Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

UK Markets in Green: Defensives Outperform as Travel & Leisure Suffers

(Note: Mouseover stock EPICs to view company names as a pop-up)

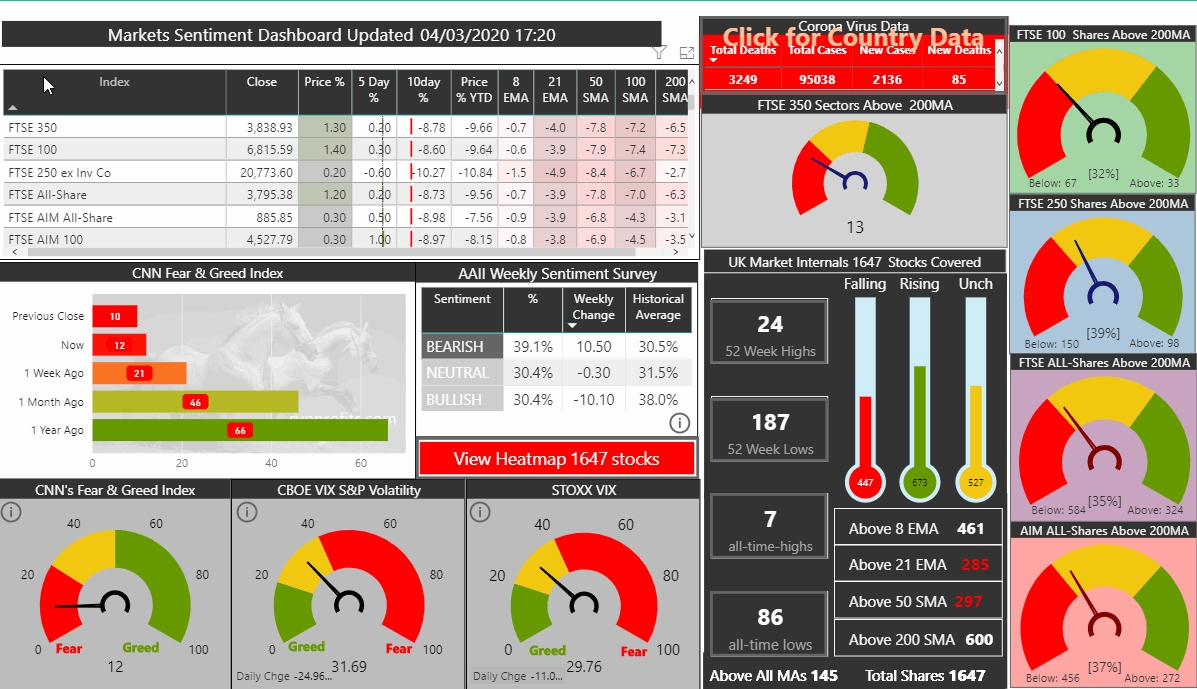

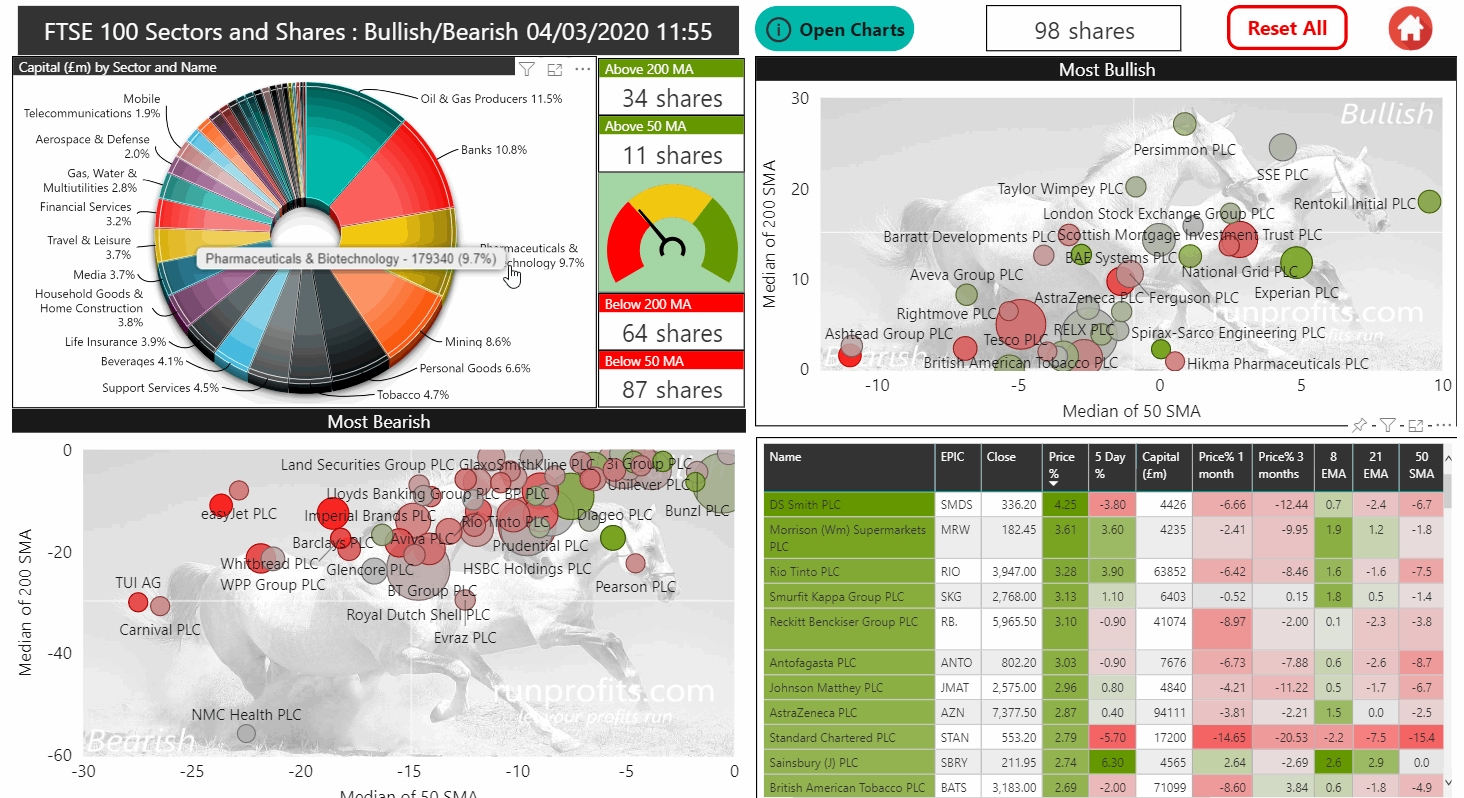

All of the UK indices held onto some green into the close with most of that sitting with the mega cap FTSE 100 index which closed up 1.2%. The gains in the footsie were clustered in defensive names like RB, VOD, MRW, SSE, IMB, CNA, BATS, UU, SBRY, MNDI and GSK all of which made 3-5% gains on the day. This reads like a textbook list of recession wary stocks and gives some insights into the expectations of market participants at present. Indeed the IMF dropped its global growth target for 2020 by 0.4% today owing to the coronavirus effect. Now that the US rate trajectory is aligned with the rest of the world, the reach for yield will intensify meaning recovery from this correction is likely to be dominated by dividend paying stocks likely to continue yielding in a low growth environment. On the losing end of the FTSE 100 spectrum were IAG, TUI and WTB which resumed their downward trajectories with all of them losing 3.5% to 4.8% reflecting the concerns over the virus.

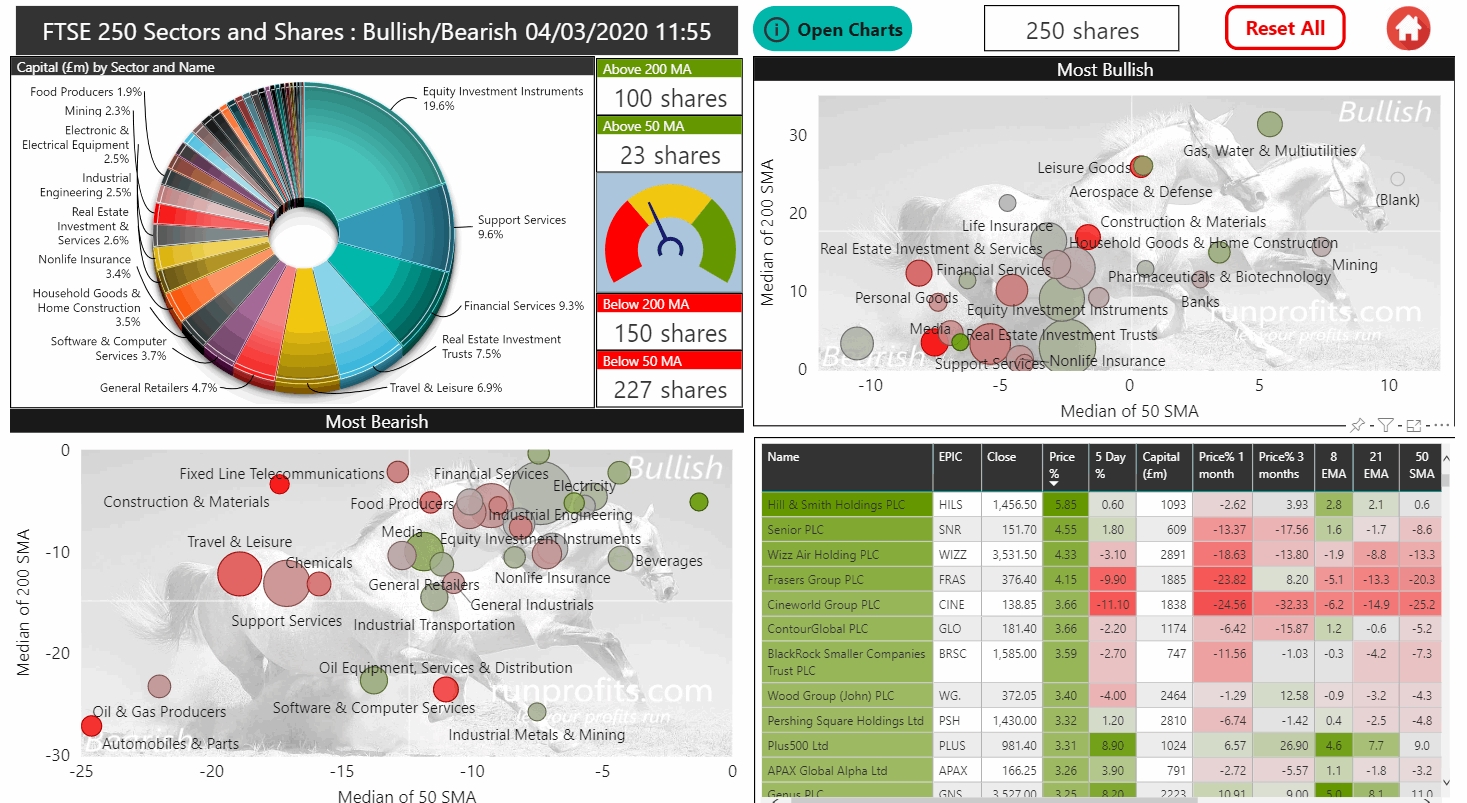

The FTSE 250 pared much of its gains for the day closing just +0.2% with the likes of TPK, HMSO, WMH losing over 4% while RTN was -5.3% and SIG -6%: as the aviation support business will suffer in line with the airlines. Winners included GNS and TEP up 4.7-5.7% with PNN and MDC up over 3%. WIZZ and TRN were also among the gainers bucking the trend for other T&L names

Buying and selling appears to be following a narrative based on the expectation of significant economic slowdown if not recession as a result of reduced mobility and social distancing. Logically money is moving into staples, utilities and pharmaceuticals and moving out of travel and leisure with restaurants and pubs getting penalized on the expectation of lower earnings from reduced footfall

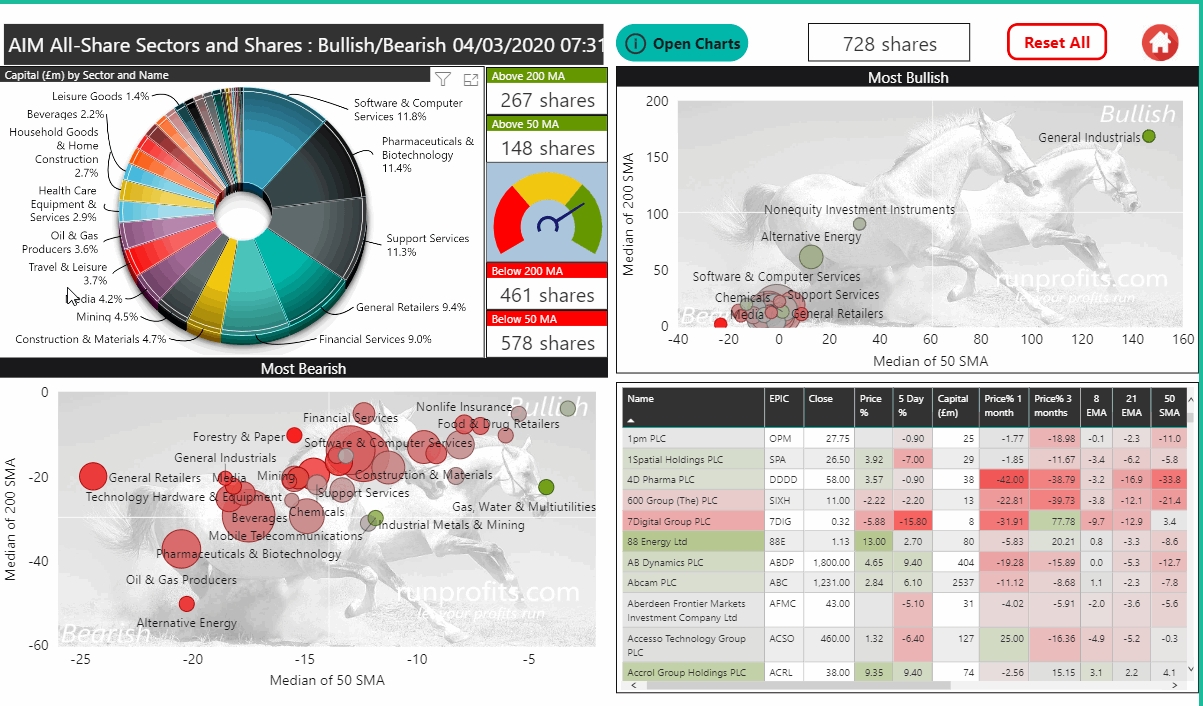

In AIM DTG lost over 3% following the other T&L names while BOO and FEVR made 3% gains in keeping with the defensive theme. BUR, the erstwhile AIM darling continued to show weakness dropping almost 5.5% to below £5

- All of the above can be viewed visually either via RP Scanner choosing the sector specific section for the Table of Contents or using Section 2 : UK Markets EOD analysis and selecting each index in turn. A full scan of all the indices can be done in minutes .

- Alternatively, index and sector analysis can be carried out in the Market Sentiment dashboard by clicking through the Index gauges to the right of the dashboard to view bullish and bearish sectors and shares in each Index

RP Scanner Section 2 can cycle through Indices

Click through Index Gauge on Sentiment Dashboard to view

Click through Index Gauge on Sentiment Dashboard to view

Commodities and Currencies

Oil hold above $52 in expectation of an OPEC cut in outputs. This may help to put a floor under the recent rapid drops to O&G names. Gold has held onto yesterday's big move up and is at $1642 at pixel. Many of the base metals have had a day in green while copper looks like it may be bottoming

The 50 basis point rate cut did not significantly dent the USD strength as the greenback provides a safe haven in times of uncertainty : GBP remains around $1.28 and the EUR at |$1.11

FTSE 100 12:00 Update

In the FTSE 100 the biggest risers aside from miners RIO , ANTO and GLEN remain relatively defensive with outperformance by supermarkets MRW, SBRY and household goods RB. And Pharmaceutical companies AZN and GSK . All of the above are up 2.5 to 4% so far today

FTSE 250 12:00 Update

In the FTSE 250 Utilities and Pharm are also outperforming while WIZZ and CINE are recovery from recent losses as both are down 20-25% on the month.

AIM All-Share 12:00 Update

AIM has rallied least today and saw outperformance in Mining with many of the gold miners up double digits on the pop in gold prices. Oil and Gas companies have also fared well as has Alternative Energy as AFC, PHE and ITM continue to bounce back from last week's sell-off

Fed Intervention Adds to Fear - 07:30 Update

The announcement of two rate cuts at once by Powell's FED initially caused a big upsurge in the US markets which quickly evapourated as participants became concerned about the speed and magnitude of the intervention. Perversely, the very act of carrying out a major intervention was in itself seen as a major cause for concern. Having finished Monday near the highs of a euphoric relief rally, yesterday saw the US market give back 75% of that rally but not finish on lows

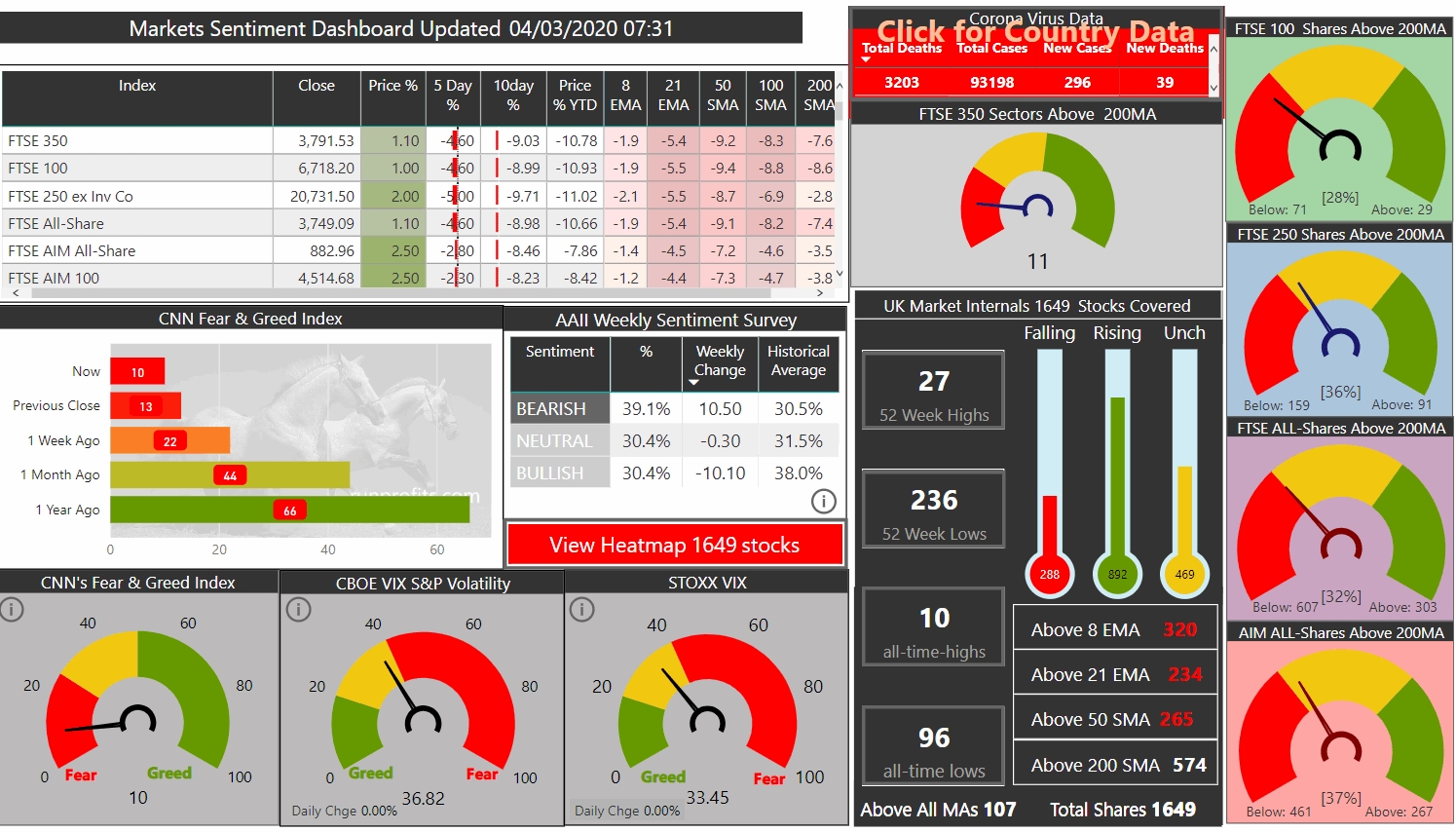

Fear & Greed has dropped back to 10 while the VIX has risen to 37

Gold added almost 3% yesterday while oil is flat

UK futures signal a 0.7% rise to 6753 after Asia closed flat to positive

Sentiment dashboard updated below