Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

FED Steps in as G-7 Disappoints: Gold Sparkles

The G-7 solidarity statement issued after 12:00 today proved disappointing to the markets as co-ordinated monetary and fiscal intervention was expected but not forthcoming. This saw US futures drop whilst the UK and European markets trimmed their sails giving back some of the morning's gains. This afternoon, the FED chief, Jerome Powell then surprised and temporarily delighted the markets with an emergency 0.5% rate drop saying

“The coronavirus poses evolving risks to economic activity,” the Fed said in a statement. “In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate.”

I had mentioned in this morning's post that two rate cuts were "80%" likely; the magnitude of the market response suggests that many (including me) were not expecting the rate cuts this soon. There is little doubt that Powell is under enormous pressure from Trump to get his presidential jewel, the rip-roaring stock market, back on track as campaign stumping intensifies. The boost to the US market did prove short-lived as the DOW and S&P whip-sawed from +2% to below -1% at pixel. Gold did rally sharply reversing much of Friday's losses and is currently up over 3.5% to the good on the session

UK Stats FTSE 100 +1%: FTSE 250 +2% AIM + 2.5% :892 Stocks Rising: 288 Falling : 459 Unch

The UK markets did finish in the green though significantly off their highs

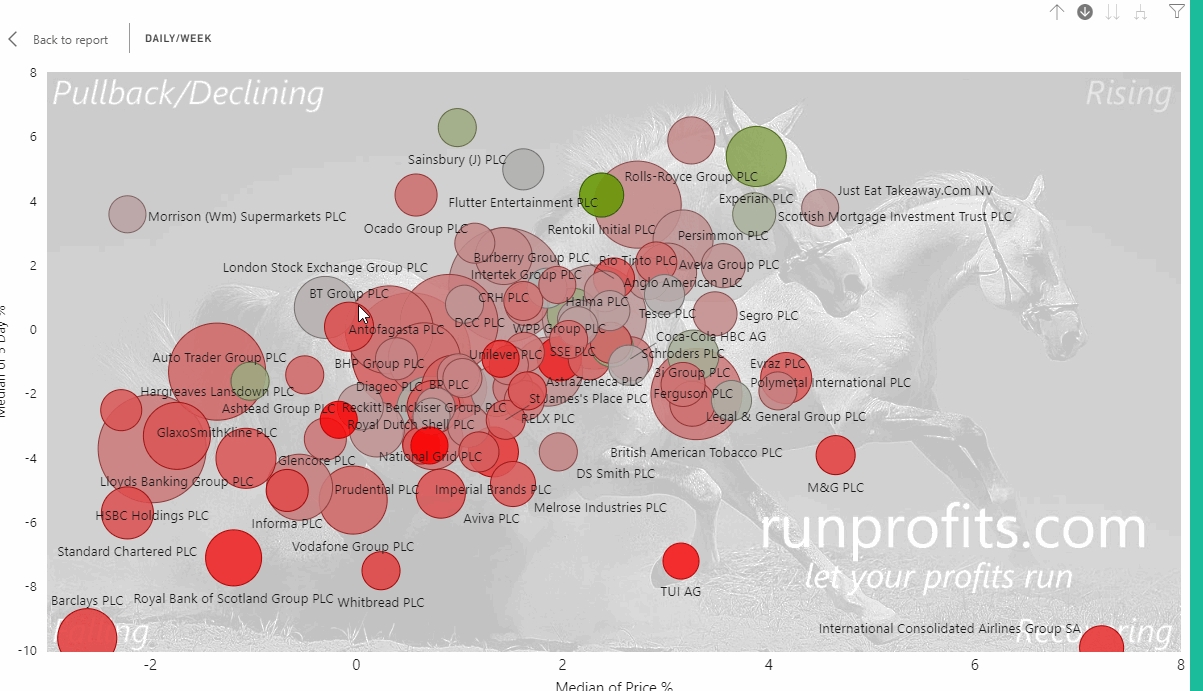

Alternative Energy roared back today up 10% while Ind Metals, Personal Goods, Mining and construction all added 2-4%: Below are summary plots for each main index at the close.

UK and Europe Surge : FTSE 250 up 3.2% as FOMO Wins Out

Europe and the UK took the US buying baton and ran with it this morning as buyers returned in force and the bulls took charge. These markets are still fear driven, in this morning's instance, from the fear of missing out (FOMO) on a "V" shaped recovery and the resumption of an uptrend. That is in turn is predicated on a co-ordinated G-7/central bank response to inject more liquidity using the few weapons left in the monetary salvos. Failing that, some now seem to expect fiscal accommodation with the likes of US's Trump calling for tax cuts (which in any case would take months to enact). Italy has also provided its companies hit by Covid-19 related shutdowns with tax credits in a bid to ease credit squeezes.

So is more money supply the solution to a supply shock in the manufacturing world or even a demand shock from "social distancing" and mobility restriction even as Covid-19 continues to spread? There is no doubt that increased liquidity will bolster risk asset prices in the short term and provide good trading opportunities. Equally if interest rates drop further ( 80% probability of two rates cuts in the US ) and more stimulus is introduced then gold would be expected to resume its uptrend after a sharp pullback at the end of last week. What is clear from the past couple of weeks is we can expect the unexpected and that volatility is likely to remain elevated which will make for good trading weather on selective bets.

What will prove telling is if the gains in the US from yesterday and the UK and European rallies today are retained or met with renewed selling.

The great thing about trading is not just the option , but the necessity, to change one's mind when the data and information change.

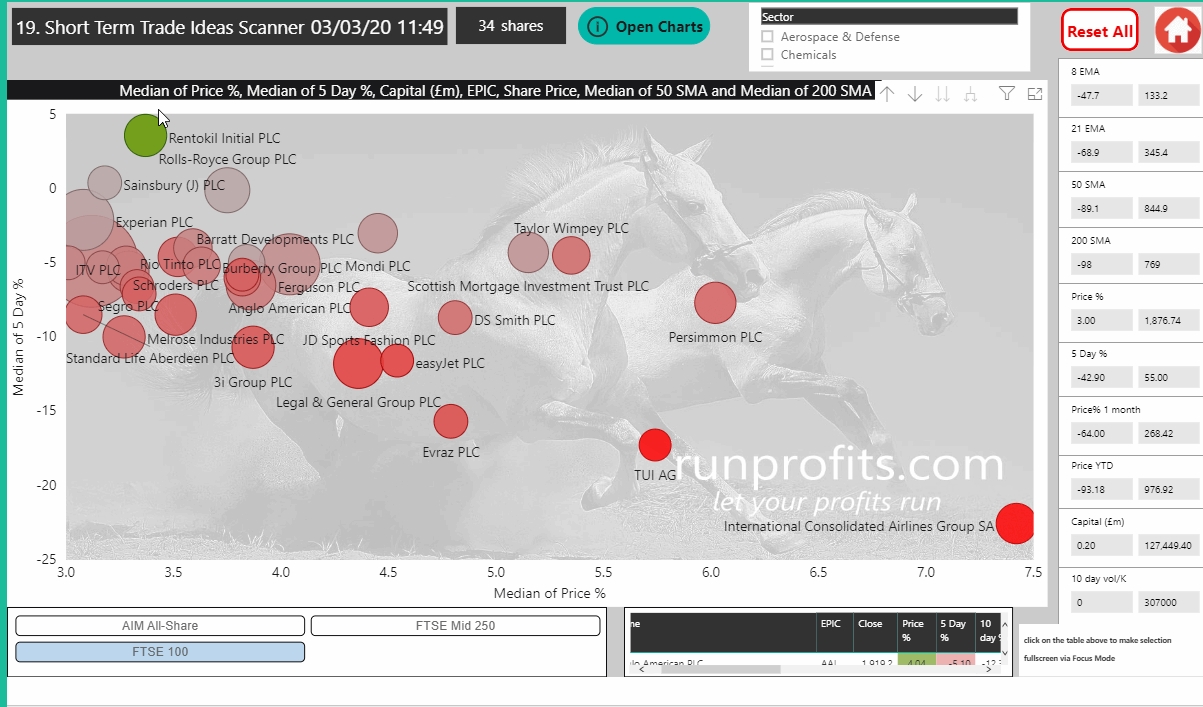

FTSE 100 Winners Today 11:30

34 shares are outpacing the index this morning with IAG staging a comeback up 7.5% while PSN and TUI follow around 5%

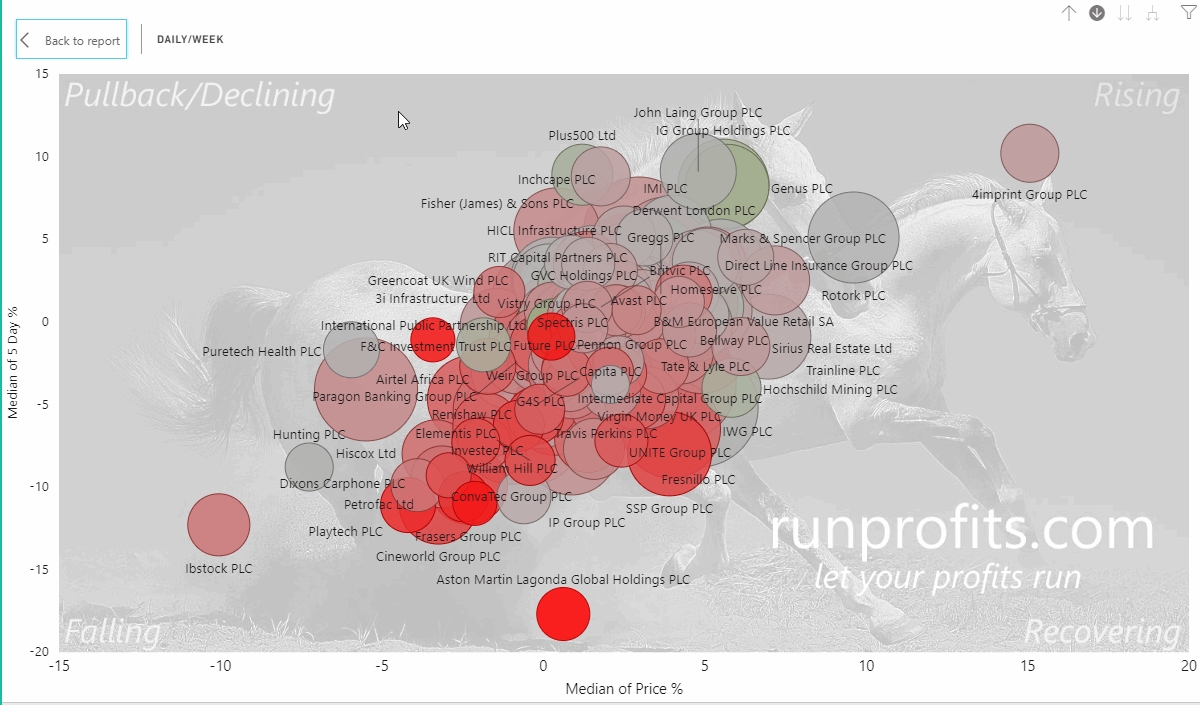

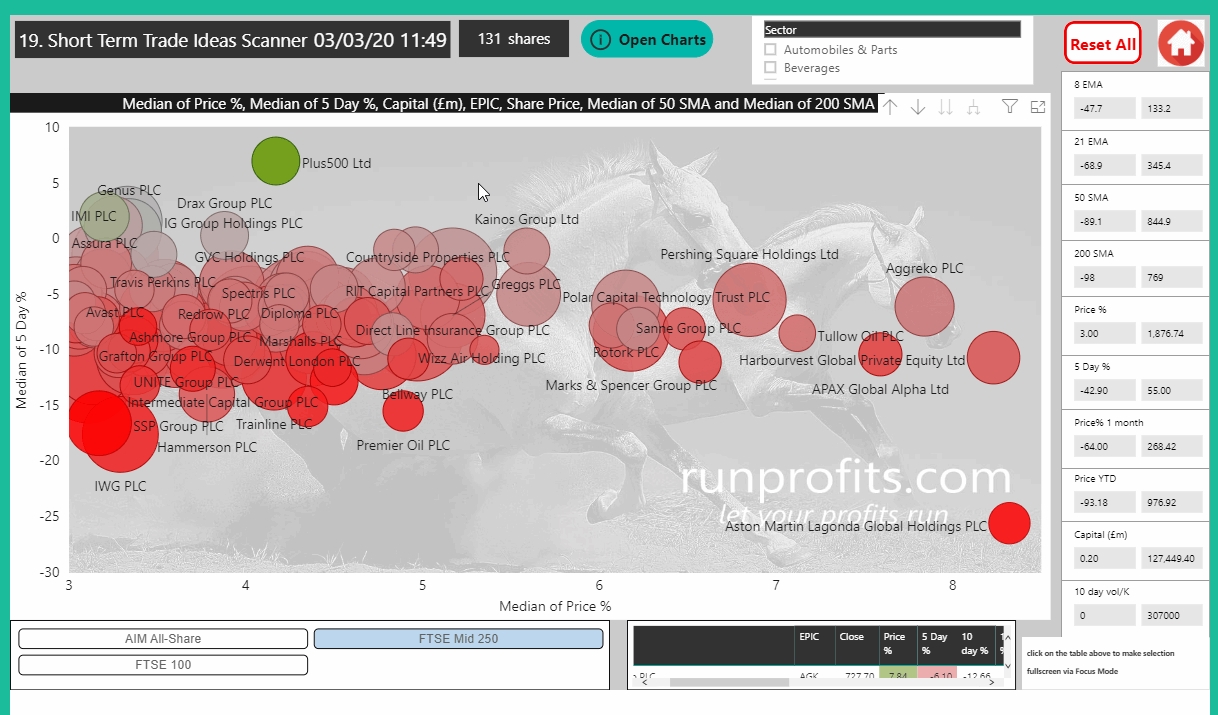

FTSE 250 Winners Today at 11:30

245 of the 250 are in the green today with 61 shares are up 4% or more today led by AGK, HVPE, AML TLW up over 7%

Rallying over 5% are JUST, HFG , ROR, PCT among 15 others

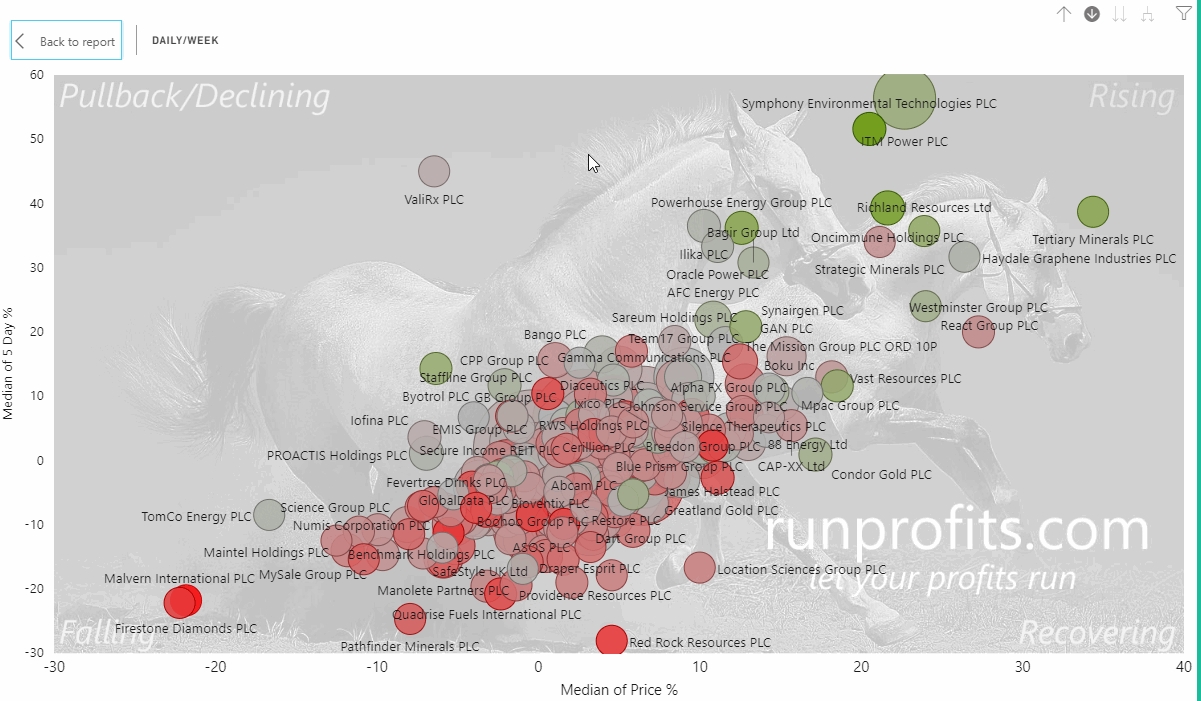

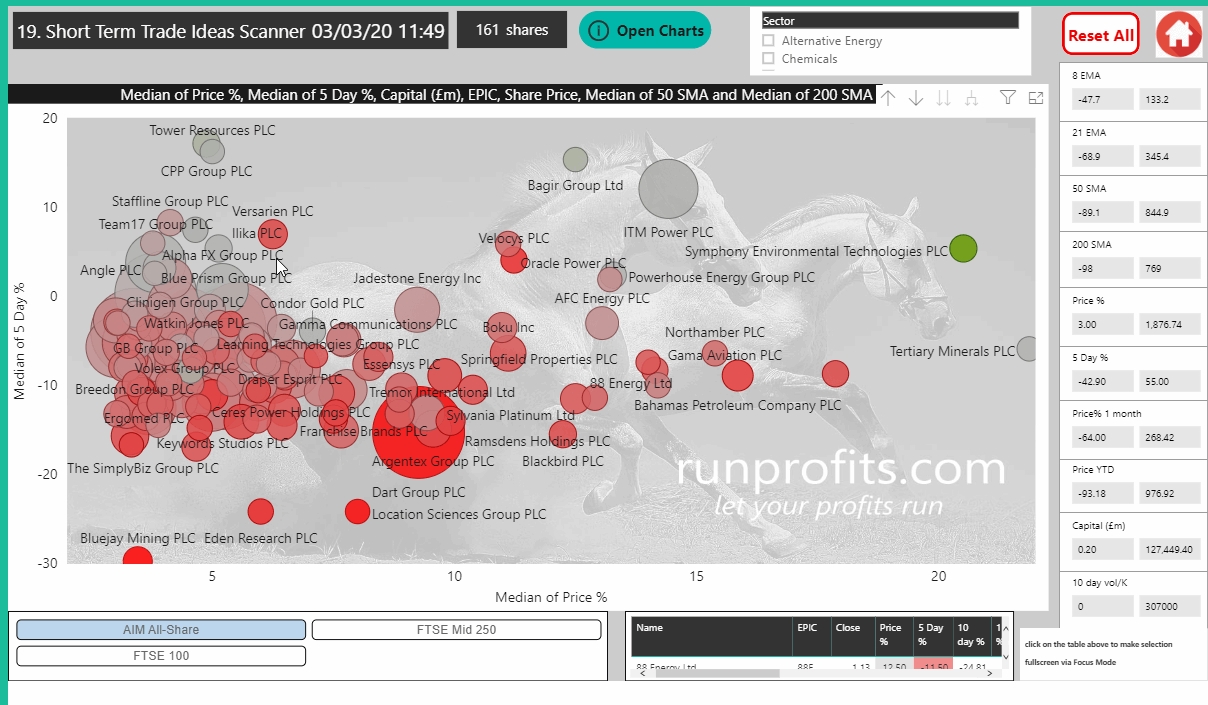

AIM All-Share Winners Today 11:30

329 AIM All-Shares are in the green today with 161 up 3% or more and 84 up 5% or more

56 shares moving north have price above 50 and 200 daily moving averages

US Records more Records: DOW +5.1%, S%P +4.6%

A stunning bounce back in the US yesterday saw new records set for a recovery day when the DOW added almost 1300 points making it the biggest intraday move in history. This appears to be an optimistic call on the Fed fixing this along with other central banks. News is expected today of a co-ordinated response.

Despite this huge move,

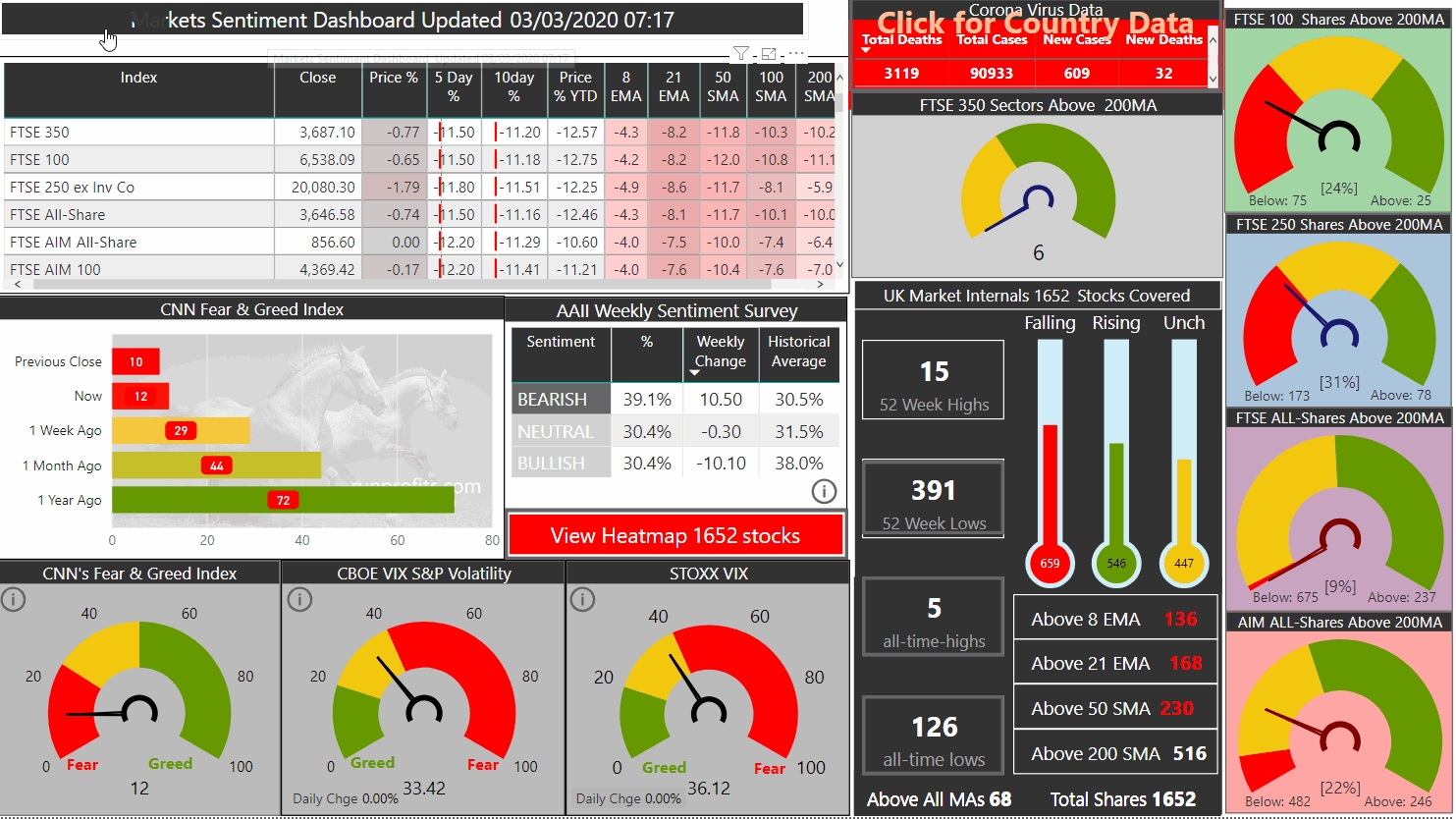

- the Fear & Greed index has moved from 10 to just 12 not confirming the optimism

- the VIX is at 33(down from 41) but elevated

Asia Down but UK Futures Positive

Asia has not followed the US lead and is in the red at pixel. Meanwhile Brent continues to rally presumably on the expectation of the output from the OPEC meeting later this week which may limit supply.

UK Futures suggest FTSE 100 will open around 1% to the good at 6720

Sentiment dashboard has been updated for overnight data : the COVID-19 cases now stand at 90,933 with 3119 deaths up from yesterday's 90,211 and 3080