produce the expected red tsunami leaving markets in a wait-and-see mode for the outcome: likley the US GDP figure tomorrow will be the major catalyst for direction with the DXY below trendline see chart)

FTSE 100 Futures

FTSE Futures at7285 unchanged from yesterday's close

US Stockmap Close

US Closed mildly in green with the DOW outperforming and a doji showing some uncertainty on the S&P : investors awaiting the outcome of the midterms

Gold Chart

Gold made a significant move north yesterday on DXY weakness and a crypto rout driven by the FTX exchange rescue by Binance which sent bitcoin plunging south to $1700 intraday and breaking support

Gold has now rallied $100 in 4 days so expect some back and filling with a retest of the $1700 at least seeming likely

I booked some profits from my Thursday long at $1713 .

DXY Chart

Slips below trendline in place since the start of 2022 and seems to be front running a slower than expected inflation number tomorrow (or a more decisive election outcome)

One dip below a major line like this is not decisive so we wait and see

Brent Oil Chart

as highlighted yesterday - pulls back and consolidate towards the 21EMA at $94.6: Oil is below its 200MA around $103 so may be prone to sharp downside moves. This led to softness in oil names ysterday and boosted airlines and travel

Copper Chart

looks to be forming a bullflag building off the recent breakoout and a potential move north of the August highs: RSI showing the overhead resistance

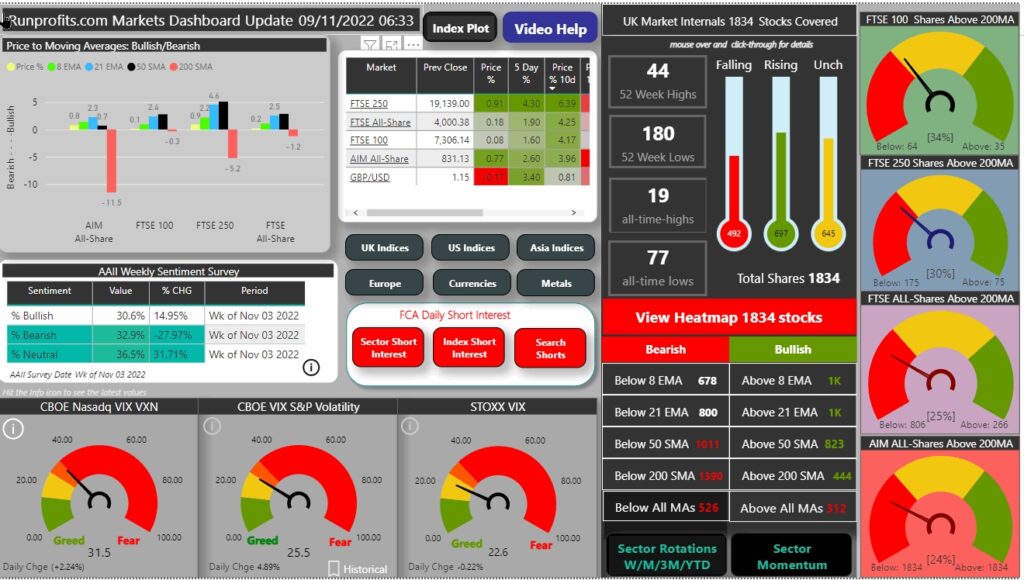

Market Dashboard and Sentiment

VIX at 25.5 slight uptick

Econ Calendar

Today's economic calendar is pretty light overnight saw China CPI 0.1% against expected 0.3%: EIA oil inventories at 15:30 may influence oil direction