More than 15 years have passed since Iceberg Orders were introduced onto London Stock Exchange. The order type has stood the test of time and their presence remains a key contributor to the fabric of interaction on the orderbook today. Taking a moment to re-examine Iceberg functionality and reframe usage variables and trends presents the opportunity to rethink how to maximise the value that this integrated order type brings.

Functionality Fundamentals

Appropriately named, Iceberg orders consist of a visible peak and a hidden reserve quantity. They are designed to assist with the working of larger orders in lit order books. The full order remains available for execution on book, with queue priority rules leaving the hidden reserve behind all lit orders available at the same price level. If the visible peak is executed without the reserve quantity, the peak’s size is refreshed from the reserve and can be optionally randomised by London Stock Exchange to between 100-120% of the original size. MiFID II introduced a minimum size of €10,000 for Iceberg Orders, with a second venue specific size requirement dictating a minimum peak size of 40% Exchange Market Size (EMS) for equities and DR’s on London Stock Exchange.

Evolving Use

Across the EU, Iceberg orders operate under and are the primary contributor to the use of the Order Management Facility (OMF) waiver (more information on the OMF waiver is available in Article 8 of RTS 1 here). ESMA reported a 3% reduction in turnover coming from OMF waiver usage between 2017-2018, all whilst in a climate of rising on-venue turnover and the increase in total activity executed under all waivers.

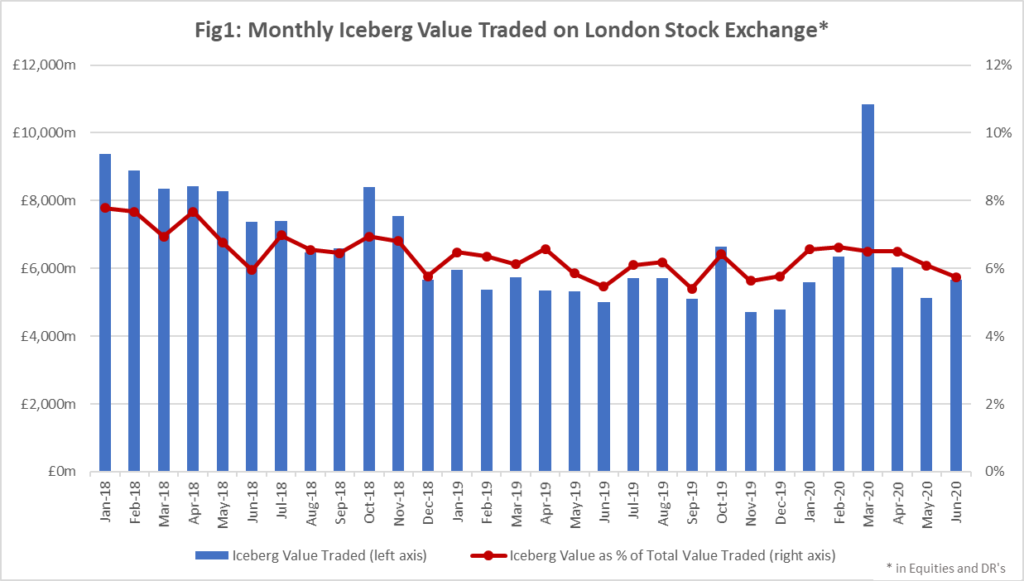

We have seen a trend showing a relative decline in usage on London Stock Exchange (Fig1), with the proportion of equity and DR turnover resulting from Iceberg Order usage falling from 7.8% in early 2018 to below 6.5% by Q2 2020.

These numbers mask some of the more granular liquidity opportunities that can be brought into focus however. Iceberg orders are a powerful tool to trade blocks on London Stock Exchange orderbook, with a third of equity and DR executions greater than Large in Scale (LIS) during continuous trading in Q2 2020 involving an Iceberg Order. An example of this can be seen in Fig.2 where a single Iceberg execution was 160% LIS in a FTSE 100 name.

We also see notably higher usage of Iceberg orders when moving away from the FTSE 350, with Icebergs proving valuable in trading securities with less on-screen liquidity and reducing the potential for greater information leakage. In H1 2020, FTSE 100 and FTSE 250 indices both saw less than 9% of continuous turnover attributable to Icebergs, compared with 11.5% in AIM securities, 13.2% in the International Orderboo0k and 18.3% in the Small Cap segment.

The likelihood of an Iceberg’s presence during continuous trading (which increases in less liquid segments), often means more liquidity is available at a price level than meets the eye. Taking into consideration this hidden liquidity when crossing the spread can enhance aggressive order routing. Oversizing non-persistent orders (IOC’s and FOK’s) presents the opportunity to find more liquidity without disclosing your intentions to trade greater size to the market.

Hidden Opportunities at the Close

Iceberg Order functionality can also be used in the closing auction, providing an efficient means of sending block orders into the close. During the auction only the peak size is visible to the market but the full order quantity remains fully executable and contributes to the price formation process. With industry focus and attention continuing on the closing auction, it is perhaps surprising that Icebergs are only lightly used, with just 0.8% of H1 2020 auction turnover attributable to the order type. This compares with 9.4% in continuous trading over the same period. With the increase in relative trading activity migrating to the close in recent years, this could begin to explain the overall downtick in Iceberg Orders contribution.

Taking into consideration market structure and regulatory evolution since Iceberg Orders made their debut, their value proposition hasn’t changed. They continue to be an important tool to achieve outsized executions on book with minimum information leakage, especially in less liquid names. Continuing to increase understanding and analysis as to how Iceberg Orders can be used reveal their importance. This importance should be taken in earnest.