Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

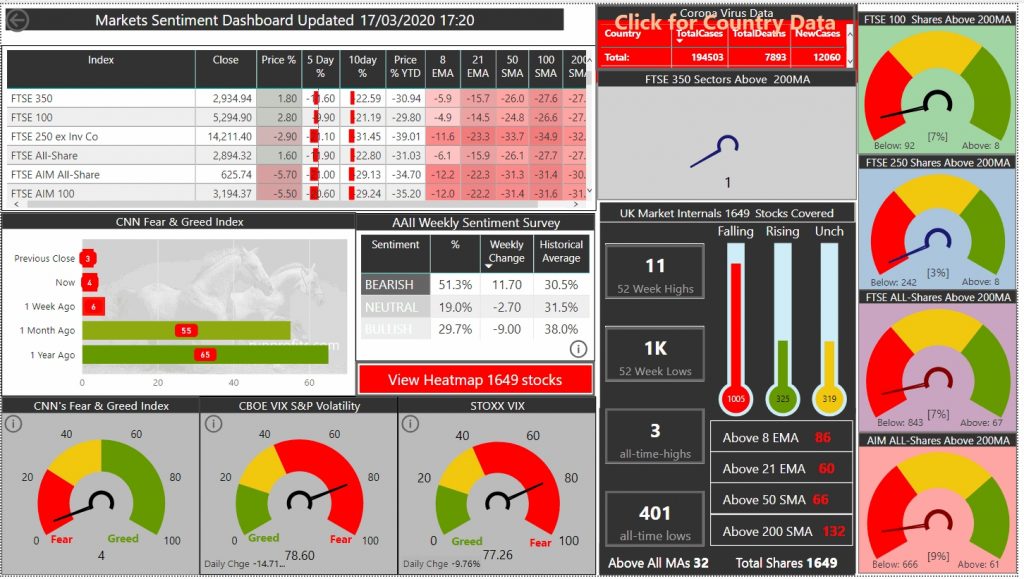

FTSE 100 close in Green : FTSE 250 Led Lower by Travel & Leisure: AIM at 2009 Levels. 17:30

Markets were highly volatile today as an initial rally in the UK and Europe fizzled out by mid-morning as Covid-19 uncertainties weighed on markets. The FTSE 100 briefly dipped below the 5000 level and found demand rallying from that low to close the day up 2.8%. Despite the volatility, the price action was very orderly with the index rallying on increasing volume and closing near the day’s high. It does however remain in a downward channel on shorter timescales and obviously in a very strong downtrend on all other timescales.

The rally in the afternoon was catalysed by more market intervention in the US with the Fed buying short term commercial debt to support struggling companies. The UK chancellor, Rishi Sunak, also announced a new swathe of measures to support UK businesses especially those in the most affected sectors adding £350bn of loan guarantees. Channelling Mario Draghi, he promised to do “whatever it takes” to support UK businesses.

Despite all of these extraordinary measures, it still seems difficult for markets to find much direction given the current uncertainties so the prognosis for most rallies must be poor as they remain prone to selling-off. Assuming they do sell-off, what is key to watch is if these result in new lower-lows or whether the recent lows hold. This might give some indication that the markets have begun to discount those uncertainties and whether we can begin to make any progress out of these doldrums.

Almost half of the FTSE 100 stocks rallied today, the outperformance was boosted by further weakness in GBP as the pound fell to near $1.206.

Pharmaceuticals, Personal Products, F&D retail and Utilities all moved higher by 5-8% as the probability of recession was almost guaranteed given the nature and extent of the slow-down. By contrast the more recession sensitive sectors like Travel & Leisure and Construction headed lower by 3-7%

The FTSE 250 continued to fall led lower by more eye watering losses in Travel & Leisure as much of the sector lost 20% or more with CINE losing almost 50%

AIM All-Share continued to fall losing another almost 6% as investors shun small caps and higher risk stocks. The Index is now at its lowest since 2009

Gold caught a bid adding almost $100 to clear $1550 before pulling back while oil remains north of $31.

VIX remains highly elevated at almost 78 although the US indices were strongly in the green at pixel with the S&P up almost 5%

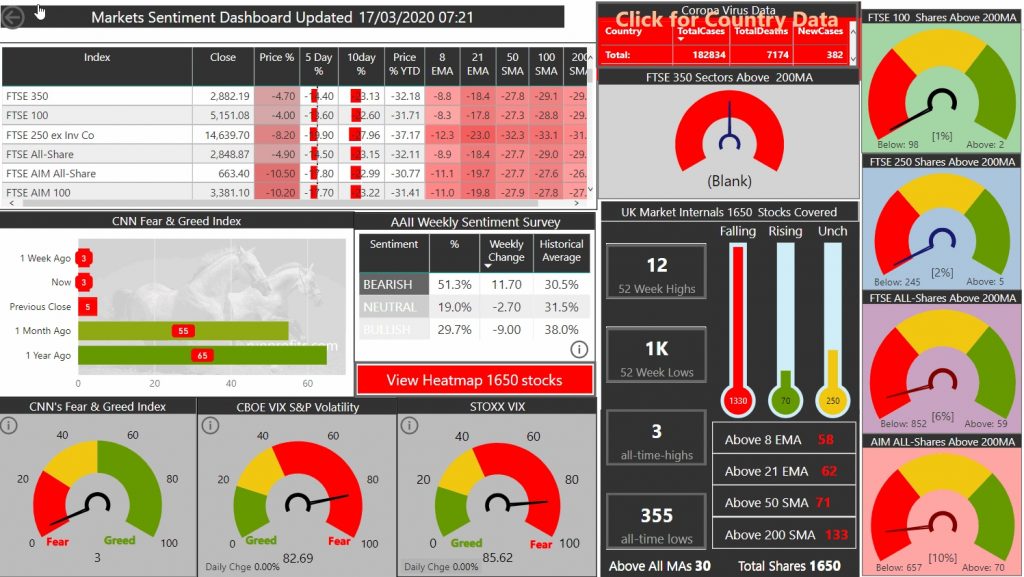

S&P Plays Catch-Up Down 12%: Gold Weakness. VIX above 80. Future Limit-Up! 07:30

US markets fell heavily yesterday and closed at their lows with the S&P 500 playing catch-up with the rest of the world now down around 30% from its highs. It has yet to exceed the 2018 Dec low of 2340 but may well check this level in the coming days

However, overnight futures have moved back +5% are are now "limit-up" the circuit breakers kicking in to the upside. This level of volatility is crazy and highlights how unstable markets are currently.

The VIX has spiked sharply and is now at 84 which takes it near to its maximum: this will start to signal peak fear and become contrarian as selling reaches a peak and buying kicks-in. This is especially true given the QE unleashed in the US which will go to work on assets

At pixel the UK Futures were up around 4% suggesting we may see some buying today from yesterday's crashed out markets. With GBP at $1.22 offering discounted overseas earners,we may see staples and consumer goods catch a bid today along with Pharma which have outperformed of late.