Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

ECB/BoE Kitchen Sinking Supports Weak Rally in FTSE 100: Oil back above $30

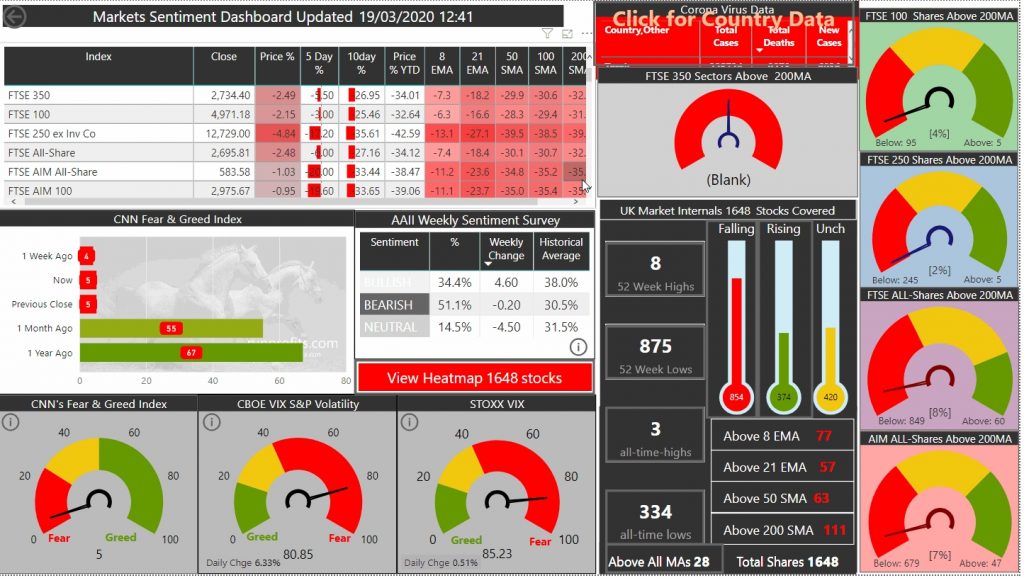

The ECB throwing another €750 billion economic package to support markets and the BoE's new governor,Andrew Bailey's, dropping interest rates yet again to 0.1% and adding another £200bn in government bonds helped promote a rally in the FTSE 100. The weakness of that rally and the fact that much of it faded into the close is a tell that we are very firmly in bear territory and there is little comfort in accommodation for these markets when economic activity has ground to a halt.

A boost to oil prices also helped lift the FTSE 100 from below 500 this am to close 1.4% to the good above 5100: Oil and Gas, Beverages and Comms did most of the lifting . Travel & Leisure names CCL and TUI made almost 20% gains today having suffered brutal losses over the past few weeks: these may well be short covering buys as funds book profits .

The FTSE 250 continued to sell-off and is now down over 43% YTD, a stunning fall from its 2019 all-time-highs despite numerous double digit rises from ELM (+124%) FGP (+34%), with HSX, GNC, ENOG, ICP all adding 20% plus

AIM also joined the rally as ABC added 9% going ex-div while BOO and HCM added 7 % and 4%. There were numerous double digit gains from the likes of JOUL (+57%), PURP (+41%), ESL (+27%) though none of these moves came even close to repairing much of the damage done over the past few weeks

VIX eased back slightly to 75 but remains highly elevated. Limited liquidity, high volatility and dollar strength will dominate these markets for the foreseeable.

Gold remains short term bearish and reflects the flight to USD and the choice of dollar as the safe haven currently. While the yellow metal is likely to recover from this in the medium to long term, tactical trades to the downside have proven profitable of late.

Greenback Liquidity Remains the Dominant: VIX above 80 : 12:30 Update

USD remains the safe haven of choice as almost every asset class is getting dumped in the flight to the greenback safety. This has reduced global dollar liquidity which doesn't seem yo have improved despite last weekend's co-ordinated global intervention . This is depressing major currencies, oil, gold and bonds. GBP is now at over 35 year lows against USD while crude remains around the $27 level

The FTSE 100 is attempting to cling to the 5000 level though ti is showing increasing signs of weakness. A retest of the recent 4890 low seems imminent and without a positive catalyst, may be be doomed to failure

Overnight the VIX has increased to 81 as fear and panic spreads throughout markets