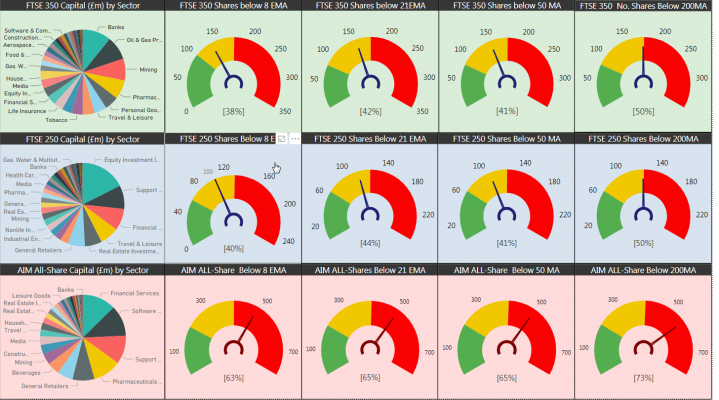

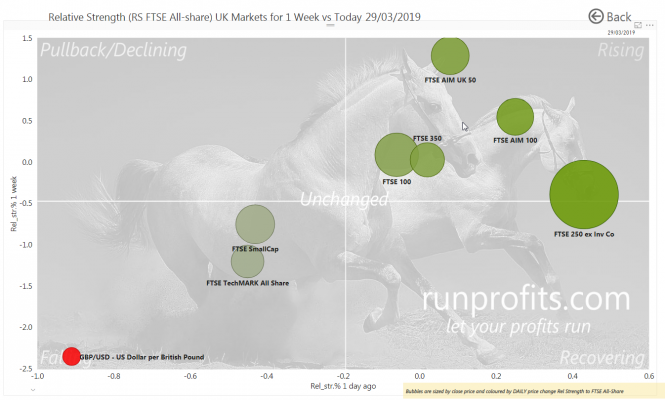

Brexit day brought green across UK markets as the UKX and NMX tuned bullish anew closing above their 8 and 21EMAs. As the UKX and NMX rose 0.7%, the FTSE250 rallied over 1% and the AIM All-Share 0.6% with the TechMARK up 0.2%. This despite the afternoon’s defeat of the government’s Brexit withdrawal agreement. The defeat actually boosted all UK indices as markets begin to price in a longer delay or general election. It would appear that the chance of a no deal exit is being increasingly priced out by market participants. GBP dropped on the vote outcome and looks set to dip below $1.30.

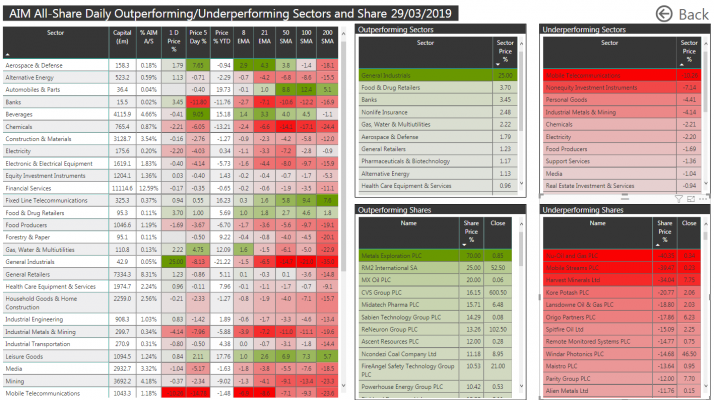

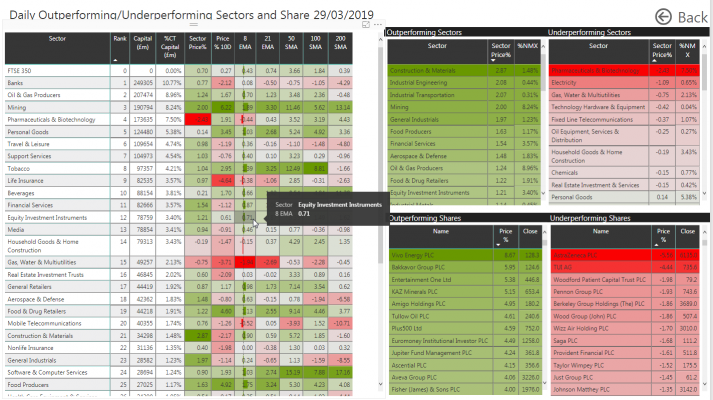

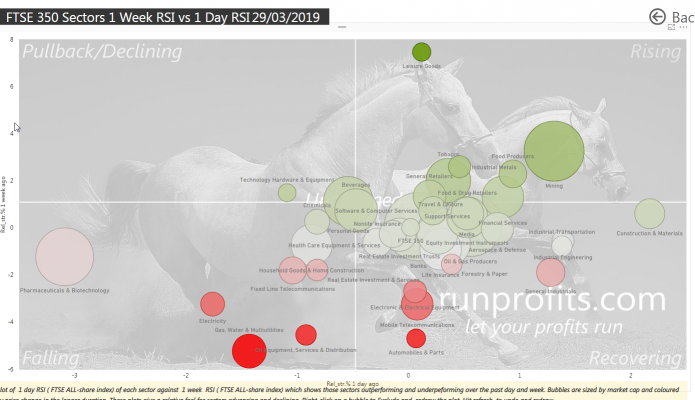

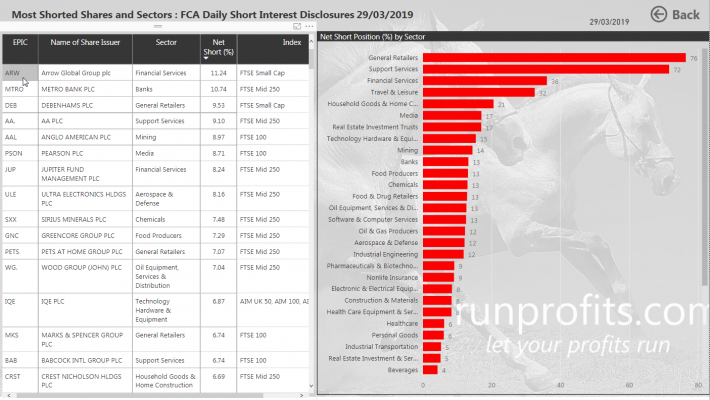

In sectors mining rallied 2%,construction almost 3% with Support Service, Media, T&L, Insurance, O&G Producers and most of the larger sectors up over 1%. AZN’s announcement of a rights issue to cover debt cause its price to tank almost 6% bringing the Pharm Sector down 2.4%. Utilities and Electricity also shed 0.8 to 1% on the day

Brent crude was down another 0.6% while copper rallied 1.7%, iron ore was flat, gold up 0.2% and silver up 0.7%

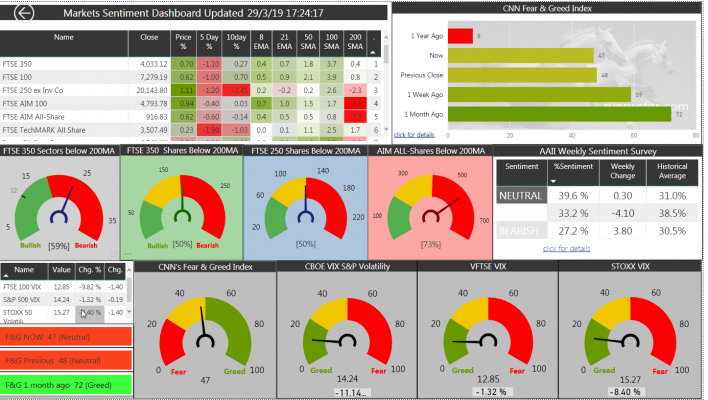

In market sentiment, the US VIX VSTOXX dropped 11% and 8% respectively while the VFTSE dropped over 1%. The Fear and Greed index has fallen to 47 from a 59 one week ago indicating a degree of caution amongst investors.