Metro Bank (MTRO) : RP Scanner Identifies a 40% Pop from a Short Squeeze Reversal

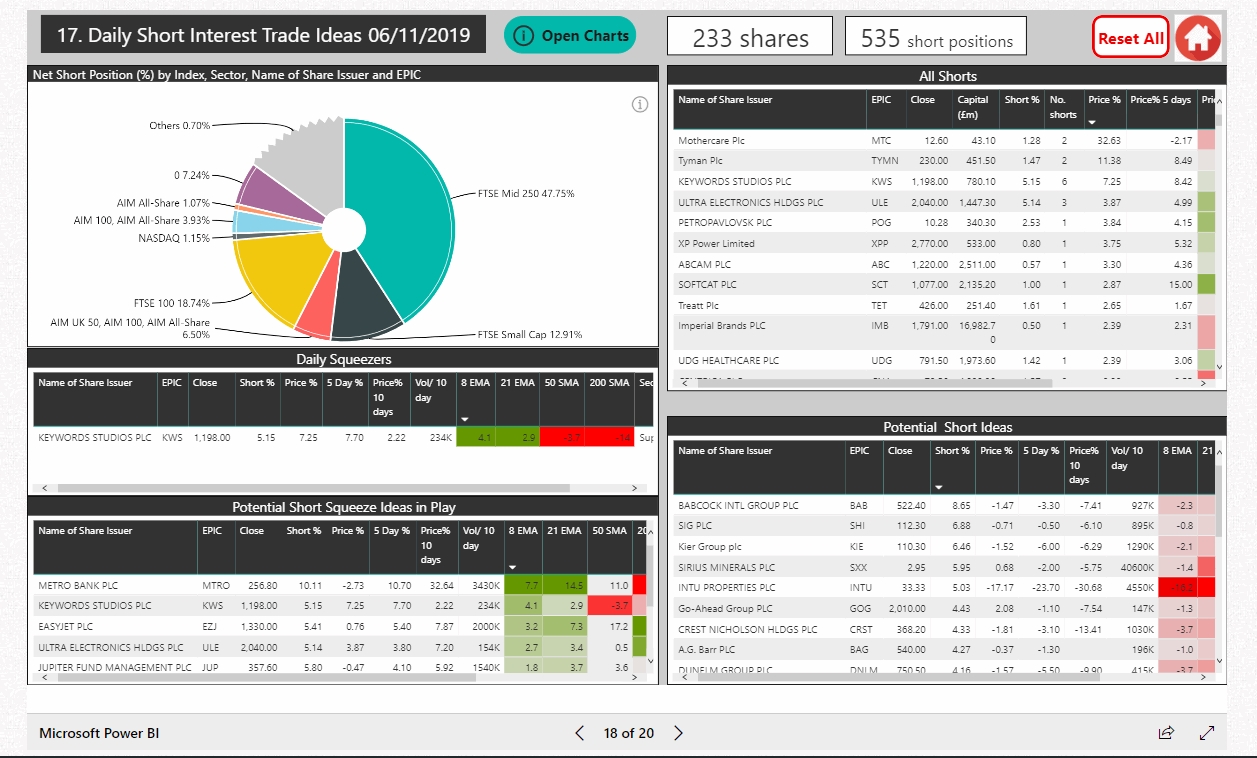

MTRO came up on the RP Scanner Short Trade Ideas on Friday 1 Nov as a potential reversal having made a 14% intraday price move under the weight of a 10% short interest : it went on to rally almost 40% in three trading days this week in a classic short squeeze reversal play.

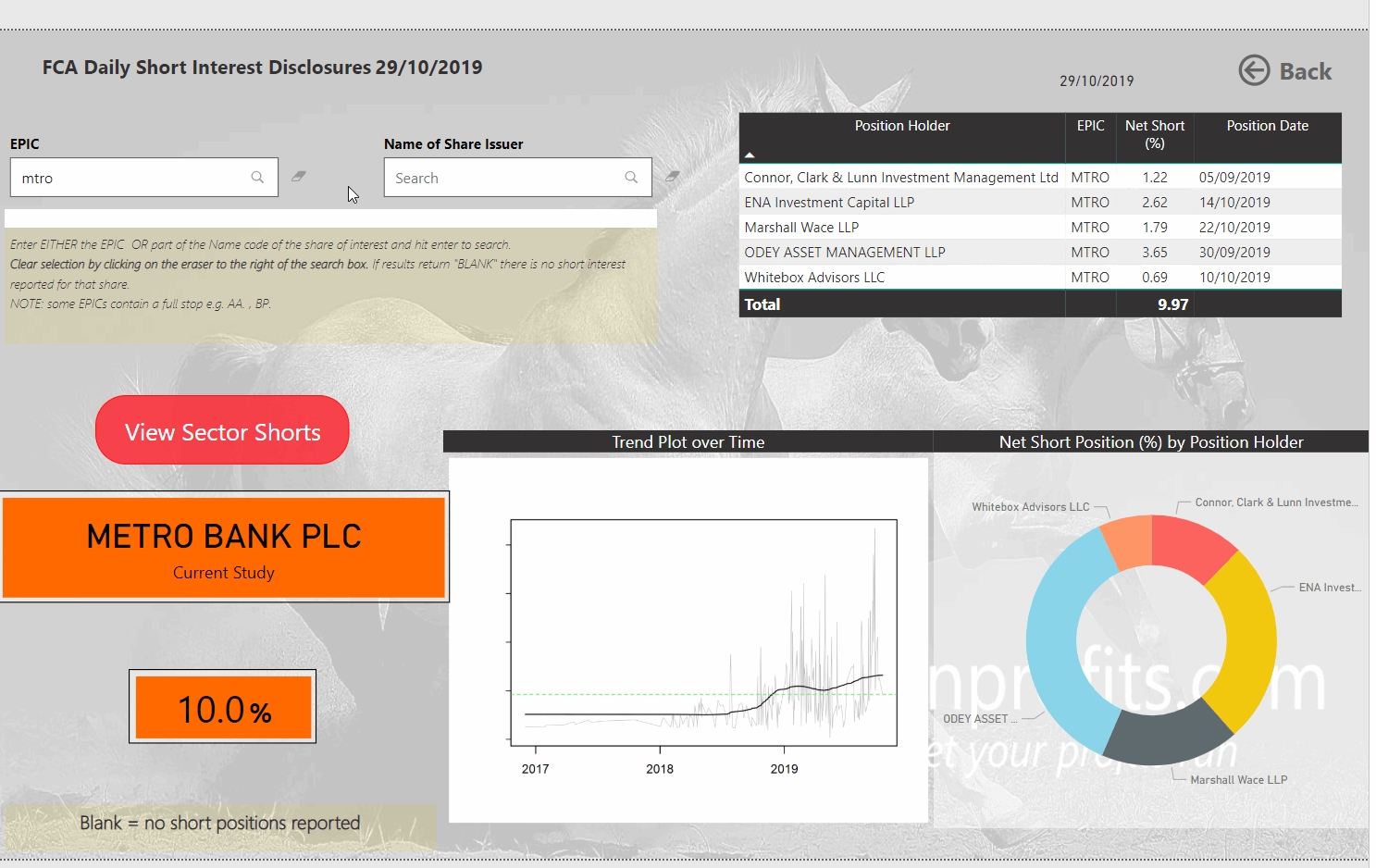

Trading reversals is a bit like handling fire: you need to understand the risks and take precautions with what is normally a hazardous pursuit. BUT price reversals can be explosive (in a good way) especially in stocks that have been heavily shorted and are extremely beaten-up. Metro bank has been utterly hammered in the past year and has collapsed from a price near £40 in July 2018 to under £1.60 in late Sep 19. Its woes came in the main from its apparent inability to manage it owns books and the discovery that it had underestimated the risk on over £900m worth of its loan book. Not a good look in the post-financial crisis world where even the slightest hint of undercapitalisation sends investors running and shorters circling. Metro has been one of the most heavily shorted shares on the UK markets and has proven to be a fairly safe and one-way bet to the downside.

However, when any trade gets crowded, the other side of the trade become more favoured. Unless MTRO went bust, its chart was running out of room to move to the downside. It was still weighed down by over 10% of its stock in open interest with shorters. It just needed a catalyst to tip the balance: that came last Friday 1 Nov when it was rumoured that LLOY was lining up a bid for MTRO.

Taking a look at the chart, MTRO was showing some signs of basing having tipped to a new low on Fri 29 Sep before recovering and rallying 20% in 4 sessions. It then entered a range-bound period forming a wedge as volatility contracted into October . Meanwhile open interest in MTRO remained high with 10.1% of the stock on loan to shorters. The breakout from the tight end of the wedge on Fri 1 November saw the price rise rapidly closing a gap that had formed from a breakdown in price on 24 Sep (which saw MTRO plummet almost 40% in a day)

That gap fill was likely to result in a wave of selling as pent up orders were sat waiting to fill: a target just below this netted a gain from a entry of 204 of +70p or 35%.

There is no doubt that these are high risk trades however the set-up of a reversal on the charts, the reduction in volatility as price was building momentum and the breakout of the wedge at 203p all added to the probability of a good risk reward given the level of short interest. Price has since fallen off slightly which may be signalling some selling to cover shorts. The upward trajectory may continue and it is worth watching for a new entry

MTRO remains on RP Scanners Short Ideas filter