Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

Market Mayhem as FTSE Drops 10%, Oil 7.5% Gold Down 3.5% 17:00 Update

The selling intensity today was pretty historic and broad across all indices and asset classes as market participants either flocked to cash or were enforced sellers under margin calls. Gold ,which had proven to be a safe have up until now dropped, $100 in a couple of hours to revisit the $1540 levels having recently touched $1700. Bitcoin and other cryptocurrencies dropped 20-30% .

The FTSE 100 revisited levels last seen in 2012 as all of the gains in the intervening 8 years were summarily dumped over the past 2 weeks.

The FTSE 250 sold-off close on 10% while AIM All Share lost 7.5%. In Europe, the German DAX was down 12.2% and the CAC down 12% while US indices all sold-off heavily with the S&P 500 down over 8% at pixel , the DOW down 9% and the NASDAQ down 8.

The extent and intensity of the selling today had the feel of a final capitulation which often occurs at the end of a prolonged series of days in red: put simply, the market runs out of sellers. Some of the sector drop today were eye popping, in the FTSE 350 of sectors, 17 sectors were down double digits with Mining down almost 15%, Oil and Gas and Travel & Leisure down 13% the list of casualties goes on. That said, it is never sensible to try and call the bottom and markets do have a habit of staying irrational much longer than one can stay solvent. Better to wait for indicative green shoots or a credible catalyst that gives the markets reason for stabilization and consolidation of the recent tectonic moves. No matter what, it will take some time for any kind of significant recovery from this current destablising collapse.

While there is little doubt that the COVID-19 pandemic is a root cause of concerns, the combination of the US's travel ban on all European countries and ta distinct disappointment on ECB's Laguarde didn't provide the right level of support

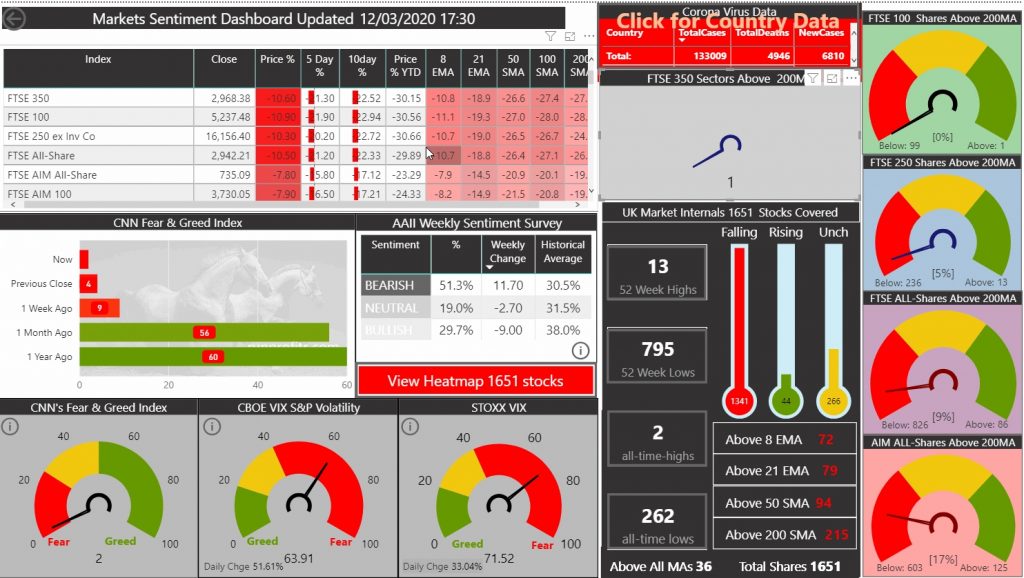

The market dashboard below shows that pretty much everything in the UK went on sale today : 1341 stocks dropped while just 44 rose and only 266 were unch and almost 800, half of the total universe covered by runprofits,, made 52 week lows.

DOW Jones in Bear Market: Oil and Asia Fall: US Travel Ban

Another grim start to the trading day as FTSE Futures look to open sharply down over 5% to the 5500 region: some 2200 points south of where we started the year. Overnight the US has announced travel bans on flights from 26 countries including much of Europe. This will hit airline and Travel & Leisure stocks today ans has impacted oil down over 6% overnight .

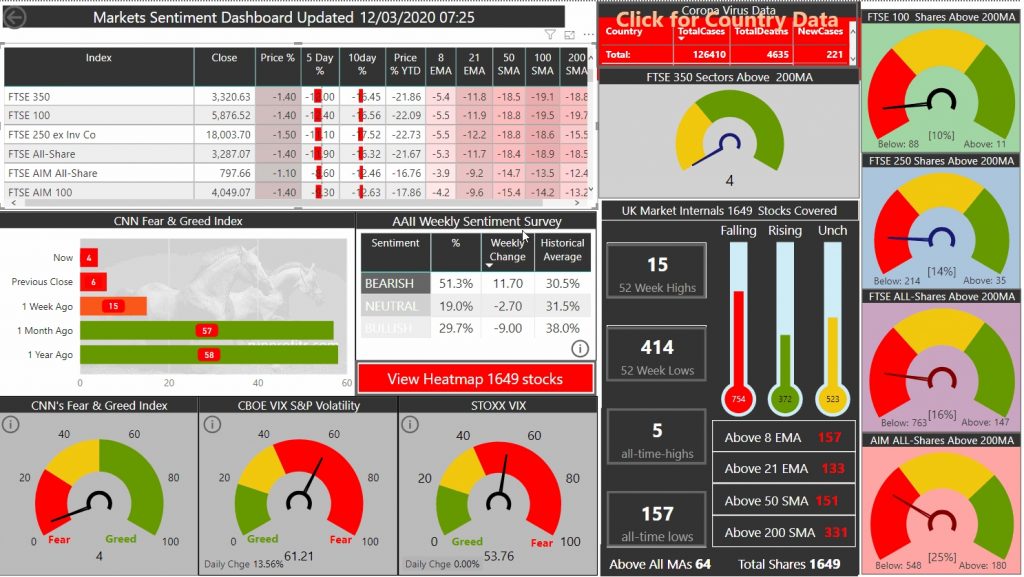

The VIX stayed around the 54 level while Fear & Greed is at 4 which is almost as low as it can get .

Today may prove to be chaotic and capitulatory as selling should reach a climax soon with a much needed bounce. The much broader uncertainties being how far, fast and severe the COVID-19 pandemic will prove and what economic havoc it has yet to wage