17:00 EOD Update: A Herd of Galloping Elephants

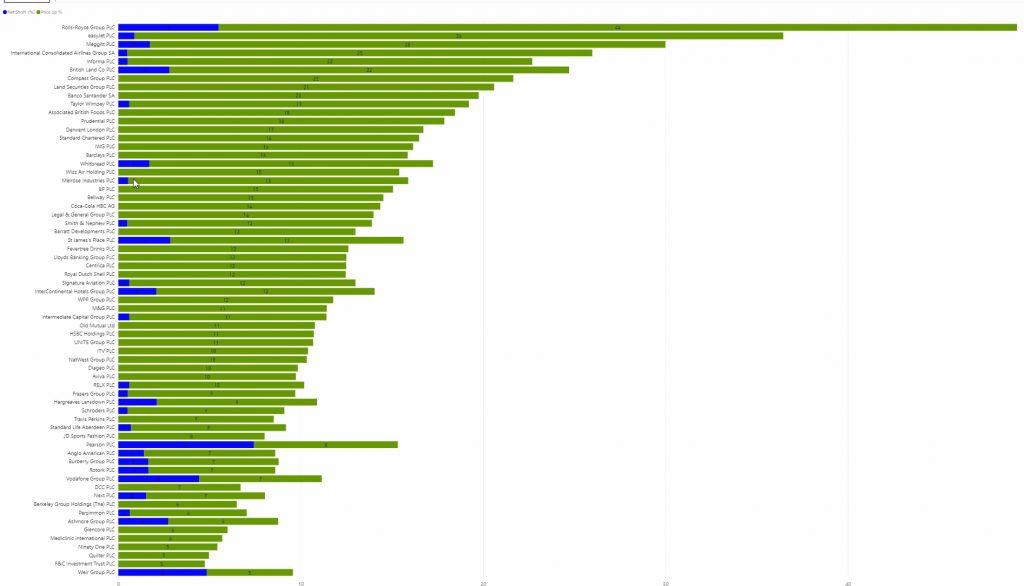

There's a phrase in the market, "elephants don't gallop": meaning big caps don't move very far ... not so today as herds of behemoths went sprinting ... in the below ALL of these shares have market caps above £2bn. in what was one of the most extraordinary days in recent market history, 139 shares of market cap > £500m outperformed the market up over 5% on the day while 81 of those gained 10% or more

The Role of Short Interest can be seen in all of the above as the blue bars feature in most of the big moves: below makes this even clearer as today Short Squeeze scanner was dominated by mid and mega caps

14:30 PM Update

Global markets have gone on a coordinated "phew" as news of Pfizer's vaccine Phase 3 study success spread: the press release from Pfizer can be read here on the Pfizer website with the key para below. As well as mass short covering particularly in the worst affected Covid sectors, there is a also a rush of FOMO money chasing many of these names. The move at pixel in the FTSE 100, while over 5%, takes up back to the level seen in August 2020 at 6250 and is still 250 shy of the June 20 6500 FTSE high. The FTSE 250 is more dramatic and has made a new post-Covid high reflecting the number of domestically oriented shares that were most affected by Covid particularly in the hospitality, travel and leisure sectors

Gold has slumped back to the $1860 level reflecting the relief rally while oil has rallied nearly 8% to touch the $43 level

“Today is a great day for science and humanity. The first set of results from our Phase 3 COVID-19 vaccine trial provides the initial evidence of our vaccine’s ability to prevent COVID-19,” said Dr. Albert Bourla, Pfizer Chairman and CEO. “We are reaching this critical milestone in our vaccine development program at a time when the world needs it most with infection rates setting new records, hospitals nearing over-capacity and economies struggling to reopen. With today’s news, we are a significant step closer to providing people around the world with a much-needed breakthrough to help bring an end to this global health crisis. We look forward to sharing additional efficacy and safety data generated from thousands of participants in the coming weeks.”After discussion with the FDA, the companies recently elected to drop the 32-case interim analysis and conduct the first interim analysis at a minimum of 62 cases. Upon the conclusion of those discussions, the evaluable case count reached 94 and the DMC performed its first analysis on all cases. The case split between vaccinated individuals and those who received the placebo indicates a vaccine efficacy rate above 90%, at 7 days after the second dose. This means that protection is achieved 28 days after the initiation of the vaccination, which consists of a 2-dose schedule. As the study continues, the final vaccine efficacy percentage may vary. The DMC has not reported any serious safety concerns and recommends that the study continue to collect additional safety and efficacy data as planned. The data will be discussed with regulatory authorities worldwide."

AM Update Breakout on Pfizer Vaccine Efficacy

As highlighted this am, the technicals for the FTSE 100 and 250 pointed to a breakout... that certainly came with a bang as huge relief spread across markets wit the vaccine announcement from Pfizer

FTSE 100 and 250 are up over 5% as Travel and Leisure and A&D explode north over 10% (T&L up 15%)

Some caution should be taken on chasing these here as many of these are being propelled by short squeezes :

Initially Travel and LEisure was up 18% but has faded to +11% as profits are booked and shorts covered

Major outperformance in A&D (+13%), Life Insurance (+11%) with Oil and Gas, Beverages , Banks, all up 9-10% at pixel

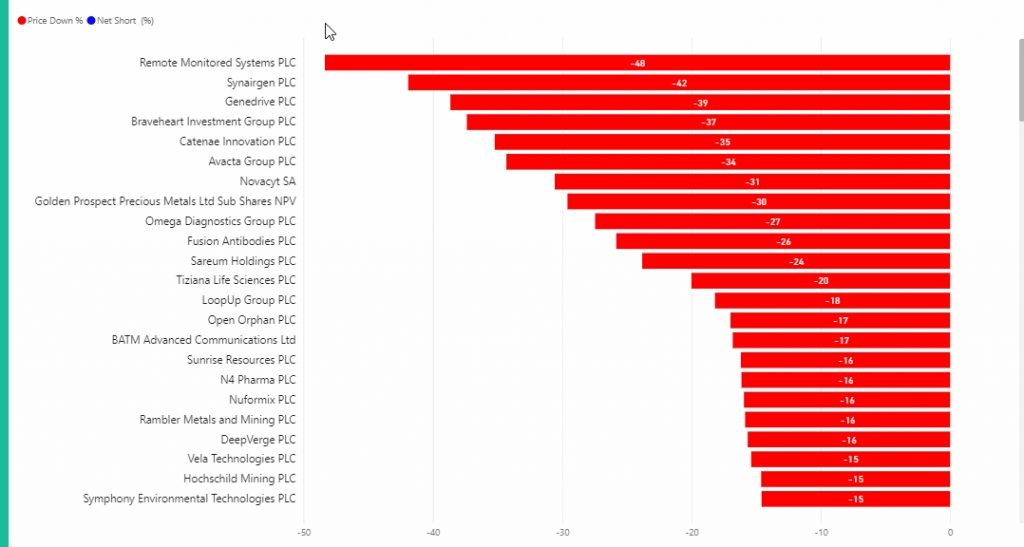

Eye watering drops from the other side of the Covid trade unwind as may of those buoyed by the pandemic see fortunes at least partially reversed

Pre Market 07:15 Update: Range Bound FTSE 100 and 250 Set to Breakout?

- The resolution of the US election and recognition (at least by the world media) of Biden as president-elect has been well received in Asian trading overnight NIK +2.3%, HSI +1.6%

- UK Futures strongly positive up 77 points at pixel as the mega cap index looks set to break 6000.

- CBOE VIX has dropped below 25 while the AAII US sentiment index has turned bullish with the Fear & Greed Index sitting at 40 an improved sentiment from last week's Fear rating (see market dashboard)

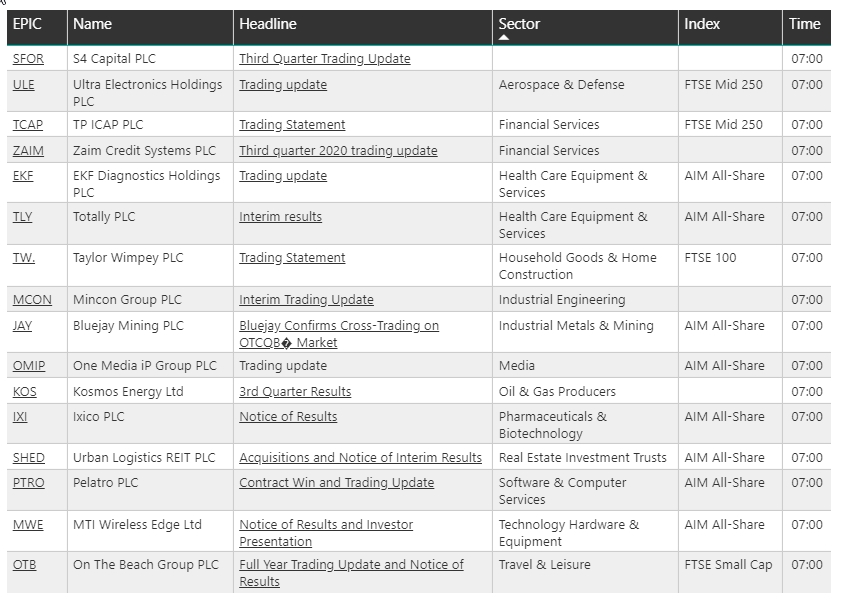

Companies Reporting Mon 09 Nov 20 22 companies reported

22 Companies reported by 07:15 potential sector/market movers being TW. in the FTSE 100 with ULE and TCAP in the 250

CDW reports notification of an Offer : PTRO of a contract win: BREE, OTAQ, YU, SHED and BNZL news of acquisitions

Pre Market 07:15 In Charts

FTSEO 100 closed flat on Friday sitting just below the channel line in play since early June: futures suggest a break out today with the FTSE 250 similarly positioned and expected to move north

S&P dramatic moves north but both both S&P and NASDAQ suggest caution with classic Head and Shoulder reversal patterns forming: these will invalidate if both indices continue to rally but are worth watching should resistance occur at these levels this week (this is driven by AAPL, MSFT, GOOG, AMZN , FB in both indices where these comprise the majority of market cap)

Open a chart using the opposite Search Box (add .L to the EPIC to specify UK): covers every asset class and most markets incl. US : redirect basic charting pages.

Search by Company/EPIC Below

[stock_market_widget type="search" template="redirect" color="#23282c" url="/stocks/{symbol_lc}" target="_blank" api="yf"]

Tab to See Data Reports: HIT “Reset All” IF Report is Incomplete