Pre Market 07:30: New Records in Iron Ore Price as Commodities Continue to Surge

Indices

FTSE 100 futures point to a flat open after last week's almost 1% change over the week: FTSE 250 lost over 3% last week while the AIM was down slightly on the week. The US and Asia were similarly flat to negative last week while Europe incurred losses across the board. In context these are minor consolidations after the November surge in global indices

Commodities

Brent crude remains bullish and is set to clear $51 having held the 50 level: this is bullish the oilers and should lift the FTSE 100. Copper futures hit the $3.60 level and is pulling back to 3.52 while iron ore continues its stellar run and is close to 160 making record prices. Gold is languishing around the $1833 level as it continues to consolidate

Sentiment

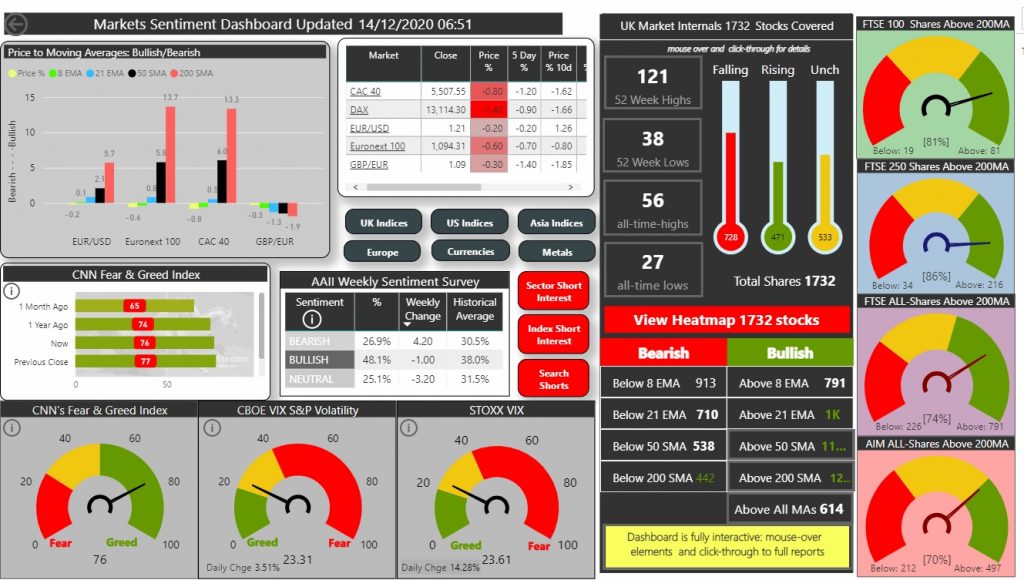

VIX has upticked to 23.3 from last week's low near 20: F&G is at 76 - Extreme Greed while the AAII remains extremely bullish at 48% :see dashboard below

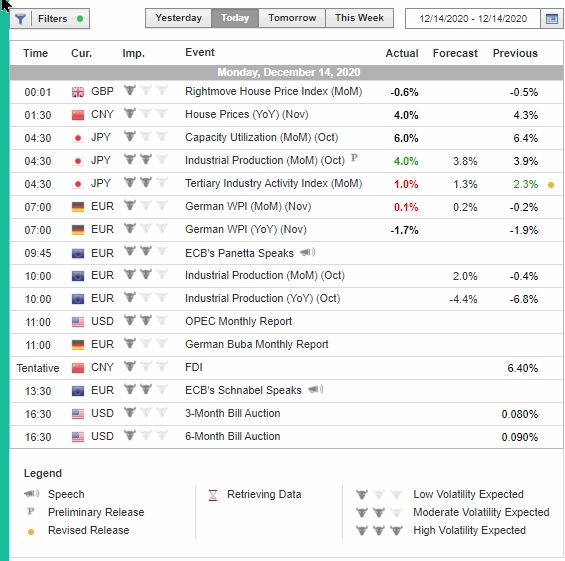

Economic Calendar