Contents: Click on Link to View

ToggleRead Tuesday’s RPG and View the Data Reports

Pre Market 07:15 Update:Oil and Copper Signalling Economic Activity Improvement: Gold stutters, Bitcoin breaks $17000/$18,000

FTSE 100 futures signal a lower cash open by around 30 points at the 6330 level as Wall Street retreated slightly yesterday evening . Asia was mostly positive overnight. VIX remains low by recent standards at 23 while the F&G Index remains at Greed with a 67 score

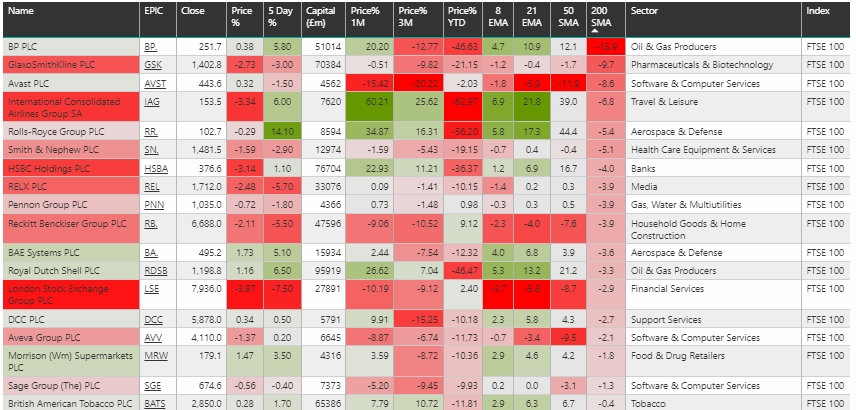

Yesterday's early weakness in the mega caps saw the FTSE 100 down over 1.4% at one stage before rallying intraday to close 0.9% down: the index remains 82% bullish with just 18 names below their 200 Mas. Many of these laggards are playing a catch-up trade over the past few weeks and include institutional stalwarts like RDSB, BP, RR, GSK, HSBC, BATS. It is also likely that many of the laggards will continue to benefit from the reopening trade

The FTSE 250 bought back all of today’s weakness to close flat while AIM continued to rally but remains perilously close to the 1000 level. I highlighted the diverging RSI yesterday which appears to be normalising so consolidation and continued rallying may be the direction of choice. That said, much of today’s rally was in a few big names in the AIM 100 with PRISM and FEVR doing a lot of the lifting helped by the 12% rally in CRW. Only around 200 names in the almost 800 strong index were positive on the day.

Gold remains rangebound and indecisive as it consolidates around the mid 1880s tracking its 8 EMA at 1887 but finding resistance from its 21EMA and below its 50 MA in a medium term sideways to bearish channel

Oil gave back some of the recent rally but remains bullish in the light of improving macro while copper is breaking out to new highs not seen since 2018.

With continued dollar weakness, GBP looks set to break the $1.32 level against the greenback and may be indicating some optimism of the Brexit outcome

Bitcoins relentless rise is being cited as a “different this time” kind of move… many are sceptical following the crypto craze of 2017-18 which ended predictably the way all bubbles end, badly. What might be different this time is the slower and less volatile rise of the digital asset: this time it is not in the hands of feverish “hodlers” but rather being quietly accumulated by institutions, trackers and ETFS. These tighter hands tend to be less reactive and are more strategic in their allocations. That said, we are approaching the previous all time high of $19,600 last seen in 2018 so there may be some turbulence ahead. What is also different this time is the hugely swollen balance sheets of the post Covid Central Banks and the commitments to further increase bond buying and extend budget deficits beyond conventional GDP ratios . Massive monetary stimulus combined with fiscal accommodation needed to prop up recoveries in many of the world’s economies into 2021 make fiat currencies increasingly unattractive. Much has been written about a potential solvency crisis as a result of Covid which makes limited assets like bitcoin more attractive.

Galloping Elephants FTSE 100 Laggards Playing Catch-Up

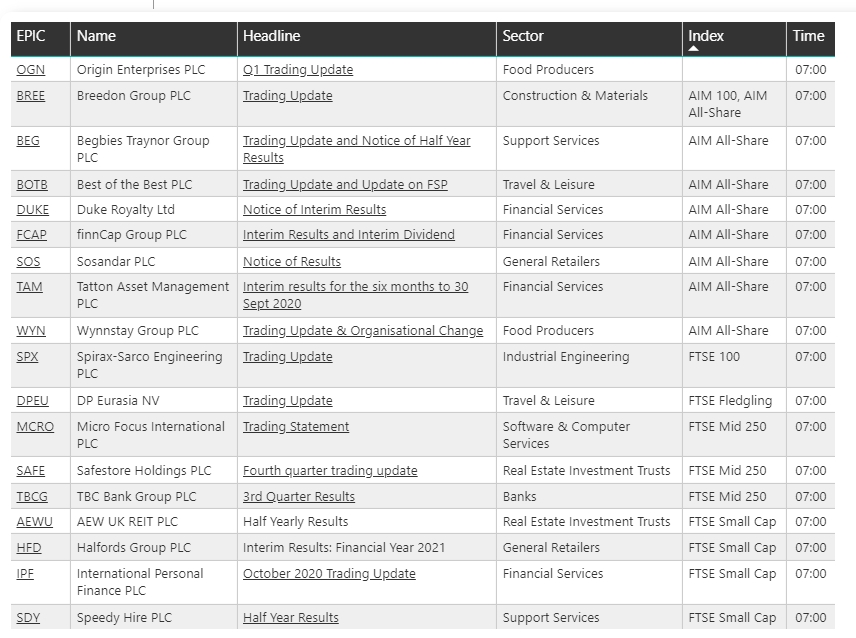

20 UK Companies Reported by 07:15

Select Report by Tab: If Report Appears Incomplete Hit “Reset All” to Refresh