Pre Market 07:15 Update: Pullbacks Ahead, UK GDP Bounceback

FTSE 100 futures signal cash will open some 70 points lower at 6330 as the index has stretched its gains over the past week adding 14.5% in just 10 days. The RSI (relative strength index) is at the highest level since Jul 2019 : this is an indicator of the overbought nature of an instrument and signals a reversion to mean is likely (see FTSE 100 chart below).

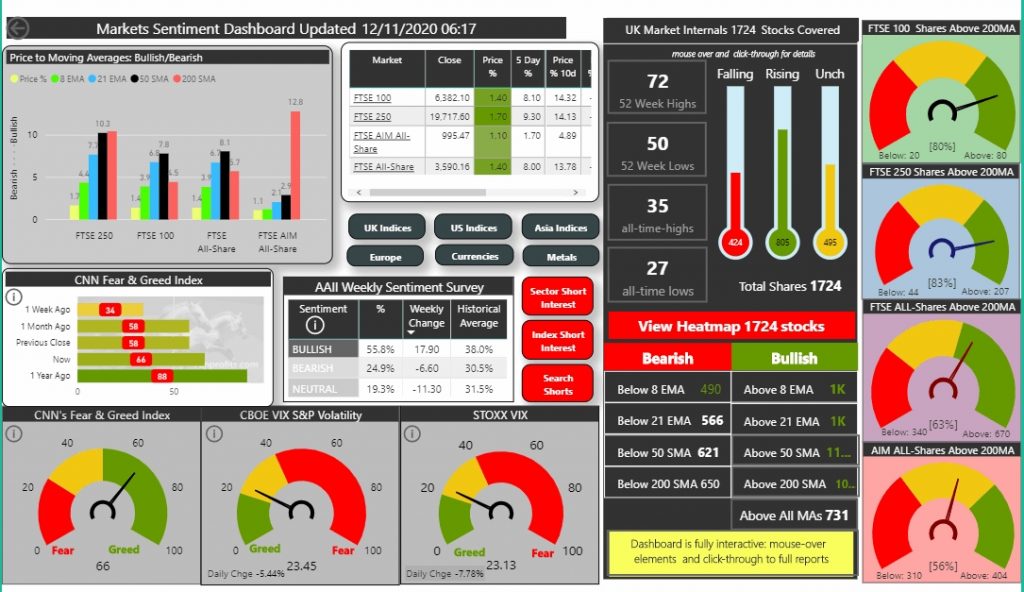

- VIX drops to 23 as Fear Index turns to more Greed at 66.

- Asia close mostly lower after a mixed Wall Street saw tech come back with the DOW closing flat on the day.

- Oil remained firm overnight having given back some gain yesterday but steadied on inventory releases: copper continues to be resilient while gold has held the 1870 level but still looks weak with a bear flag forming suggesting more selling may be ahead.

- Q3 UK GDP bounced back from -19% in Q2 to +15.5 in Q3 lower than the expected 15.8% while both Industrial Production and Manufacturing Production were lower than expected (see calendar).

- These are likely to weigh on overbought indices and contribute to today's pullback.

- Several of the FTSE 100 go ex-div today including RDSB, GSK, FERG, RSA, SBRY: these drag on the index : there are also numerous 250 names ex-div

Pre Market 07:15 In Charts

FTSE 100 adds another 1.3% to stretch gains increasingly looking overextended and due a pullback and consolidation of the recent gains

FTSE 250 has broken-out to new post CV19 Highs

AIM All-Share set to test recent post CV19 highs though with decreasing momentum

FTSE 100

FTSE 250

AIM All Share