Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

Weekly Wrap :Double digit Index Losses: AIM All-Share Worst Hit: Peak Fear?

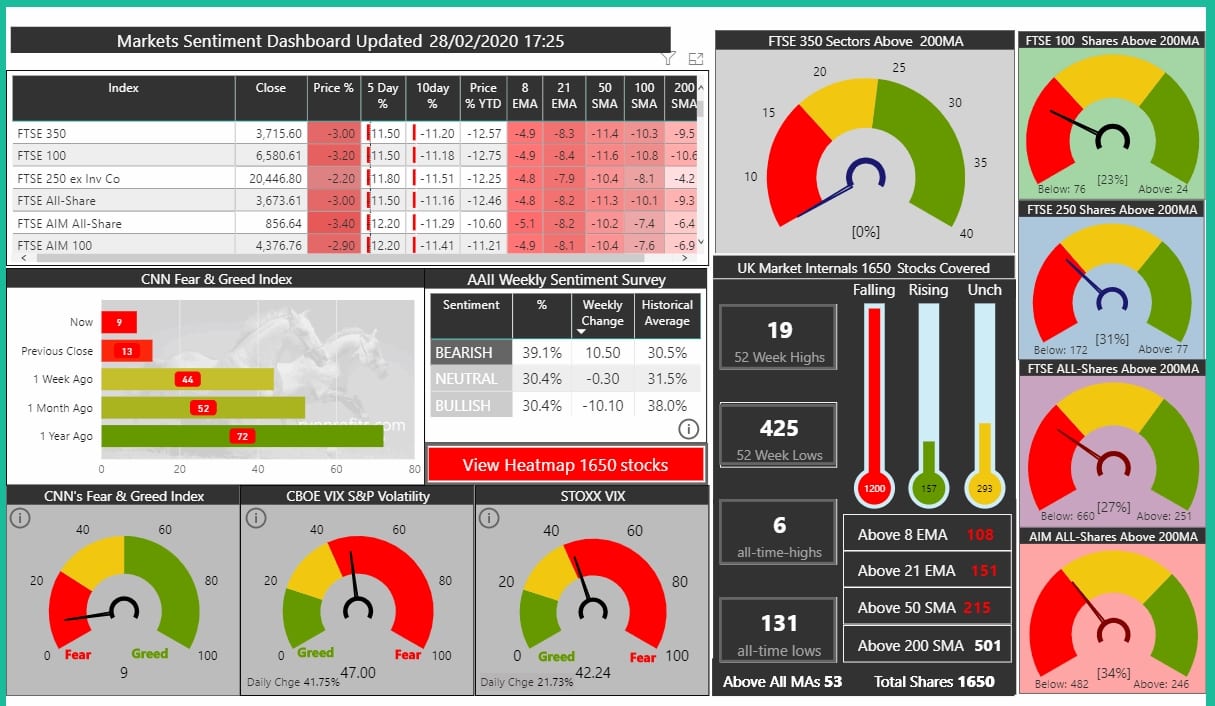

In brief we end the week with all of the UK indices down double digits with the AIM All-Share suffering the most down almost 12%.

Crude has lost 16% this week alone and is down 26% YTD.

Today saw 1200 stock losing value while 157 gained with 293 unch.

We end the week with the Fear and Greed Index at 9 and the VIX around 47 . These extremes are often contrarian and may signal the worst of selling is over for now. Next week may see some much needed relief rallies.

What is Still working?

Given the huge drops we have suffered this week with all of the indices now down double digits in 2020, is anything left in the green YTD?

What has worked and survived this train wreck may well continue to work when we recover. there are obvious caveats on names strongly correlated to the coronavirus itself (Novacyt who make coronavirus diagnostic kits is an obvious candidate) and others which may have caught a bid on strong gold price which may suffer some volatility if the shiny rock drops back.

The 2020 so far data report gives an overview of the indices , commodities and individual sectors to data as well as splitting winners and losers into mid/large caps and small caps by market cap

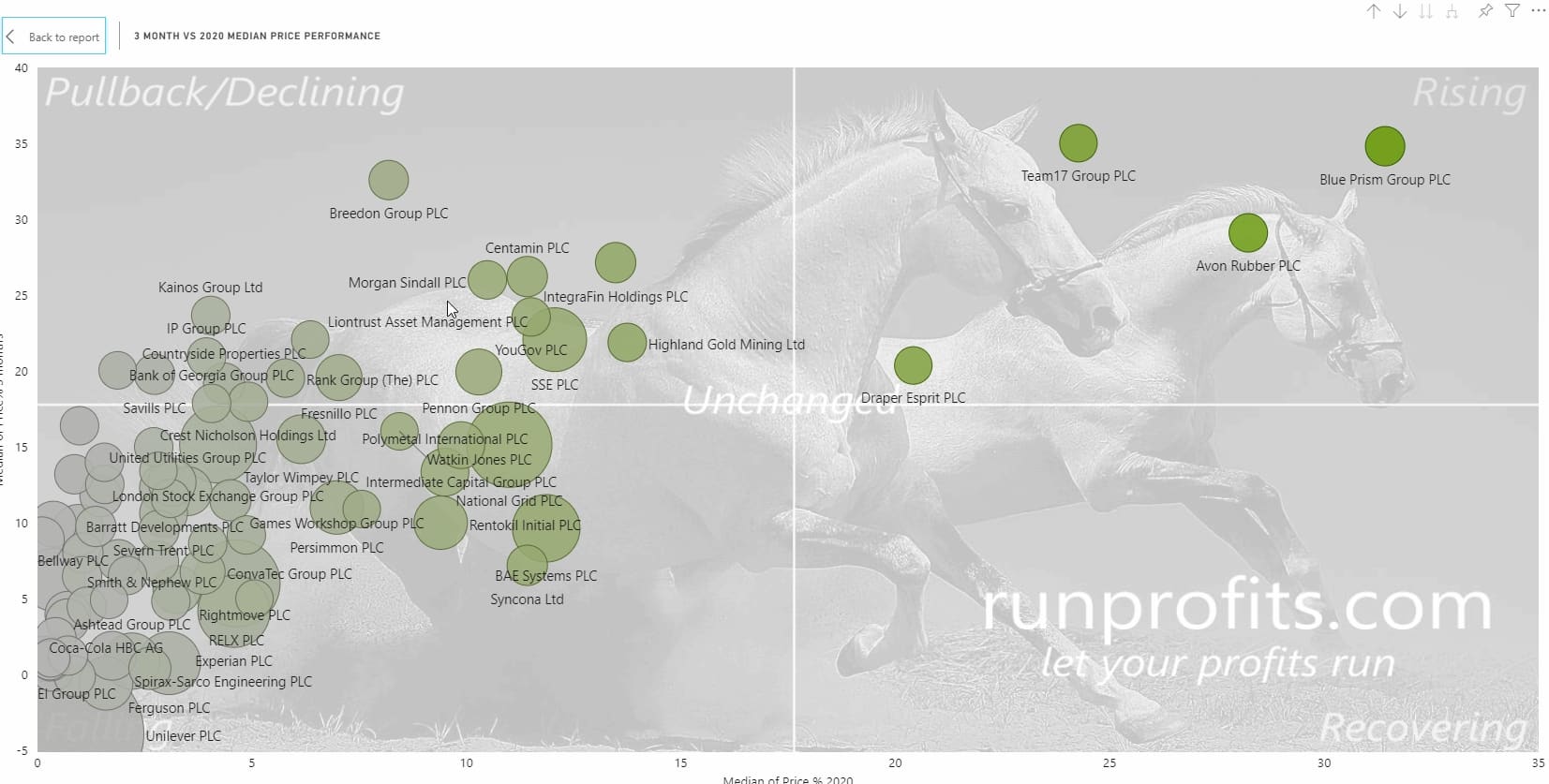

Mid/Large Cap Risers in 2020 so far

This scan can be accessed in the "2020 So Far" report by selecting the Mid/Large Cap risers.

In 2020 there are now just 89 mid or large caps remaining in the green YTD, CWR, POG and DJAN are all up 50% or more and have been excluded from the below plot as they skew the data. Other notable strong contenders are PRISM (+31%), AVON (+28%), GROW (+20%)

- 14 winners are in Equity Investments with SYNC up 11% and PSSL up 5%

- 8 of the winners sit in Household/Home Construction and include the home builders with PSN and TW still up 6-75 YTD as of today

- 8 are in software with PRSM up 31%, TM17 up 25% while the rest are up more modestly in the 2-4% having suffered significant pullbacks over the past week

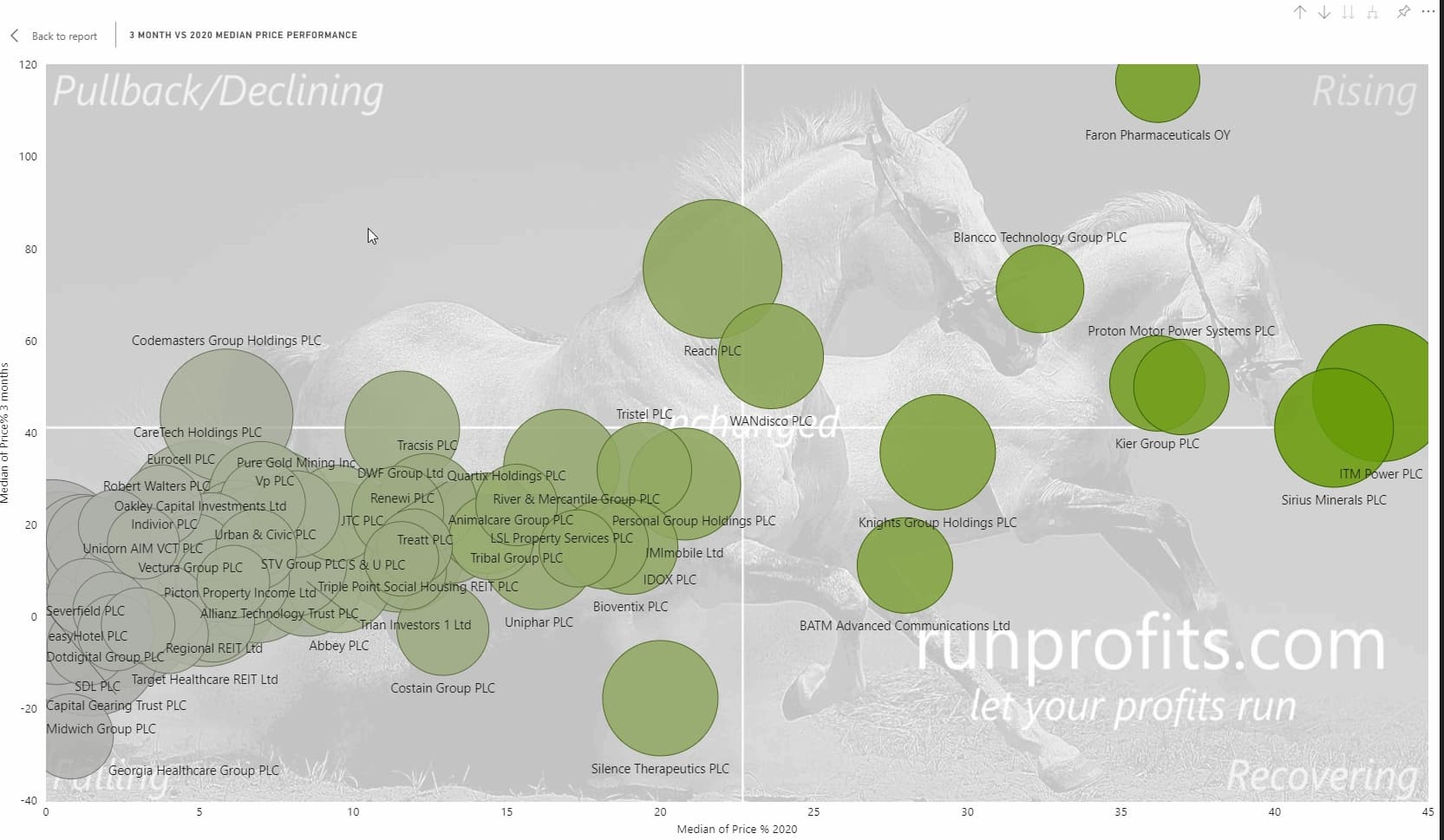

Small Cap Winners in 2020 So Far

In total there are 412 Small caps in the green so far in 2020: pruning these back by selecting those with a market cap above £100m reduce this set to 116 shares. These can be further analysed in the report by selecting by sector or relative price momentum

The outperformers YTD are CGP (+160%), EUA (+92%) GFRD (+153%) and SLP (+57%): all of these have been excluded from the below below to remove skew

Pre Market Note 07:30

After the European close yesterday there were signs of the US staging a recovery off an initial 4% drop in the NASDAQ and DOW..The indices even went green as buying kicked in on the expectation of a V-shaped recovery. The typical buy-the-dip symmetrical recovery of every other dip in this bull market thus far. But that didn't last and the US market promptly turned around and sank The DOW dropped 4.4% but more precisely 1190 points, the most in its history but then it has been coming off historic highs. Within the space of less than a week we have moved from historic highs to hysterical slides. Anyone who even pretends they know where this ends is delusional as mass panic confounds all analysis beit fundamental, technical, macro although maybe behavioural analysis may be of some use.

One thing is true, this will end and calm will restore. One further thing that may be inferred is that the chance of a global recession looks to be on the cards and may be the real driver of these falls. Crude continues to drop today down another 2% almost while funds flock to treasuries pushing their yields to historic lows. Both Apple and Microsoft have warned of the impacts of the coronavirus on their guided earnings for 2020. When valuations were already stretched adverse guidance can have dramatic impacts on inflated multiples causing rapid reratings. Given the tumble in the US , these bellwether stocks' warnings are likely being extrapolated much more broadly. This suggest that markets are likely to move beyond correction territory of 10% and may well tend towards a 20% .

We can use some data to guide us based on historic precedents and recent lows: at pixel the Fear and Greed Index sits at 13: while that is extreme fear and pretty low, it can get lower so try 5 for the real extreme fear. In both 2016 and 2018 we had deep corrections of almost 20%, this correction looks set to tend to those limits which suggest we may have further to fall. That said, when panic sets in most things are possible so expect to be surprised.

UK futures look set to open down over 3.5% , today will be another in red .