Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

VIX Remains Highly Elevated : Disconnect or Warning?

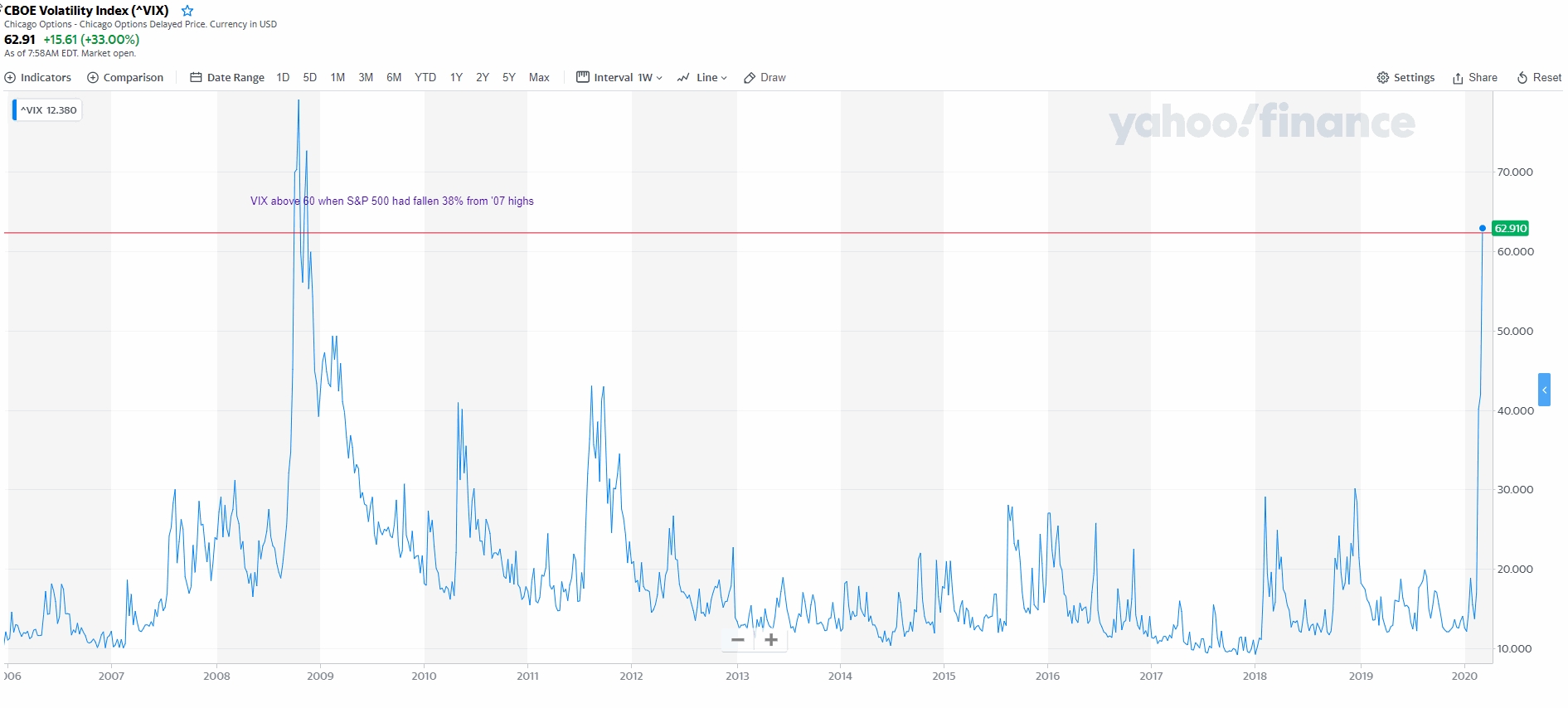

The elevated VIX level relative to the valuation of the S&P 500 (the market upon which the options used to calculate the VIX are based - see previous article) is troubling at the moment. Looking back at historical levels of the VIX, it has only been this elevated above 60 during the financial crisis of 2008 (GFC).

Specifically the VIX rose above 60 in October 2008 by this time the S&P 500 had dropped over 35% from its 2007 highs. The VIX continued to rise in October 2008 reaching a peak of over 80 on 21 November 2008 by which time the S&P 500 was down over 50% from its high

Remembering that the VIX is a forward looking volatility measure, the S&P 500 went on falling into 2009 reaching a low on 6 March 2009 down almost 60% from its 2007 highs. On that date the VIX had dropped to 50 and continued to drop in 2009 as the markets recovered and stabilized.

The VIX remained below 50 from 6 March 2009, the date of the dead low of the financial crisis, until 9 Match 2020 when it closed above 54.

The values of the VIX north of 50 in the past few days and now above 60 are troubling. This means that either there is an overreaction to the slowdown and potential economic disruption of COVID 19 OR many market participants are expecting much further falls.

A further troubling sector is Oil and Gas Producers which has dropped below the 2016 lows which in turn were lower than the 2008 lows . While this is a heavily cyclical sector and one may argue is undergoing secular if not structural changes, oil is very much the lifeblood of the global economy and may be signalling more widespread slowdowns ahead. That the sector is now at 2004 levels is also concerning. It is worth noting that while renewables are playing an increasing role in global energy production , they still only account for around 15% of the global energy consumption

The GFC was predicated on systemic risk arising from contagion in highly derivatized financial products based on subprime mortgage. The current crisis we face is also one of a fear of contagion but one with much more tragic consequences. Governments and societies are trying to run the gauntlet of safeguarding public health and well-being through containment while attempting to minimize economic damage by over reaction. Striking that balance is an unenviable task given the risks on both sides of the equation especially the potential toll in human lives which must be preeminent

Given the nature and extent of this uncertainty,and recognizing that the number of COVID 19 cases and deaths continue to rise daily, it seems unlikely that we will see much data to assuage fear and sentiment anytime soon. One has to hope that the VIX is wrong, more from the implied cost in human lives rather than the potential financial outcomes.