Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

New '20 Lows for FTSE 100, 250 All-Share: Oil - 9%

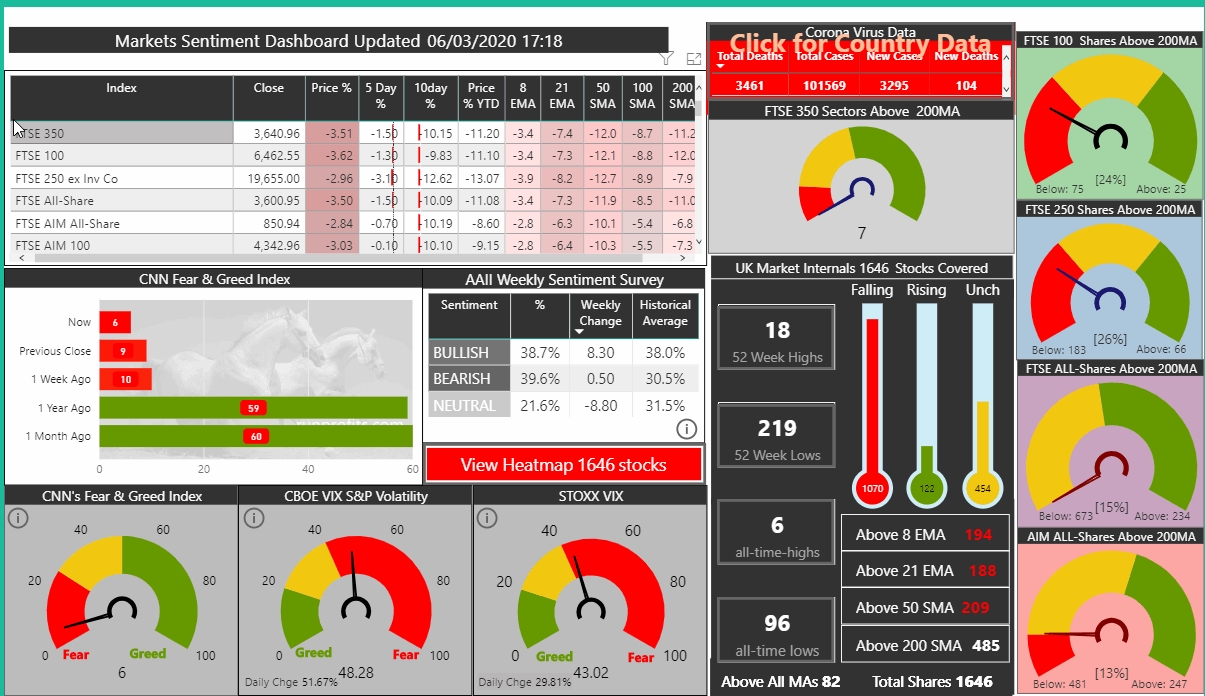

Today saw even more intense selling as the FTSE 100 made a new 2020 low, the VIX has made a high not seen since 2009. The FTSE All-Share has dropped to levels not seen since the end of Dec 2018 after the UK markets had dropped precipitously. the FTSE 250 did recover somewhat off its lows today as it approaches bear territory.

The OPEC+ meeting in Vienna failed to reach an agreement on cutting crude production with Russia not agreeing to the 1.5 million bpd cut sought by the group. Crude price had been propped up by this expectation and the 9% drop on the news clearly shows that this was already in the price. On a day deep in the red, this added to the bad news sending the FTSE 350 O&G sector down over 5% . Mining also had a big day in red as cyclicals continued to be punished

No sectors showed any green today while the aggregate sector table looked like the below table across indices:

- Oil Services suffered the most as oil price drops inevitably lead to O&G producers shutting down rigs and operations which impact the service providers revenues

- Life Insurance and Banks have also had a bad day led lower by the likes of LLOY, BARC and RBS all down around 4% with VMUK down 6% and MTRO down over 13%: In Life Ins, OML dropped 7.5% with PRU and JUST down over 6%

- Mining had an awful day with AAL down almost 10% while RIO, BHP GLEN and ANTO all lost 4-6%

The VIX has spiked to almost 50, a level not seen since 2009 while the Fear index has dropped to 6

Gold wavered on the US NFP number and recovered its composition: this is often a signal to get out of the way as trading spot gold can be perilous with sudden moves in either direction especially around macro events like NFT and interest announcements. .Later this afternoon the yellow stuff did pitch south dropping $45 in moments before recovering much of it. As a heavily manipulated market it can be tricky to trade unless one has wide stops or is accustomed to its "personality". Price action will often whipsaw in both directions looking to take out stops before settling and then showing its true intent.

Sector Table

Sector Table for Friday 06 March 20

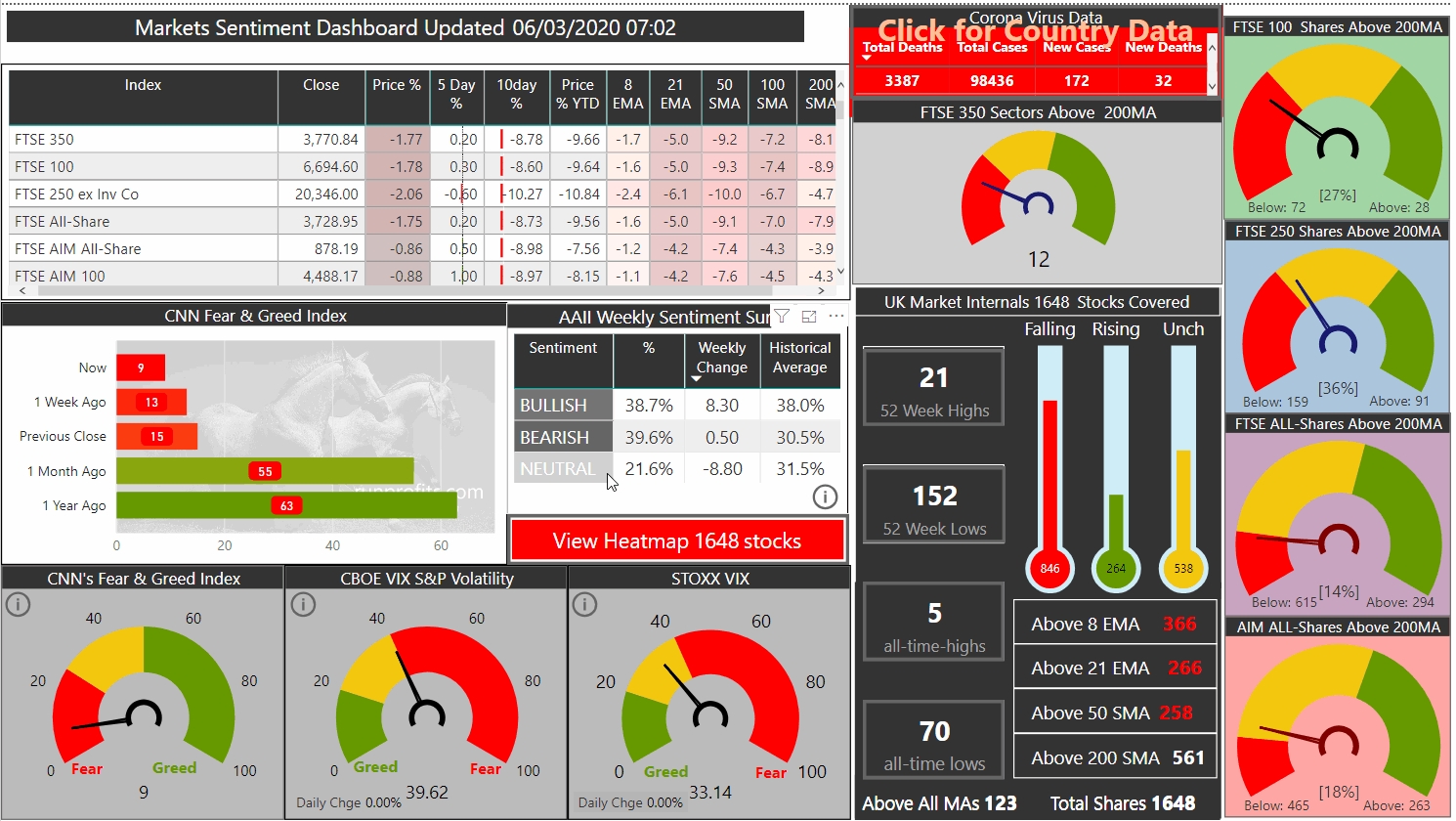

Market Sentiment Fr 06 Mar @ 17:18

All UK Indices Down over 3%: FTSE 250 approaches Bear Correction

There is little point in adding superlatives to the current meltdown: any nascent rally since the big fall last week has been snuffed out and this morning saw a near return to the lows of last week for the FTSE 100 and new 2020 lows for the FTSE 250

THE mid cap index has given back over 17% of its recent gains and is on the verge of a technical bear correction (greater than 20% fall)

We have returned to and have checked the lower channel line in the FTSE 100 around 6460: this appears to be a key battle area for the bulls and bears. This has held...for now. A break below this will likely take the index to around 6300 -6400 where there is longer term support. Volume has been decreasing on down days relative to up days giving some solace for the bulls. The AIM All-Share has held above its 2020 lows as has the TECHMARK which has been a leading indicator of price action for the past few years

Our European cousins the CAC and DAX have both made new lows for the year this morning before recovering slightly

Gold continue to move north and looks set to reach the $1700 level

FTSE 100 Weekly Chart

US and Asia Sell-Off as Volatility Prevails: Gold Rallies: UK Futures -1.8%

There is little sign of any stability nor a decrease in volatility as the US sold-off 3% or more on all of its indices as more coronavirus cases are reported in the US. Asia was also down sharply overnight while the UK FTSE Futures is set to open in the red with a current level of around 6600. In the US government bonds are making record lows in rates which suggests the markets are expecting a full blown recession.

The Fear & Greed Index has returned to single digits and stands at 9 while the STOXX VIX is at 33 below the US VIX of almost 40