Contents: Click on Link to View

ToggleDaily RPG Reports: Hit + to Expand Tab and Access Report: (Latest Update Open by Default)

Publication Schedule

below times are indicative and can be subject to data availability and prone to occasional technical issues. The purpose of this is to find trading opportunities and not to provide a comprehensive or accurate news service. The London Stock Exchange publishes regulatory news here . This should be the ultimate source to verify any RNS type data

- 1. Pre Market RNS 07:15: identify potential catalysts in RNS to trading opportunities based on chart set-ups: scope potential positions for market open

- 2. AM Liquidity 08:15-09:00 : market responses and price reaction to overnight/RNS catalysts : identify good entry points for trades (breakouts/downs, gaps) in early liquidity

- 3. Pre Close 15:00-15:30 captures the impact of US participation/enhanced liquidity and identifies potential setups before market close

Click on a tab below to open the RNS Report

Click on EPIC to open the chart Click on Headline to Open RNS Click on Time Stamp to see all recent News Help and Navigation

Pre Market Sentiment and Charts Influencing UK Markets 06:30 (3 mins read)

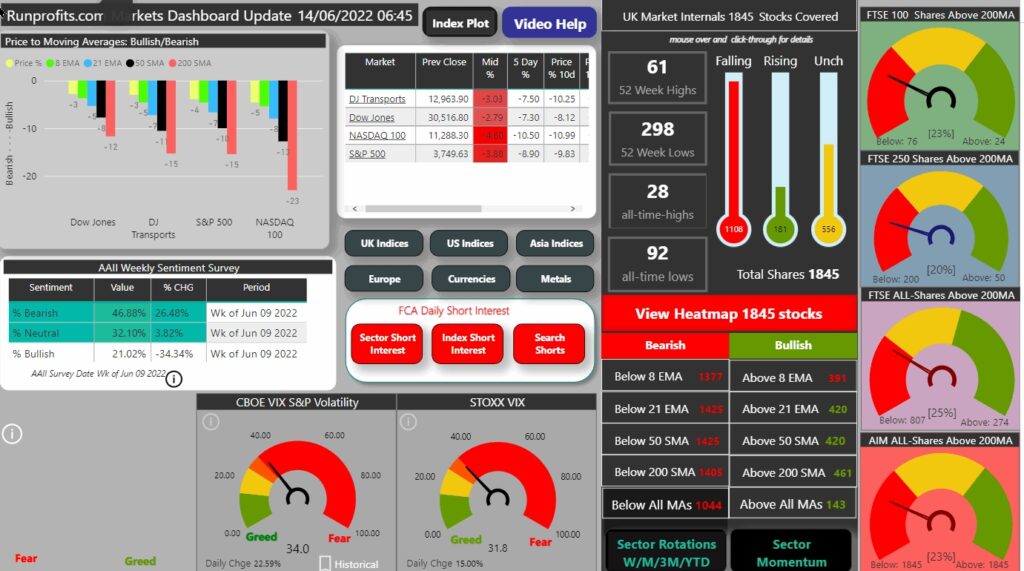

FTSE Futures show +40 on cash close as megacap index finds support at 7200: this looks to be a key level. Losing this likely completes a head an shoulders reversal and pitches towards 6800 (chart) so support is encouraging for now

FTSE 250 dropped -2.8% , didn't take out March low and may well be forming an inverted head and shoulders reversal

AIM All Share made a new low for the year

US session was ugly with broad selling in very sector: S&P , NASDAQ, DOW making new '22 lows - see map

DXY was the outperformer

Sentiment VIX has spiked to 34 VSTOXX to 32

OIl maintaining bullish bias but showing signs of slowing momentum as strong dollar and economic outlook weigh

Market Dashboard

US Stock Market