UK Gross Domestic Product (GDP) 2021 6.9% (f)

Estimates of GDP are released on a monthly and quarterly basis. Monthly estimates are released alongside other short-term economic indicators. The two quarterly estimates contain data from all three approaches to measuring GDP and are called the First quarterly estimate of GDP and the Quarterly National Accounts. Data sources feeding into the two types of releases are consistent with each other.

https://www.ons.gov.uk/economy/grossdomesticproductgdp

https://commonslibrary.parliament.uk/research-briefings/sn02784/

Forecasts

The OECD in its latest report on the global economy (published 1 December), raised slightly its UK 2021 GDP growth forecast to 6.9%, from 6.7% at its previous September forecast. However, it lowered the UK’s 2022 GDP growth forecast to 4.7% from 5.2%. The UK is forecast to see the fastest growth in the G7 in 2021, after seeing the largest fall in GDP in 2020.

The IMF, in its latest report on the global economy (published 12 October), lowered slightly its UK 2021 GDP growth forecast to 6.8%, from 7.0% at its previous July forecast. The UK is still forecast to see the fastest growth in the G7 this year, after seeing the largest fall in GDP in 2020.

Morgan Stanley: 2022 Global Macro Outlook : Growth Despite Inflation

The surge in global inflation has investors fretting about future growth, but Morgan Stanley economists say price surges will subside, making way for 4.7% global GDP growth in 2022. Here’s the view on the global economy.

https://www.morganstanley.com/ideas/global-macro-economy-outlook-2022

PWC: The UK Economic Outlook December 2021

Explore our latest analysis of the UK economy and our view on the outlook for GDP growth, inflation and the labour market

UK GDP growth

The UK economy could reach its pre-COVID level by the end of the year. We expect the UK economy to end the year with an annual GDP growth rate of between 7.0% and 7.1%. This is largely similar to our previous forecasts made in July.

The UK economic outlook will be determined by four key factors, which we base our two scenarios around:

https://www.pwc.co.uk/services/economics/insights/uk-economic-outlook.html

BoA: Outlook 2022: Dawn of a breakout era?

Investors, get ready. Chris Hyzy, Chief Investment Officer, Merrill and Bank of America Private Bank, believes the markets and economy are poised for more growth next year. Here’s what you could do now to prepare.

Join Chris as he brings together some of the best minds in the business to explore:

- Where taxes, inflation and the economy could be headed

- The outlook for equities, fixed income and the longer-term investment landscape

- Actionable portfolio ideas you could consider now

https://about.bankofamerica.com/en/making-an-impact/outlook-2022

JPM: Outlook 2022: Preparing for a vibrant cycle

A turbulent recovery from the pandemic.

Most markets have delivered stellar returns in 2021 as the global economy continues to heal from the coronavirus pandemic. Yet in recent months, investors have focused on potential risks both to economic growth and market returns. Inflation is complicating central bank policy, supply shortages are hitting economic output, and COVID-19 remains a concern for consumers, businesses and investors.

But over a longer horizon, we see the foundation for a far more vibrant economic environment in the developed world than the sluggish growth and weak productivity that characterized much of the 2010s. This could have important consequences for investors, especially those who are still positioned for a reprise of the previous cycle.

https://privatebank.jpmorgan.com/gl/en/insights/investing/outlook

[pdf-embedder url="https://runprofits.com/wp-content/uploads/2021/12/outlook-2022.pdf"]

Blackrock 2022 Global Outlook : : Thriving in a new market regime

We are entering a new market regime unlike any in the past half century: We see another year of positive equity returns coupled with a down year for bonds. But we have dialed back our risk-taking given the wide range of potential outcomes in 2022.

https://www.blackrock.com/us/individual/insights/blackrock-investment-institute/outlook

[pdf-embedder url="https://runprofits.com/wp-content/uploads/2021/12/bii-2022-global-outlook.pdf"]

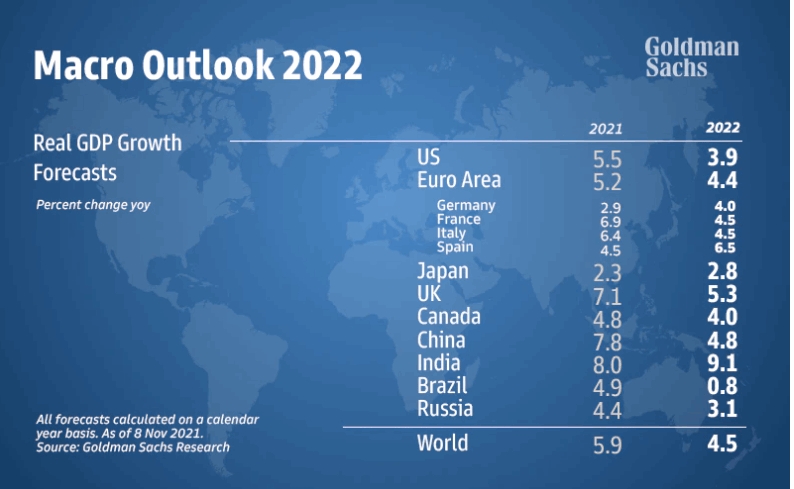

Goldman Sachs Outlook 2022: The Long Road to Higher Rates

Although the fastest pace of recovery now lies behind us, we expect strong global growth in coming quarters, thanks to continued medical improvements, a consumption boost from pent-up saving, and inventory rebuilding. For 2022 as a whole, global GDP is likely to rise 4½%, more than 1pp above potential.

The major DM economies should grow rapidly through midyear and then moderate gradually as the near-term impulses wane. In EM, we expect comparatively sluggish performance in China, where the property market is likely to soften further and macro policy looks set to ease only modestly, and in Brazil, where financial conditions have tightened sharply and a potentially messy election looms. By contrast, we are more optimistic on India because of significant catch-up potential and on Russia because of a boost from the oil and gas sector.

The biggest surprise of 2021 has been the goods-led inflation surge. This recently prompted us to pull forward our forecast for Fed liftoff by a full year to July 2022. Subsequently, we expect a funds rate hike every six months, a relatively gradual pace that assumes a normalization in goods prices and in overall inflation (albeit later and more partial than we previously thought).

By the time Fed hikes get underway, some advanced economies (including the UK and Canada) should be well into the interest rate normalization process, and a number of economies in Latin America and Eastern Europe may already be approaching its end. By contrast, we think the ECB and RBA are still far away from hiking rates, and markets seem to have overshot in their expectation of an imminent hawkish turn.

Beyond the next few years, we expect nominal policy rates across most DM economies to rise well beyond the rock-bottom levels now priced in the bond market. For one thing, inflation should settle ½pp above the pre-pandemic level on average, in part because central banks have tweaked their goals accordingly. Moreover, neutral real rates are more likely to rise than to fall, given increased political tolerance for budget deficits and climate-related investment needs.

https://www.goldmansachs.com/insights/pages/outlook-2022-the-long-road-to-higher-rates.html

[pdf-embedder url="https://runprofits.com/wp-content/uploads/2021/12/gs-macro-outlook-2022-the-long-road-to-higher-rates.pdf"]

[pdf-embedder url="https://runprofits.com/wp-content/uploads/2021/12/gs-macro-outlook-2022-the-long-road-to-higher-rates.pdf"]

Schroders Outlook 2022: Global economy

The emergence of the Omicron Covid variant has reminded us of the uncertainties which remain around the global pandemic. Despite these, we expect 2022 to be another good year for growth as the global economy continues its recovery. We do, however, see growth cooling following an exceptionally strong 2021, as the massive support offered by governments and central banks during the pandemic’s initial stages begins to fade.

Collection of Reference Outlooks for 2022 from , Blackrock, BoA,

Goldman, JPM, PWC