Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

Daily Wrap .. What just Happened?

Today's price action was truly historic and comes on the heels of two weeks in hell for anyone long this troubled market. The capitulation selling in oil and gas names was astonishing today with the likes of PMO down over 60% while BP lost 25% and RDSB returned to lows not seen since 2008 at the depths of the financial crisis. That seems uncalled for by any definition and is either a massive price dislocation and overreaction or a very ominous indicator of what is to come.

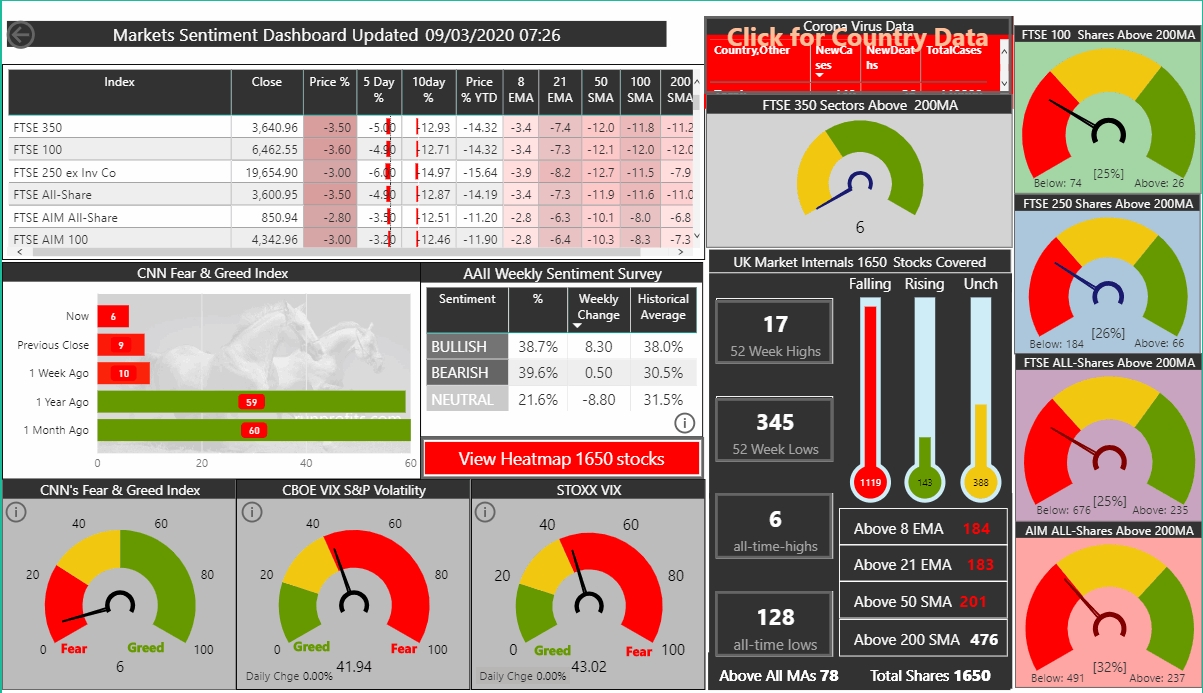

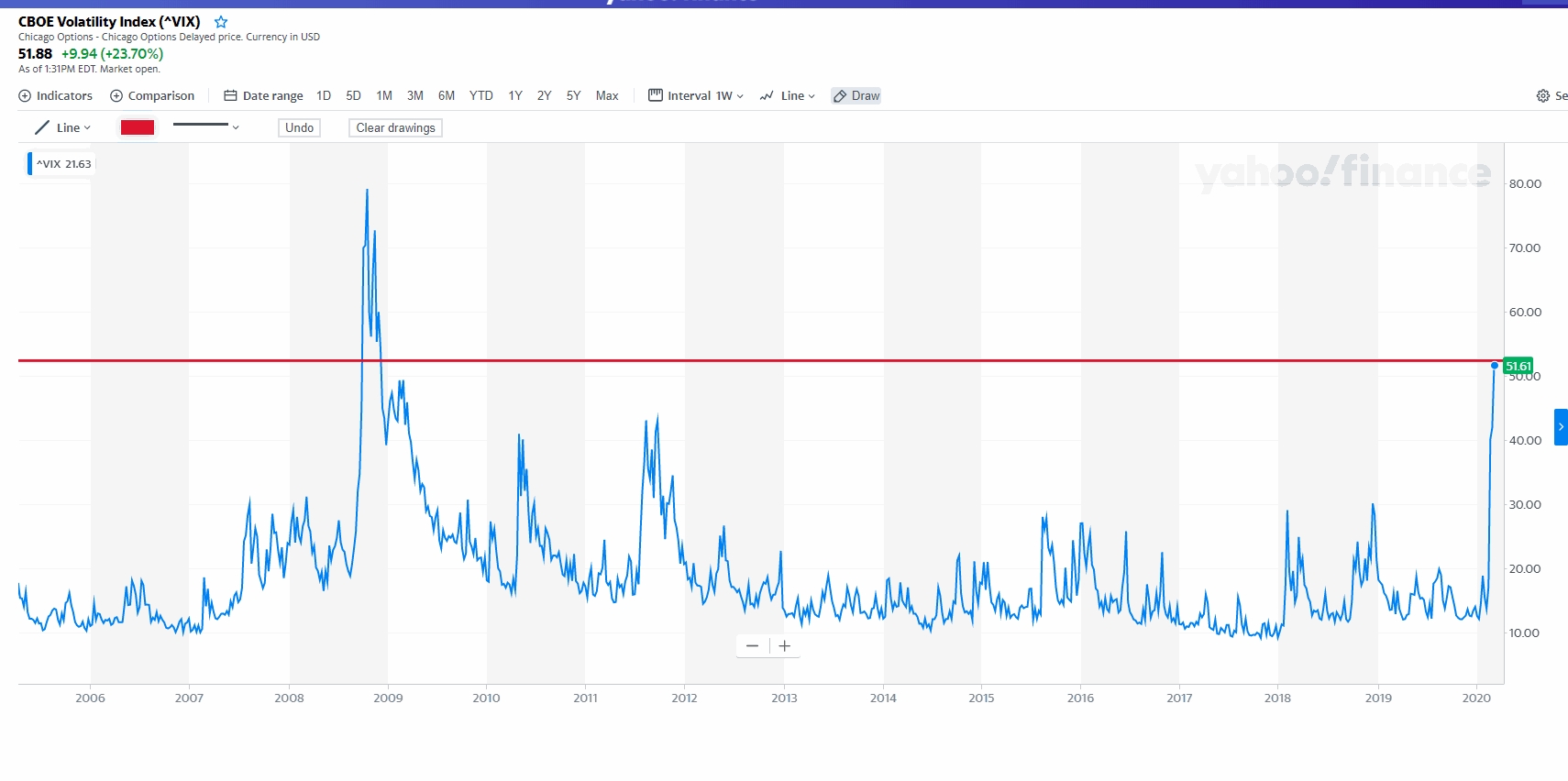

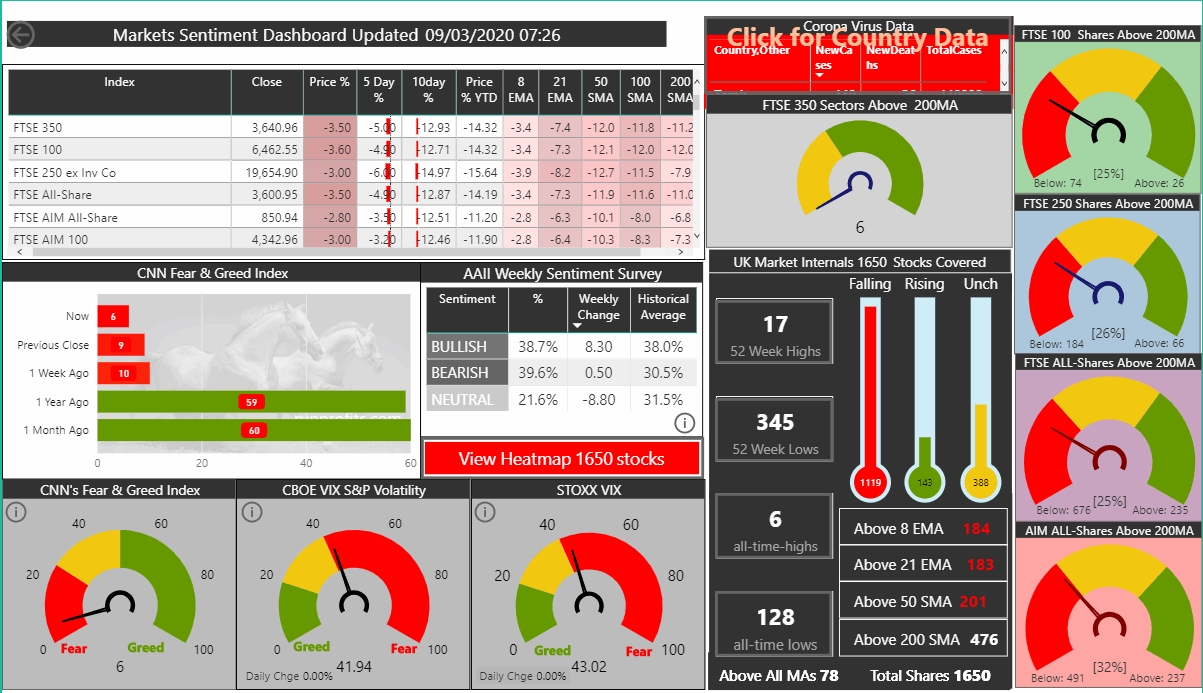

The Fear and Greed index has dropped to 4 and is running out of road to go any lower while the VIX has spiked above 51 : this is now at levels last seen in 2008 (see Figure)

Losers

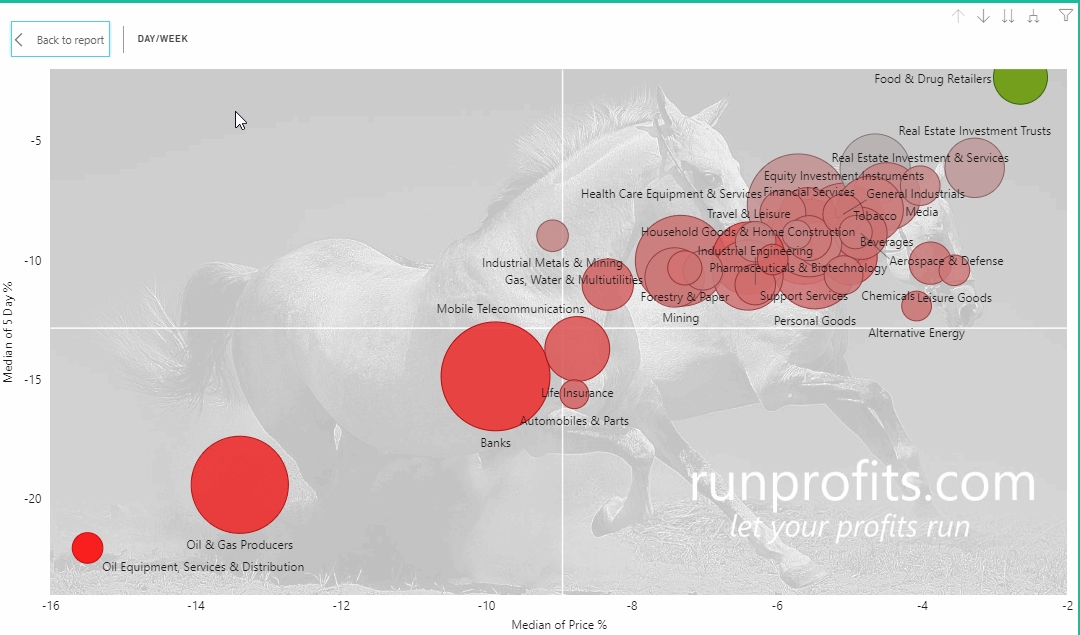

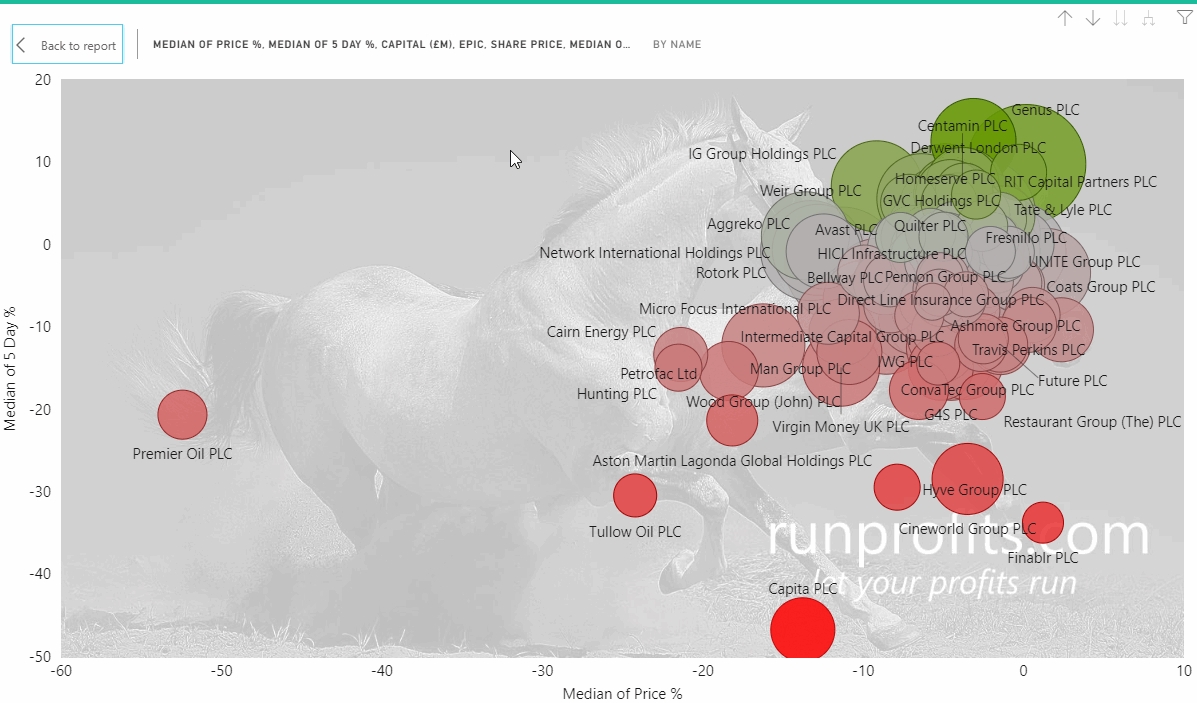

Surveying the Wreckage : the below plot shows the aggregated sectors across indices: Oil and Gas and their dependent O&G Services companies got destroyed today in every index

Next in the line of fire was the Banking sector while Life Insurance, Industrial Metals and even Utilities all lost more than 8%

Winners (relatively)

On the other end of the spectrum, the more recession proof sectors like Food & Drug retail continued to do well on a relative basis as did bond proxies like REITs, Beverages and Tobacco which offer some form of defense

Tomorrow we will publish a review of performance in 2020 YTD looking at the outperformers and under-performers

Sector Performance Mon 09 Mar 20

VIX Levels 2007 to 2020

Fourth Biggest Drop in FTSE 100 History - 12:30 Update

Black Monday is an apt description for this morning's price action: the FTSE has only ever seen three days in its history that were this precipitous: two of those were consecutive days in Oct 1987 when the first Black Monday occurred. The other one happening in October 2008 in the depth of the financial crisis There were several 5% drops during that month in 2008 as Lehman brothers failure kicked-in and the the fear of contagion from sub-prime CDOs spread panic throughout the global financial system.

It was exactly the 1987 Wall Street crash that gave rise to circuit breakers which limit the slide or exchanges by preventing any further (panic) selling. As I write, the US futures remain "limit locked" and signal at least a 5.1% drop today.

Below is the sentiment dashboard at 12:15 today . This afternoon I'll pick about the wreckage and highlight the biggest losers and any winners

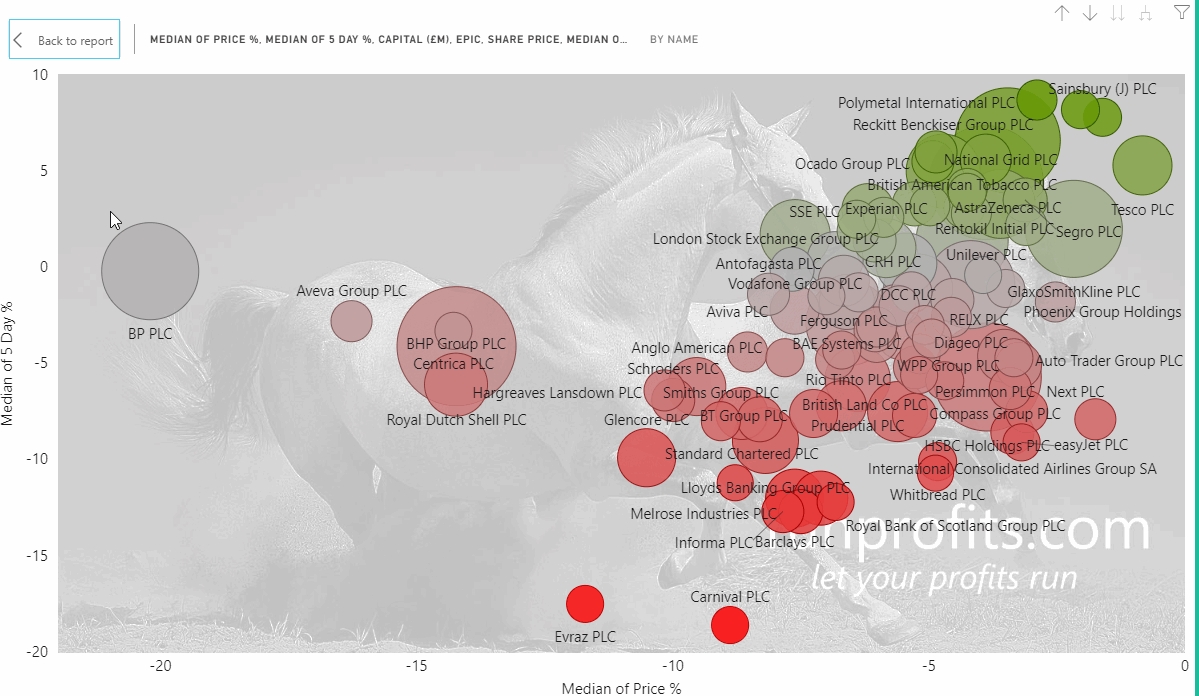

FTSE This am. 0 Winners: 100 Losers

Everyone of the FTSE 100 share fell this am

The carnage was concentrated in the Oil and Gas sector with BP down over 20% with RDSB and CNA down 14-15%: GLEN >10%

FTSE 100 Mon 09 Mar @ 12:16

FTSE 250 This am. 0 Winners: 100 Losers

6 Shares emerged in green this am with WMH, 3IN, FIN, PRTC, GOG and FRES

As with the big caps, most damage done in oil and T&L with PMO -60% , TLW -30% and CNE, PFC, HTG all -20% or more

FTSE 250 Mon 09 Mar @ 12:16

Market Sentiment Mon 09 Mar @ 12:16

OPEC, Russia and Trade Wars

Russia walking away form the OPEC+ meeting on Friday without agreeing to curb outputs sent another big red flag for the markets. Arguably it was Putin's reprisal to the US on trade sanctions. Failing to prop -up oil prices by further limiting production by over 1.5m bpd. I wrote about the significance of this in Friday's musings .

To my mind, it was an ominous signal for anyone holding O&G stocks as a perfect storm of

- excess supply

- decreasing and uncertain demand owing to coronavirus

- macro concerns on recession

- the move towards alternative energy.

However Saudi poured petrol on the flames by announcing over the weekend that it was going to discount its production starting an effective price war. What started as looking like a move to co-operate and control supply seems to have rapidly developed into a precarious Mexican stand-off. Shale oil in the US is the biggest loser given the high costs of production and breakeven point: oil below $50 makes most of these rigs uneconomical. Given these companies are heavily indebted this has a big knock-on effect in the credit markets. Credit spreads in the US have been widening for the past few weeks so clearly this was already of concern

Today we are likely to see widespread capitulation in oil and gas names which will take mining and the FTSE 100 down . At pixel FTSE futures are set to open down over 9% around 5875: US futures have gone limit down meaning the exchanges circuit breakers have kicked in

This is shaping up for a very Black Monday