Contents: Click on Link to View

Toggle

Please add me to runprofits.com mailing list for future articles and trade ideas

More US Record Highs: Time for a Pause?

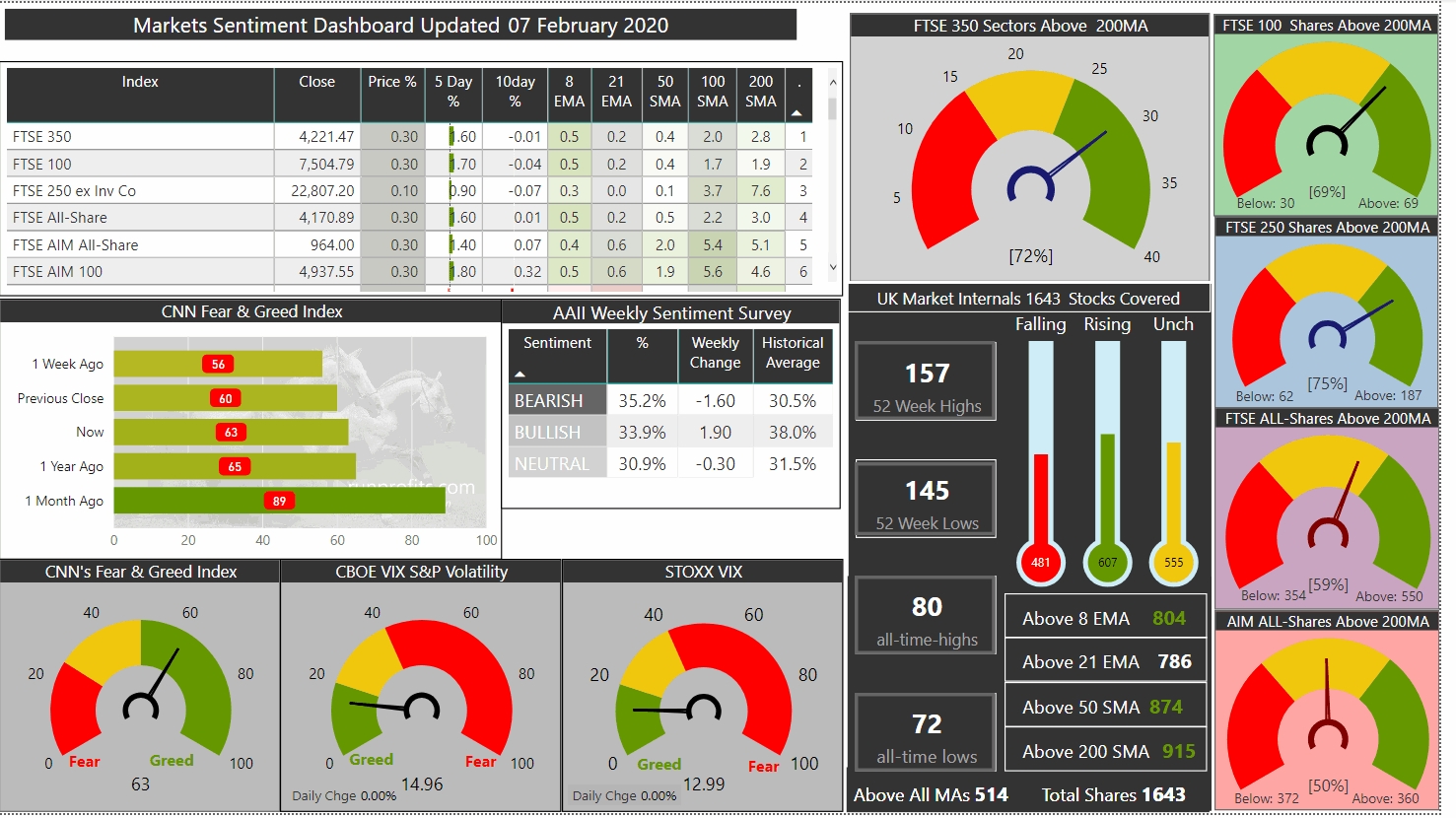

Overnight saw the US markets make even higher highs as the S&P added 0.3% while the DOW Jones matched that in percentage but didn't exceed its previous ATH. The NASDAQ closed flat on the day making a double top as well. Given the slowing of momentum, the recent pullback that was snapped up a bit too quickly , and the failure to make substantial new highs this may well be signalling time for a pause and deeper pullback. The Dow Jones Transportation index failed to rally with the other indices which is often a sign of weakness.

Oil remains weak at $55 for Brent while commodities have shown some recovery but again are significantly down on the year

- The VIX ,while low at around 15, is elevated compared to its recent base of around 12.

- The Fear and Greed index has stayed in the low 60's off recent highs of 90+:

- Gold has remained pretty bullish and suggest that there may be increased safety trades in play as the yellow metal has been in a strong uptrend since summer '19 and looks set for an assault at $1600 - see chart.

these suggest that more protection is being sought to the downside potentially indicating more caution with fingers over sell buttons.

Today is US monthly employment figures, the NFP: this may well provide an excuse for a sell-off.

Alternatively we may well grind higher but recent tremors do favour more downside

Updated 07.10

Next Update 15:00 Fri 07 Feb 20

Figure 1; Market Sentiment